Is Bitcoin a Better ‘Safe Haven’ than Gold?

Since the 2008 financial crisis and the ‘Great Recession’, one asset stood out as the ‘safe haven’ investment that investors flocked to. That asset was gold. The price of gold increased by over 20 percent during the ‘Great Recession’ from $800 in December 2007 to $965 in June 2009 and continued its rally to peak at $1,917 in August 2011. Furthermore, whenever there has been geopolitical turmoil or economic distress, the price of gold subsequently rallied.

However, a new safe haven asset has started strengthening its position. That new safe haven is the cryptocurrency bitcoin.

Bitcoin as a Safe Haven

The argument that bitcoin is a potential safe haven investment is demonstrated by the fact that the price of bitcoin has regularly spiked when there has been geopolitical turmoil or an economic crisis. The first time this was noticeable was when Cyprus announced it would bail in its banks’ depositors in March 2013. In the weeks following the announcement, depositors were restricted from withdrawing large amounts of cash and were faced with a haircut on their deposits. During that time period, the price of bitcoin doubled from $45 to over $90 within two weeks of the announcement of the bail in terms and went on to reach the $200 mark a month later as events unfolded.

During peaks of the Greek government-debt crisis, which started in late 2009 and still worries European leaders today, the price of bitcoin also experienced several price hikes as investors bought bitcoin in anticipation of local demand in Greece increasing substantially should they have left the Eurozone and reintroduced a weak drachma.

In the last 12 to 18 months, bitcoin’s use as an alternative store of economic value has been highlighted in countries that are experiencing economic distress and heavily weakening currencies, such as Bolivia, Brazil, and Venezuela. Demand for bitcoin in these countries jumped once their own currency started dropping in value as everyday users needed a way to store value and the access to more stable fiat currencies, such as the US dollar, is not always accessible due to capital controls. This is why bitcoin has been able to act as a safe haven and also as a viable monetary alternative to struggling economies.

Even following the surprising outcome of the UK’s ‘Brexit’ vote, which many economists believe will hurt the British economy, the price of bitcoin jumped in the week following the referendum results and cryptocurrency exchanges offering the BTC-GBP currency pair experienced a substantial increase in user sign ups from the UK.

Bitcoin and Gold are Similar in Nature

According to the blockchain analyst Chris Burniske at ARK Invest, who was the first public investment manager to invest in bitcoin, both bitcoin and gold share similar characteristics as an investment asset. Bitcoin and gold both have, “an extremely limited supply and a relatively inert state. Bitcoin and gold can both be used: for example, gold is used in electronic circuits and bitcoin is used as payment,” Burniske told CNBC.

However, there is one important difference; gold bars can be counterfeit whereas a ‘fake’ bitcoin does not exist, but there is an analogous theoretical possibility known as ‘double spending’ if someone controls a majority of the network.

Burniske also points out that gold has actually been a terrible investment in the last five years and that, in his view, this has led to, “people starting to wonder where there are safe havens to store their assets. I think you have a lot of people saying ‘Hey we want to diversify a little bit’ making allocations to bitcoin.”

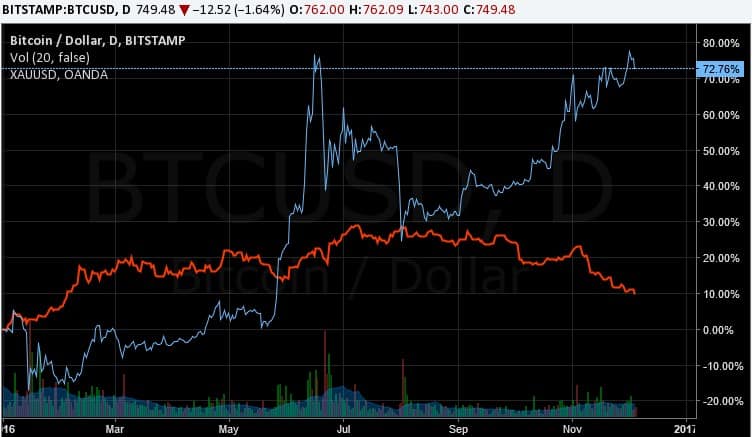

Unlike gold, however, which has netted a -31 percent total return (-9 percent annualized) over the last five years, bitcoin generated over 5,000 percent total return for its investors, with an annualized return of over 170 percent. The chart below shows both bitcoin’s and gold’s performance over 2016. While bitcoin and gold have tended to follow each other in response to risk-off sentiment in the markets, since Autumn 2016 a divergence is clearly noticeable.

Burniske is not the only one who believes that bitcoin makes a good alternative safe haven investment next to gold.

Winklevoss Twins Belief Bitcoin to be Superior to Gold

The two prominent bitcoin investors Tyler and Cameron Winklevoss stated earlier this week that they view the cryptocurrency bitcoin to be a superior investment to gold. They argue that when looking at the fundamental traits that give gold its value, including scarcity, portability, durability, and quasi-indestructibility, “bitcoin matches or beats gold across the board.”

While the argument for bitcoin versus gold presented by the Winklevoss twins makes valid points, it should be noted that you will only ever hear positive statements about Bitcoin as a technology, a currency and a store of value by the Winklevoss twins as they are a major holder of the digital currency, run a licensed US-based bitcoin exchange called Gemini, and are in the process of launching a bitcoin ETF.

Not Everyone Agrees that Bitcoin is a Better Safe Haven than Gold

One should not forget, however, that bitcoin is still in its infancy as it has only been around for eight years and is, therefore, very volatile and carries an uncertain future. Gold, on the other hand, has been considered an excellent store of value for thousands of years.

This is the argument made by research analyst Vijay Michalik, from consultancy firm , who considers gold to be the better safe haven investment and that bitcoin actually does not fall into this category at all due to its volatility.

Michalik told CNBC: “Bitcoin is still such a new innovation that the economics of its value aren’t fully understood. Volatility and the long-term unknowns involved in bitcoin’s development stop it from being considered a safe-haven asset like gold.”

Michalik is not the only one who is skeptical about bitcoin’s status as a safe haven investment. James West, author of investing research publication Midas Letter, also has his doubts. While West acknowledges that bitcoin has similar characteristics to gold, he views bitcoin as “just a technology-based fiat currency” whose infrastructure is unstable and not too dissimilar from traditional financial institutions. Hence, he views gold as the better safe haven investment as there inherent risks of holding gold as substantially lower, than holding bitcoin.

The Real Question is “Which Asset will Perform Better in the Long Run?”

The reality is that whether bitcoin or gold performs better during times of crisis is actually the wrong question to ask. The real question investors need to ask themselves is “Which asset will perform better in the next five to ten years?”

Gold had an incredible run from 2000 to 2011 fuelled by a low-interest rate environment, a boom in commodities before the financial crisis, a massive growth in ‘invest in gold’ businesses and marketing campaigns and gold’s perceived safe haven status. However, since its peak, gold has been a disappointing portfolio constituent for investors. In the last five years, gold returned -8.9 percent per annum for its holders.

Bitcoin, on the other hand, has had an incredible run since its inception in 2009. The price of bitcoin rallied from $0.01 in early 2009 to over $1,100 in late 2013 and is currently trading in the mid-$700’s. Bitcoin’s rally has been fuelled by the demand for a decentralized currency that cannot be controlled by any central bank or government, people’s desire to conduct financial transaction outside of the traditional banking system, a growing bitcoin startup sector driven by heavy venture capital investment and its use as a truly international currency that anyone with an internet connection can access.

While it is impossible to accurately predict the performance of any asset class in the next five to ten years, it looks more likely that bitcoin will outperform gold. Of course, it is highly likely that bitcoin will suffer more volatility shocks than gold.

But as the bitcoin ecosystem grows and evolves, it is hard to see how bitcoin would not outperform gold in the upcoming years given the wider use cases and bitcoin’s improvement of the properties of money.