Illicit crypto activity drops 20%, but stolen funds surge, Chainalysis says

Analysts at Chainalysis say illicit blockchain activity has dropped nearly 20% YTD, yet stolen funds and ransomware inflows continue to rise.

Illicit crypto activity has declined nearly 20% year-to-date, a positive sign for the growing legitimacy of the sector, according to a mid-year report from blockchain analytics firm Chainalysis.

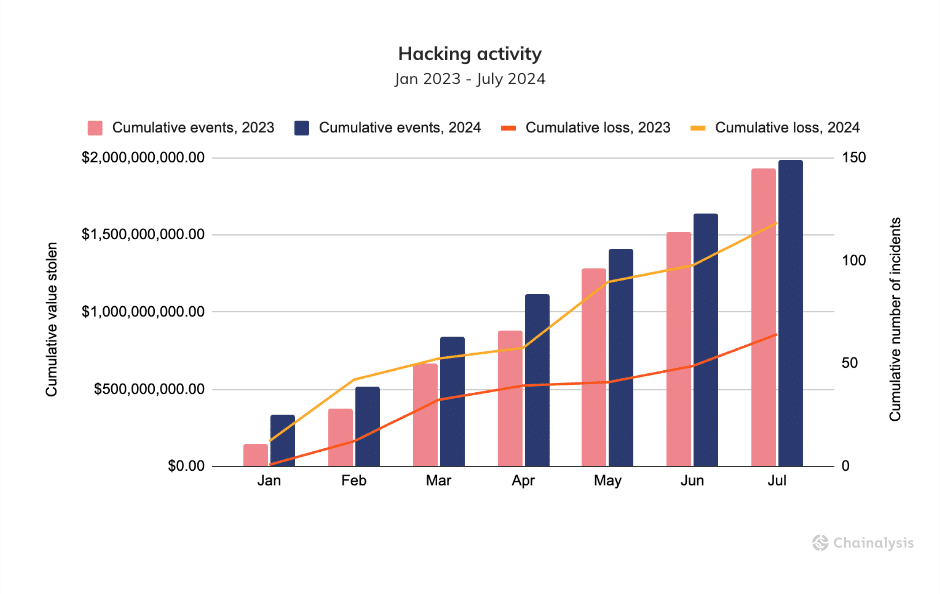

Despite the decline, there are still concerning trends in specific types of cybercrime, the firm noted, saying that funds stolen in crypto heists nearly doubled to $1.58 billion and ransomware inflows rose by 2% to $459.8 million in the first half of 2024.

Chainalysis attributes the surge in stolen funds to a resurgence in attacks on centralized exchanges, pausing a trend where hackers had focused on decentralized finance. The New York-headquartered firm noted that while the overall number of hacking incidents has only “marginally outpaced” that of 2023, the average value stolen per event has soared by nearly 80% in 2024, driven partly by rising crypto prices.

“The average amount of value compromised per event has increased by 79.46%, rising from $5.9M per event from January to July of 2023 to $10.6M per event thus far in 2024, based on the value of the assets at the time of theft.”

Chainalysis

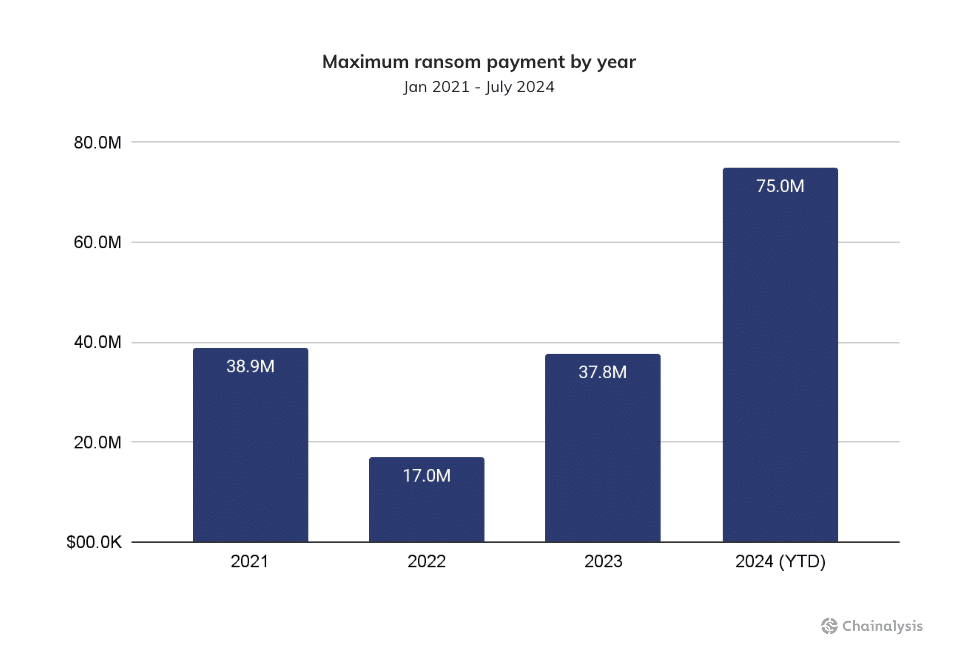

Ransomware also continues to be a persistent threat, with 2024 on track to surpass last year’s record $1 billion in ransom payments. Chainalysis says 2024 has seen the largest ransomware payment ever recorded at approximately $75 million to the Dark Angels ransomware group.

The ransomware landscape has fragmented somewhat following law enforcement actions against major players like ALPHV/BlackCat and LockBit. However, some affiliates have migrated to less effective strains or launched new ones, increasingly targeting “larger businesses,” according to the report.

Chainalysis cautions that while the overall decline in illicit activity is encouraging, the continued rise in stolen funds and ransomware payments underscores the evolving tactics of cybercriminals.

Elephant in the room

Centralized crypto exchanges are not only frequent targets for hackers but also play a significant role in laundering stolen assets. Chainalysis previously found that trading platforms have received nearly $100 billion worth of crypto from known illicit addresses since 2019, pointing to a troubling lack of international cooperation on anti-money laundering efforts.

According to the firm, nearly 30% of all crypto from illicit addresses eventually ends up at sanctioned services, including the Russian exchange Garantex. The peak was in 2022, when $30 billion of “dirty crypto” interacted with such services, underscoring the persistent challenges in combating crypto-based money laundering.