IOTA price suffers a deep reversal: is the rally over?

IOTA price experienced a harsh reversal this week, becoming one of the worst-performing top-100 cryptocurrencies.

IOTA (IOTA) has declined for four consecutive days, reaching a low of $0.3400, down 46% from its year-to-date high.

This retreat coincided with that of Bitcoin (BTC) and other altcoins that typically drop sharply when Bitcoin trends lower. Notably, Bitcoin has retreated from its all-time high of $104,200 as its strong rally paused. These pullbacks are common when the coin reaches significant levels. For instance, Bitcoin dropped from $73,700 in March to $49,800 in August earlier this year.

IOTA’s price decline also aligns with the start of the counting phase for the Rebased Governance proposal started. Coin holders can continue voting during this process, which runs until Dec. 16.

IOTA Rebased marks the most significant upgrade in the network’s history, introducing new features such as MoveVM and Ethereum Virtual Machines.

Additionally, the upgrade brings full decentralization capabilities and the ability to process over 50,000 transactions per second. IOTA holders will also be able to stake the coin, earning an annual yield between 10% and 15%.

Some crypto investors remain optimistic about IOTA’s future recovery. In an X post, Andrew Moh, a popular crypto analyst, noted that the coin has better tokenomics than most others.

For example, 76% of all IOTA tokens are in circulation, the coin has a 12% inflation rate that is declining, and there are no venture capital allocations. He also believes that strong technical indicators could drive long-term growth for the token.

IOTA price analysis: will it rebound?

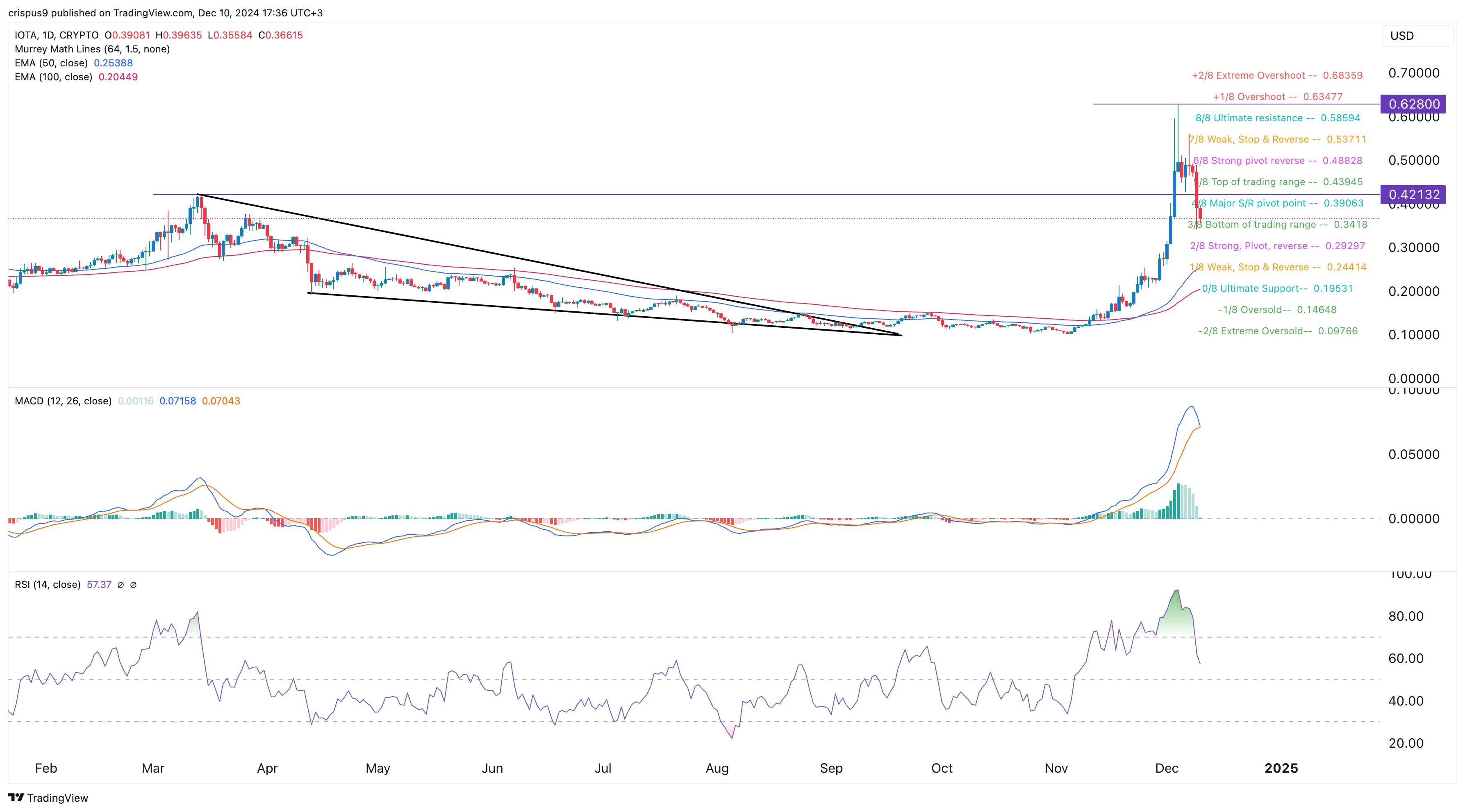

The daily chart shows that IOTA peaked at $0.6280 during the hype surrounding the Rebased upgrade. It has since erased some of these gains and fallen below the key support level of $0.4213, which marked its highest point on March 14.

The coin has also dipped below the major support and resistance pivot point of the Murrey Math Lines at $0.3900. In many cases, assets tend to bounce back after reaching such levels.

IOTA remains above the 50-day and 100-day Exponential Moving Averages (EMAs), although the MACD and the Relative Strength Index (RSI) indicate bearish momentum. As a result, the coin may continue its mean reversion process and retest the 50-day EMA at $0.2440. A rebound is likely if Bitcoin moves back to its all-time high, as some analysts predict.