Is the Arbitrum token a bargain as its DEX market share gains?

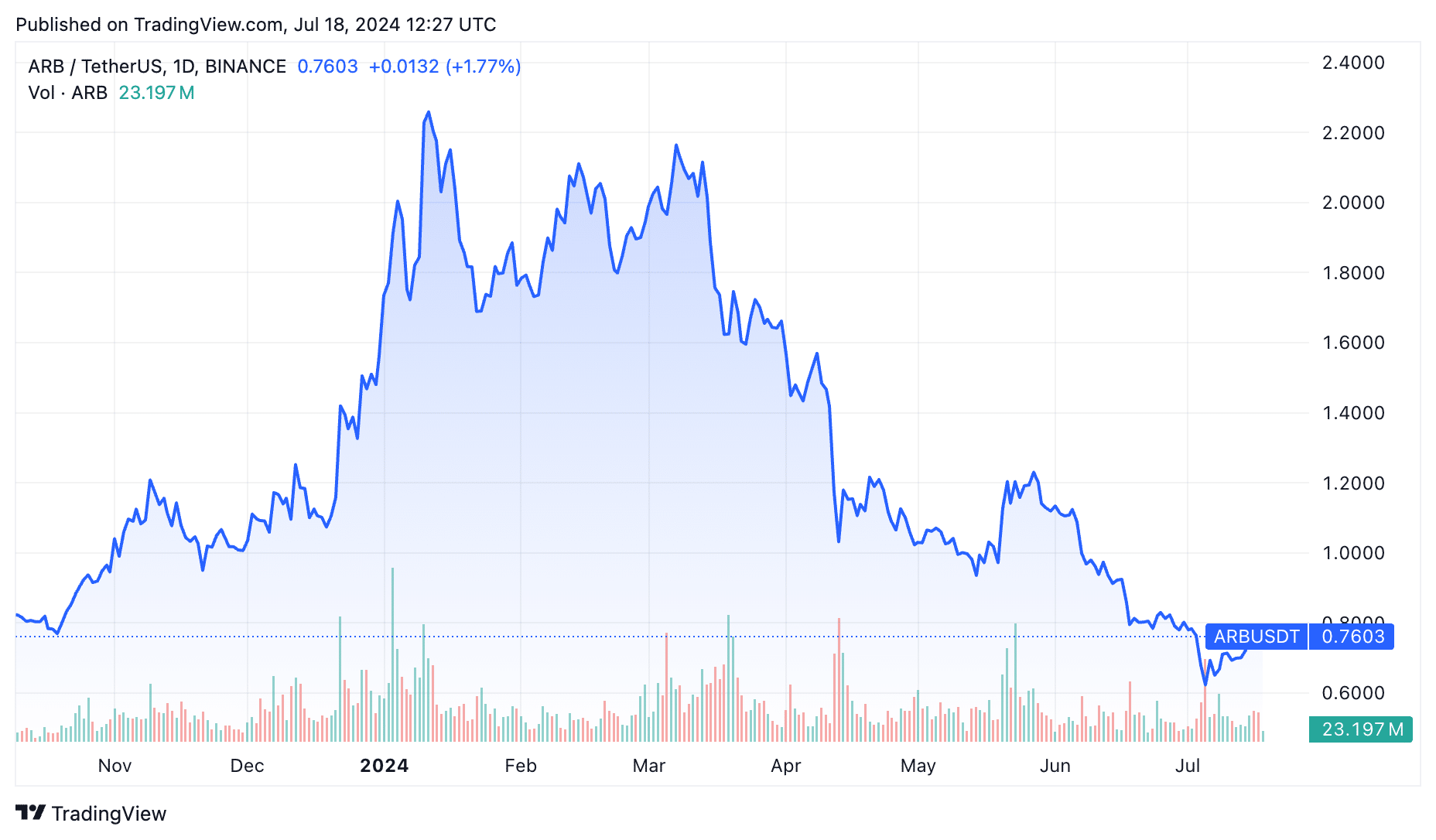

Arbitrum (ARB) token price has dropped by over 68% from its all-time high despite strong ecosystem growth and market share gains.

Arbitrum (ARB) token was trading at $0.76 on Thursday, marking what some believe to be early stages from a bull run after trading at an all time low of $0.571 in recent days.

Arbitrum’s market share gains

Third-party data shows that Arbitrum has become a significant player in the blockchain industry, surpassing some of the biggest names.

According to DeFi Llama, Arbitrum Decentralized Exchanges (DEX) are third in terms of volume. Its DEX apps handled transactions worth over $847 million on Thursday, making it the second-biggest DEX blockchain after Solana and Ethereum.

Solana and Ethereum handled transaction volumes worth $1.81 billion and $1.7 billion, respectively.

Arbitrum processed DEX volume worth $7.5 billion in the last 7 days compared to Solana and Ethereum’s $13.17 billion and $11.7 billion, respectively.

These numbers mean that Arbitrum has surpassed other well-known blockchains in terms of DEX transactions. BNB Chain processed tokens worth $4 billion in the last 7 days, while Thorchain, Base, Optimism, Avalanche, and Sui processed less than $3.5 billion in this period.

The biggest DEX networks on Arbitrum are Uniswap, Balancer, Camelot, Ramses, and PancakeSwap. Users love Arbitrum because of its fast transaction speeds and low costs, with an average cost being about $0.0012.

Additional data shows that Arbitrum has attracted substantial users and developers. It has 665 DeFi dApps and 966,000 active addresses, higher than Ethereum’s 359,000 and BNB Chain’s 890,000.

Arbitrum’s DeFi total value locked stands at over $3.15 billion, making it the 5th biggest chain. The volume of stablecoins in the ecosystem has risen to $4.2 billion.

Arbitrum’s ecosystem is also growing as developers take advantage of its features. JuicyPerp, a gamified perpetual platform, recently joined the ecosystem. The same is true with Huddle, a real-time communication layer for AI, games, and the metaverse.

Why Arbitrum price has dropped

Arbitrum seems like an undervalued token compared with other networks. For example, the ARB token has a market cap of $2.5 billion while Near and Cardano, which have smaller ecosystems, are valued at $6.4 billion and $15 billion, respectively.

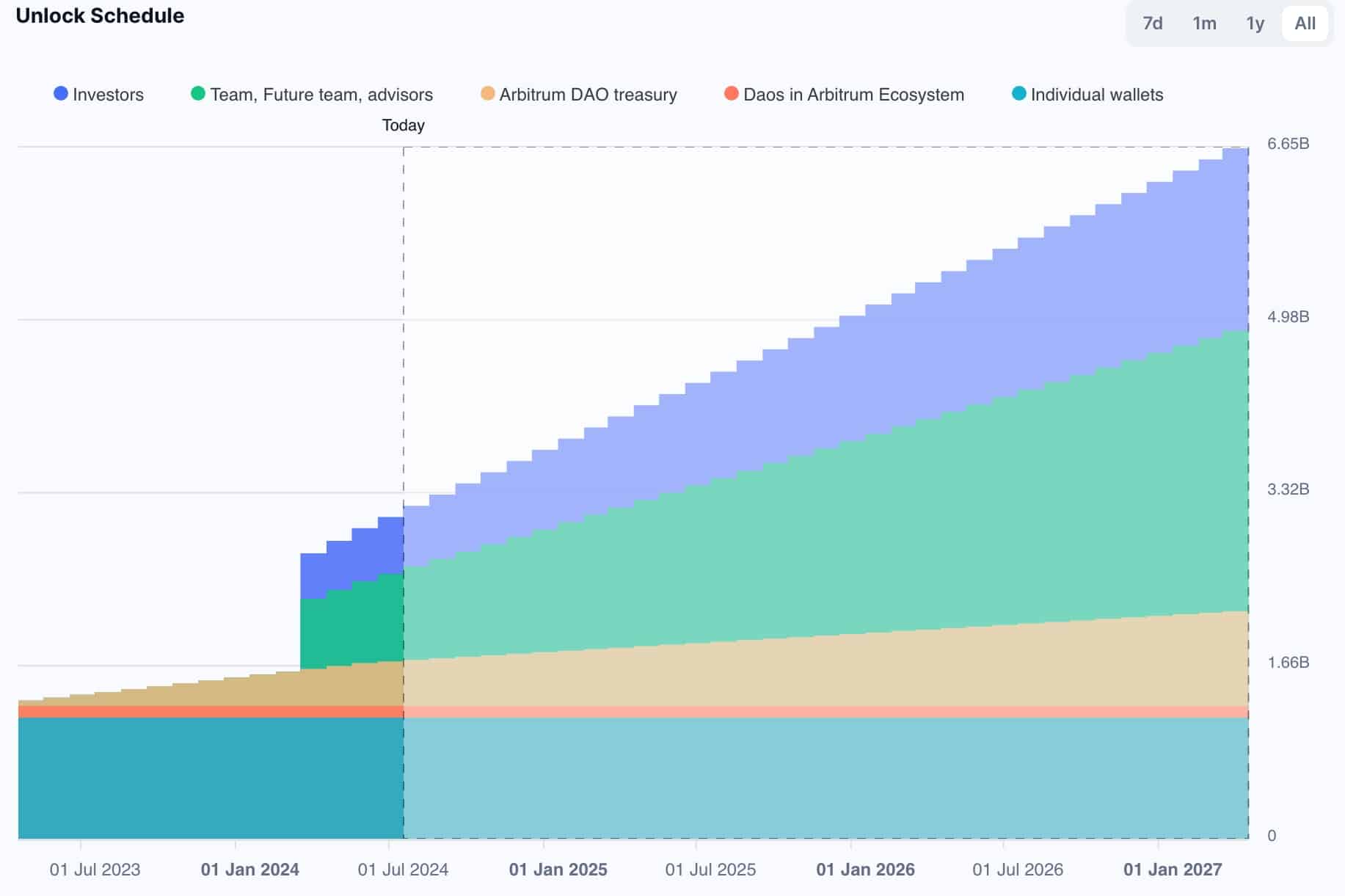

A likely reason for this is that Arbitrum’s holders will continue seeing more dilution in the next few years. Data shows that Arbitrum’s circulating supply stands at over 3.3 billion tokens against a total supply of 10 billion ARB tokens.

Its token unlocks happen on the 16th of every month, with these tokens going to the team, advisors, and investors.

Arbitrum has also dropped because of the recent Bitcoin price action. After soaring to a record high of $73,400 in March, Bitcoin has remained below $65,000. ARB reached its record high at the time and then retreated in line with other altcoins.