Interview | Solana’s stablecoin supply nears $13b: Marinade Labs exec explains why

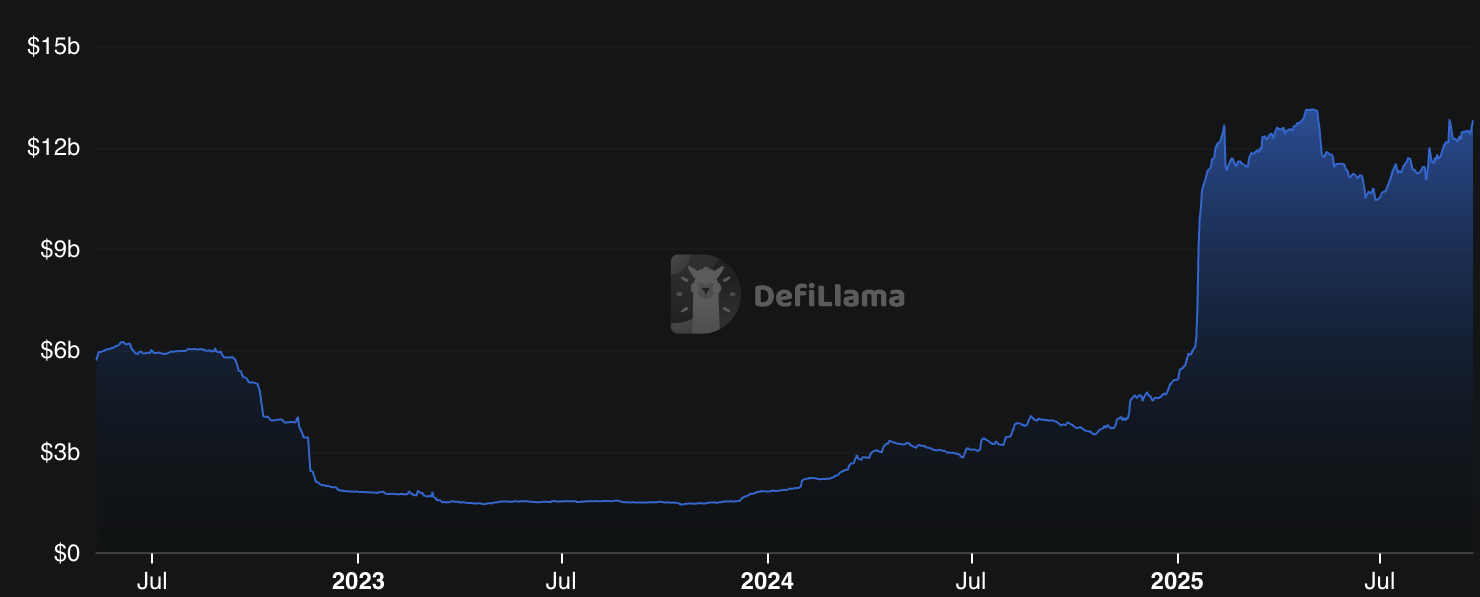

Solana’s stablecoin supply is nearing $13 billion, with the network increasingly dominating stablecoin volumes.

- Solana is becoming dominant in stablecoins, with supply nearing $13 billion

- The network processes nearly 50% of all USDC transfers

- Nicky Scannella from Marinade Labs explains why users are choosing Solana for stablecoins

Stablecoins are quickly becoming the backbone of crypto, and Solana is capturing an ever-larger share of the pie. The network now hosts $12.8 billion in stablecoins, a figure that may soon surpass its April 2025 highs at $13 million.

What is more, the Solana network processes almost half of all USDC transactions, with Circle recently minting an additional 250,000 USDC on the network. To explain why Solana is starting to dominate stablecoins, crypto.news reached out to Marinade Labs, a native Solana protocol with over $2.4 billion locked.

Nicky Scannella, in charge of Business Development at Marinade Labs, explained what makes Solana so attractive for stablecoin transfers.

Crypto.news: Solana now hosts over $12B in stablecoin supply — what’s driving this inflow compared to Ethereum or other L1s?

Nicky Scannella: Solana combines liquidity, security, and efficiency at scale, with the highest on-chain activity of any major chain. That makes it the best home for stablecoins. Add in momentum from SOL ETF approvals and fresh institutional interest from firms like BlackRock and Grayscale, and the inflows make sense.

CN: How do you think the changing U.S. and global regulation of stablecoins will affect protocols like Marinade?

NS: Marinade welcomes regulatory frameworks — we’re prepared, especially with Marinade Select. Clear rules build trust without sacrificing Solana’s decentralized nature. As stablecoin adoption grows, it also pushes us to expand our product line with more stablecoin-focused solutions, which is an exciting direction for us.

CN: TradFi institutions and big tech projects are increasingly eyeing launching their own stablecoins. Given that many of these firms control user on-ramps, how can DeFi compete in the stablecoin realm?

NS: These launches aren’t competition; they’re bridges between TradFi and crypto. DeFi’s edge is openness and inclusivity. Marinade helps power Solana by making it more decentralized, which creates the foundation stablecoins need to grow in a sustainable way.

CN: Marinade recently integrated with Paxos’ USDG stablecoin. What is the significance of this move, and what motivated you to pursue the partnership?

NS: We’re working with USDG because it promotes aligned incentives — the core ethos of Solana. At the same time, USDG fits perfectly with our push to build more stablecoin-based products, which is a growing need as adoption accelerates. This integration makes staking more accessible while reinforcing decentralization on Solana.