Is Polkadot the next FTX? $87M spending spree, racism claims, and user backlash

How do Polkadot’s financial practices, spending $87M with a net loss of $108M annually, compare to FTX’s pre-collapse habits?

Table of Contents

Polkadot (DOT), one of the early competitors to Ethereum (ETH), has recently come under the spotlight after publishing its latest treasury report.

The report revealed that Polkadot spent a whopping $87 million worth of DOT tokens in the first half of this year. This spending spree is double the pace compared to the previous six months, raising eyebrows from observers and investors.

The bulk of Polkadot’s spending, over $36 million, about 42.4%, went towards marketing and outreach activities. This included advertisements, influencer endorsements, events, meetups, and conference hosting aimed at attracting new users, developers, and businesses to the Polkadot ecosystem.

Development accounted for the second-largest chunk of Polkadot’s budget, with about $23 million (26.7%) allocated to building essential services such as wallets and toolkits for developers.

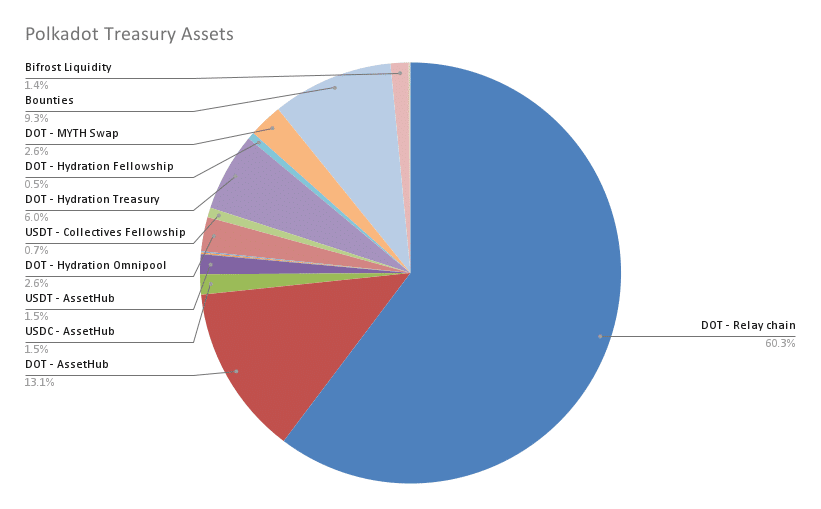

Polkadot’s head ambassador, Tommi Enenkel, highlighted in the report that the Treasury holds about 32 million DOT (approximately $200 million) in liquid assets, with an annual net loss of 17 million DOT (around $108 million).

At this rate, Polkadot has about two years of runway left if the DOT to USD rate remains constant, painting a precarious picture, especially when juxtaposed with the extravagant spending habits.

This scenario brings back memories of FTX, which also exhibited a similar pattern of lavish spending before its downfall.

Critics argue that Polkadot’s heavy focus on marketing over development could be a red flag. Others worry about the sustainability of its financial practices.

Let’s delve deeper into the criticisms Polkadot has faced, the controversies surrounding its recent financial moves, and whether it is headed for an abrupt end similar to FTX.

Public backlash and controversies

Polkadot’s recent treasury report has sparked widespread criticism on social media, with many users expressing outrage over the project’s spending habits and internal practices.

One of the most contentious points is Polkadot’s allocation of nearly $5 million to influencer marketing in the first half of 2024.

Observers like Stacy Muur have pointed out that for this amount, Polkadot should have garnered approximately 100 million views, given the average cost per view of 5 cents. However, the project’s visibility on platforms like Twitter (rebranded as X) remains minimal.

Delving deeper into the expenditures reveals why these concerns have surfaced. Polkadot engaged several agencies for its marketing efforts, including EVOX, an Italian Web2 agency focusing on Esports and Gaming, which received $2.2 million.

Lunar Strategy, a Web3 agency, achieved 2.7 million views and 180 collaborations for $1.3 million, equating to $0.48 per view and $7,000 per collaboration—figures that many find excessively high.

Furthermore, extravagant expenditures such as paying CoinMarketCap $500,000 for an animated logo and using branded private jets have been derided as unnecessary and excessive.

Beyond the financial scrutiny, Polkadot has also been accused of discriminatory behavior towards its developers, particularly those of Asian descent.

A developer named Victor from the Polkadot China community recently alleged that Asian developers, especially those from China, face unfair treatment within the ecosystem.

Victor has also alleged that his accusation resonates with other developers in the community, including those from projects like Bifrost, Phala Network, and OneBlock, who have, according to him, voiced similar grievances about discrimination and a perceived lack of true democratic processes within Polkadot.

As the criticism mounts, it becomes apparent that Polkadot’s approach to managing its resources and community relations may need a significant overhaul.

The project’s heavy focus on marketing over development and the reported discriminatory practices within its ranks raise serious questions about its sustainability and ethical grounding.

Are marketing and development Aligned?

Polkadot’s marketing expenditures, when compared to its developmental efforts, reveal misaligned priorities.

Initially, there was immense hype surrounding Polkadot, especially with the launch of its DOT token. Institutions were bullish, and Messari ranked it as the third most-held token by institutions, following Bitcoin (BTC) and Ethereum.

The potential seemed limitless, with billions of dollars worth of DOT locked up. However, reality quickly set in—beyond staking, there was little one could do with their DOT tokens.

Promised functionalities in DeFi were either non-existent or severely limited. In the past, users encountered critical challenges using decentralized exchanges (DEXs), which starkly contrasted with the seamless experiences offered by competing chains like Ethereum and Solana (SOL).

The introduction of governance further complicated matters. Instead of supporting innovation, it became a battleground for grifters to exploit the treasury, draining resources that could have been allocated to meaningful development.

The core issue lies in Polkadot’s failure to prioritize usability and liquidity. The user interface, especially Polkadot JS, has faced widespread criticism for being difficult to navigate. Even with wallets like NovaWalletApp and FearlessWallet, the process remains cumbersome.

Liquidity on DEXs is another critical issue. Swapping tokens or onboarding stablecoins like USDC and USDT involves complex steps that deter many users.

Such practices have eroded trust and diverted funds from more critical development efforts. Moreover, Polkadot’s approach to handling its developmental challenges has prioritized public relations efforts over substantial technological advancements.

For instance, Chainwire, a press release distribution agency, was paid $490,000, and Unchained, a commonly used agency name, received $460,000, as per the recent treasury report.

While other chains like Ethereum and Solana faced their own issues with high gas fees and network congestion, they continued to attract users and developers by delivering tangible value and maintaining a strong ecosystem.

In contrast, Polkadot appeared more focused on marketing and public posturing, often criticizing other projects rather than addressing its internal shortcomings.

Without necessary changes, Polkadot risks fading into obscurity, much like EOS and Tezos, despite its early promise and technical advantages.

Could Polkadot collapse like FTX?

The question of whether Polkadot could collapse like FTX is on many minds, especially given the recent scrutiny of its financial practices. To understand the potential risks, let’s compare the two.

FTX was a major crypto exchange that gained rapid popularity through aggressive marketing and high-profile sponsorships. It spent millions on ads, celebrity endorsements, and naming rights for sports arenas.

However, behind this facade of success, FTX had serious financial mismanagement and hidden debts. When these issues came to light, it led to a catastrophic collapse, wiping out billions in investor funds.

Polkadot, similarly, has been spending heavily on marketing, about 40% of its total expense, far higher than typical marketing budgets of 8-15%.

Despite this, Polkadot’s visibility and user engagement have not seen proportional growth. For the sake of argument, this mirrors FTX’s approach of prioritizing image over substance.

Financially, Polkadot’s recent treasury report reveals troubling signs. With $87 million spent in just six months and a net loss of 17 million DOT (around $108 million) per year, Polkadot’s runway is limited to about two years if current spending continues. This financial strain raises concerns about sustainability, especially if market conditions worsen and revenues decline.

Another parallel is the handling of governance and resource allocation. FTX faced internal turmoil and poor decision-making, which contributed to its downfall. Polkadot’s governance has also been criticized for approving questionable proposals and inefficient spending, diverting funds from critical development needs.

However, it’s important to note key differences. FTX’s collapse was accelerated by its role as an exchange, where liquidity issues can quickly spiral out of control.

Polkadot, as a blockchain platform, operates differently. Its collapse would likely be slower, driven by a loss of user and developer trust rather than an immediate liquidity crisis.

Polkadot’s success hinges on its ability to pivot. Addressing user experience issues, improving liquidity on its DEXs, and better governance are crucial steps.

Unlike FTX, Polkadot has a chance to correct course and leverage its technological strengths to regain community trust.

Polkadot can avoid the pitfalls that led to FTX’s dramatic collapse. The next few months will be critical in determining whether Polkadot can realign its strategies and sustain its growth.