K33 Research: Approval of Bitcoin ETFs will cause bearish trend

As the verdict on spot Bitcoin ETFs approaches between Jan. 8 and Jan. 10, market analysts, including K33 Senior Analyst Vetle Lunde, predict a sell-the-news scenario.

Lunde, citing trader exposure and derivatives’ massive premiums, suggests a 75% likelihood of this outcome, overshadowing the 20% chance of approval.

Despite signs of froth in the market, such as futures premiums reaching annualized levels of 50%, institutional players continue to build long exposure, reflecting expectations of approval. Open interest surged by over 50,000 BTC in the last three months, driven by anticipation of ETF approval.

On the retail side, funding rates on offshore exchanges hit an annualized high of 72%, indicating extreme anticipation. However, given the aggressive leverage from long positions, the impending ETF verdict may trigger long squeezes.

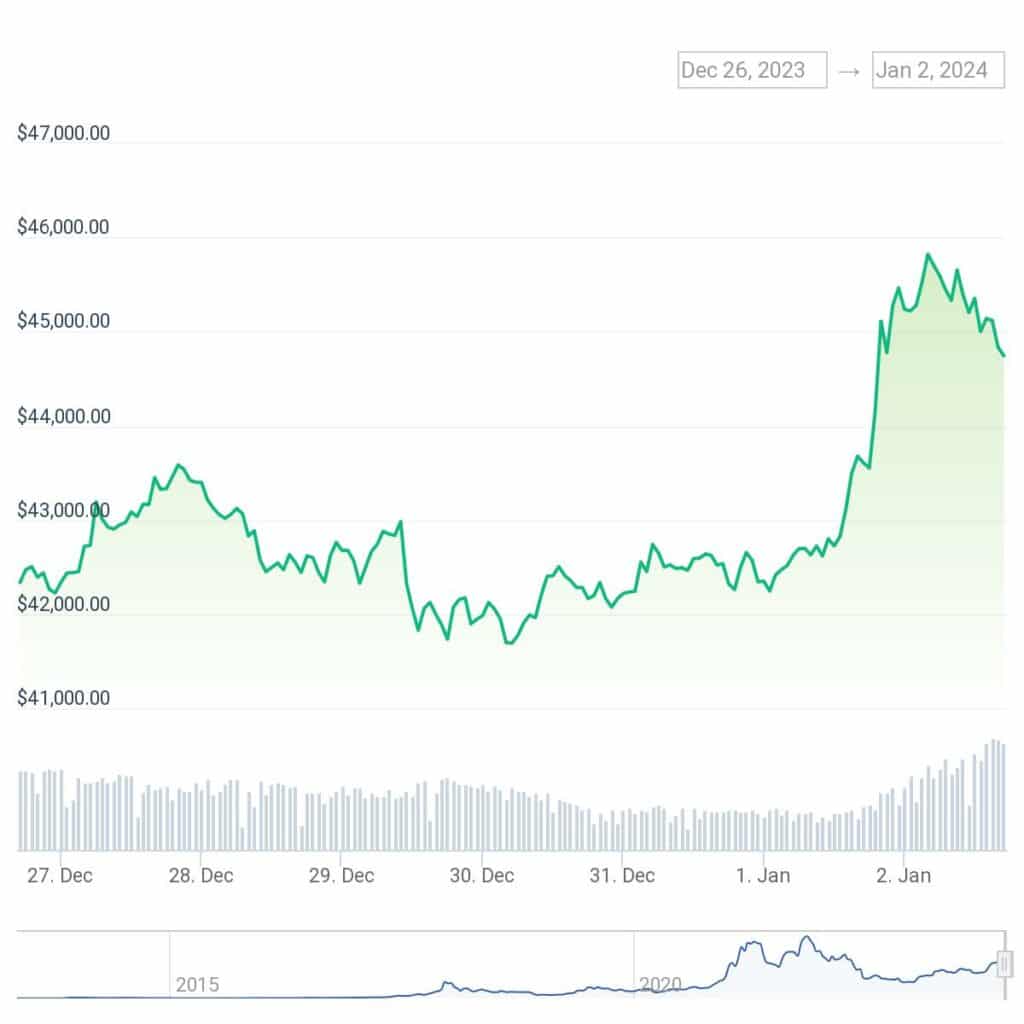

Bitcoin’s recent gains, surpassing $45,000, correlate with growing U.S. spot ETF approval anticipation. Analysts suggest a potential peak in the current rally on the verdict date due to profit-taking and unsustainable premiums.

Looking ahead, Lunde expects a net inflow of at least 50,000 BTC, equal to $2.3 billion in January, crucial for sustained market growth. While a sell-the-news event may lead to short-term fluctuations, the combination of potential spot ETFs and the Bitcoin halving event in April could contribute to a favorable market outlook as the year progresses.