July FOMC decision and its impact on Bitcoin and crypto prices

The Federal Open Market Committee will deliver its July interest rate decision on Wednesday, a move that could impact Bitcoin and other crypto prices.

Cryptocurrencies wait for the Fed decision

Most cryptocurrencies traded in a tight range ahead of the Federal Open Market Committee decision. Bitcoin (BTC) was trading at $66,300, down from this week’s high of $70,000 while Ethereum was at $3,320.

The market cap of all cryptocurrencies was down by just 0.78% to $2.38 trillion. Even some of the best-performing altcoins of the day like Mog Coin (MOG), Kaspa (KAS), and Ripple (XRP) were up by less than 6%.

Economists expect the Federal Reserve will leave interest rates unchanged between 5.50% and 5.25% in this meeting. According to Polymarket, only 4% of participants in the $2.4 million pool expect the bank to slash rates by 25 basis points.

Nonetheless, this will be an important meeting since the bank could provide guidance on when rate cuts will start.

With inflation falling for three consecutive months and the unemployment rate rising, the Fed could point to a September cut. The alternative scenario is where the bank maintains a vague data-dependence posture. In this case, it will watch Friday’s non-farm payrolls data for cues on the labor market and the next consumer price index report. It will then provide guidance on a September cut at the annual Jackson Hole Symposium.

Implication for Bitcoin and altcoins

All assets are impacted by the actions of the FOMC. For example, in 2020 and 2021, BTC and other altcoins soared as the bank slashed rates to zero. They then reversed in 2022 as the bank started its benchmark rates.

One reason Bitcoin and other coins could do well when the Fed starts cutting interest rates is that investors have packed trillions in low-risk assets. Money market funds have accumulated over $6.1 trillion in assets as investors benefit from the average return of 5%.

These assets will be less attractive when interest rates start moving downwards. As a result, there are chances of a rotation to riskier assets like stocks, crypto, and Bitcoin ETFs.

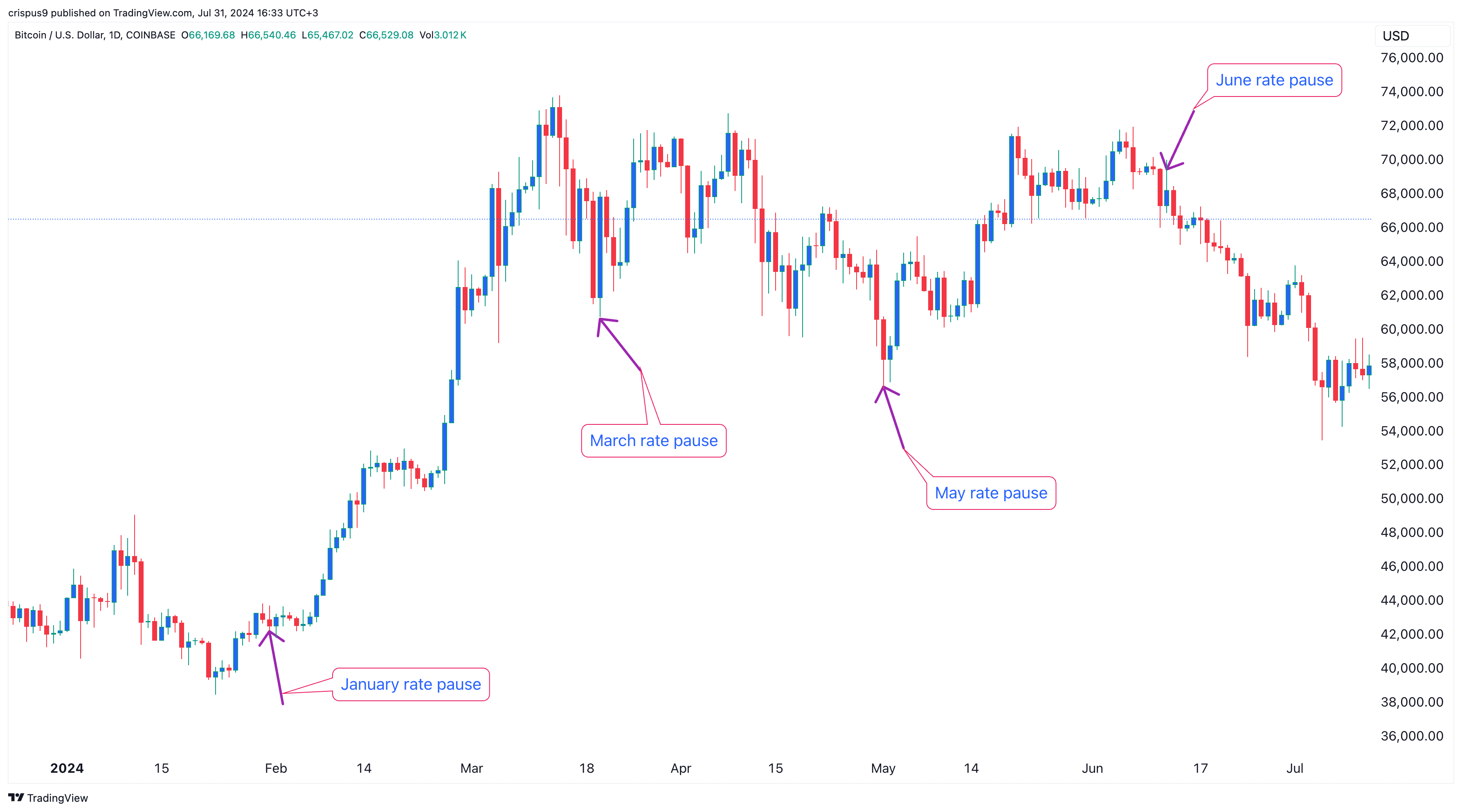

Still, for this meeting, the impact on cryptocurrencies may be limited since the rate pause has been priced in. As shown in previous Fed decisions, there has been no major impact on Bitcoin prices.