Investor interest in SUI is fading away after fall from ATH

Sui has been moving in a highly volatile zone over the past month, but these movements have increased negative sentiment around the asset.

Sui (SUI) reached an all-time high of $2.36 on Oct. 14 as the cryptocurrency market witnessed a sharp bullish momentum. The launch of MLS Quest, a Major League Soccer-themed non-fungible token platform, in partnership with the Gamified blockchain startup Sweet added to the positive sentiment around SUI.

Another key driver was launching USD Coin (USDC) on Sui’s mainnet.

However, the bullish trend around SUI faded away in two weeks after reaching its ATH as the broader crypto market faced correction.

Triggering negativity

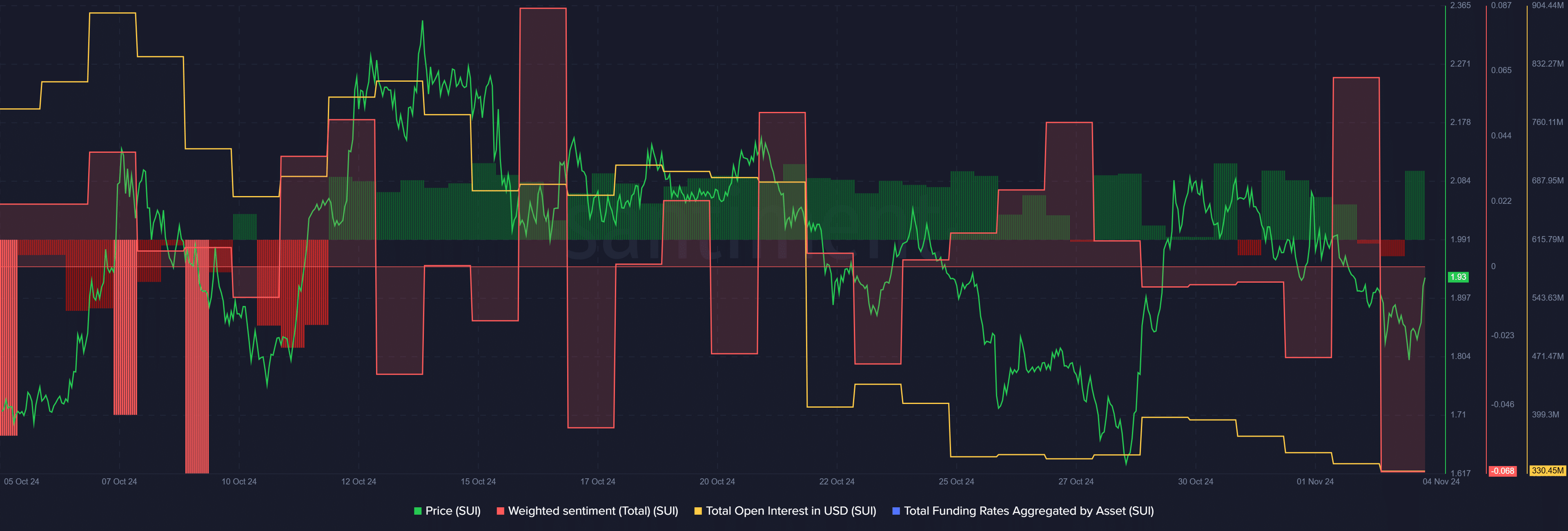

According to data provided by Santiment, the weighted sentiment around Sui on social platforms saw a major shift from 0.06 to -0.06 over the last two days.

Negative sentiment usually hints at times of fear, doubt and uncertainty—FUD for short—consequently, pushing the price downwards.

Data from the market intelligence platform shows that the total open interest in SUI’s perpetual contracts plunged from $895 million on Oct. 7—when the market-wide bullish movement started—to $330 million at the reporting time.

SUI’s open interest is currently at its two-month low.

Despite the increasingly negative sentiment, SUI’s funding rate shifted from -0.002% to 0.01% as its price surpassed the $1.95 mark earlier today.

SUI is up 0.3% in the past 24 hours and is trading at $1.88 at the time of writing. It’s still the 18th-largest crypto asset with a market cap of $5.3 billion. SUI’s daily trading volume increased by 30%, reaching $630 million.

Notably, if SUI faces a further correction, the long liquidations could potentially panic the investors—ultimately leading to a selloff due to the negative sentiment surrounding the asset.