Tough times for prediction markets: Kalshi wins case against CFTC, still faces shutdown

A U.S. District Court has ruled in favor of the Kalshi prediction market, effectively approving betting on the presidential election’s outcome.

Kalshi has won a lawsuit against the U.S. Commodity Futures Trading Commission (CFTC) after the regulator banned betting on political events in the U.S.

However, in response, the regulator filed an emergency motion to make this decision. The company believes that this threatens the platform’s collapse.

Table of Contents

What is known about Kalshi

Kalshi is a financial exchange that allows investors to trade assets based on the expected outcome of future events. Founded in 2019, Kalshi’s markets cover many areas, from economics and international relations to weather and the chance of spotting aliens. In 2021, the platform attracted a $30 million investment in Series A funding led by Sequoia Capital.

According to its founders, Kalshi is the first CFTC-regulated exchange dedicated to direct trading of future event outcomes. The exchange allows investors to take yes or no positions on whether an event will occur through a new asset class called event contracts.

What is the essence of the Kalshi-CFTC conflict?

In September 2023, the CFTC banned Kalshi from placing contracts in congressional elections. The regulator explained this by the fact that such bets are contrary to the public interest and are effectively illegal in some states.

The company that runs the platform went to court, and the regulator’s decision was called “capricious and arbitrary.”

On Sep. 6, U.S. District Judge Jia Cobb ruled in favor of Kalshi but did not provide a reason. She said she would publish it in writing later.

The CFTC’s response

On the day of the court’s decision, the regulator filed a motion to stay the order for 14 days after the judge’s opinion was published. The CFTC explained this by stating that the papers needed to be thoroughly reviewed for a possible future appeal. If this emergency motion is granted, the ban on contract placement will remain in effect until the end of September.

The Commission is in the unenviable position of finding out that it has lost but without any explanation or reasoning. There can be no doubt that the issues presented in this case are serious legal questions. However, at this time, the CFTC cannot fully argue the likelihood of success in any forthcoming appeal, because the court has not yet issued its memorandum opinion.

Kalshi said this would be disastrous for the platform. The platform noted that a delay that the agency will likely try to turn into another, and then another before it is too late, would be devastating for Kalshi, which has staked its future on this lawsuit and these markets.

Kalshi noted that the commission lost fairly and allegedly cannot be allowed to “snatch a procedural victory from the jaws of defeat” by delaying. The company also noted the growth in market shares of platforms such as Polymarket and PredictIt in its appeal. Unlike Kalshi, neither of these resources is regulated by the CFTC.

Ban on betting on U.S. elections

In August, several members of the U.S. Congress appealed to the CFTC with a request to ban betting on the outcome of the presidential election. In the letter, the politicians equated such activity with gambling.

Five senators and three members of the House of Representatives sent an open letter to Rostin Benham, the head of the CFTC. The politicians stated that such markets could undermine public confidence in the country’s electoral system.

Members of Congress noted that elections should not be perceived as a “commercial enterprise.” In their opinion, this negatively affects democratic processes in the United States. Therefore, the congressmen believe the CFTC is obliged to develop rules that eliminate this phenomenon.

What’s Happening with Election Bets

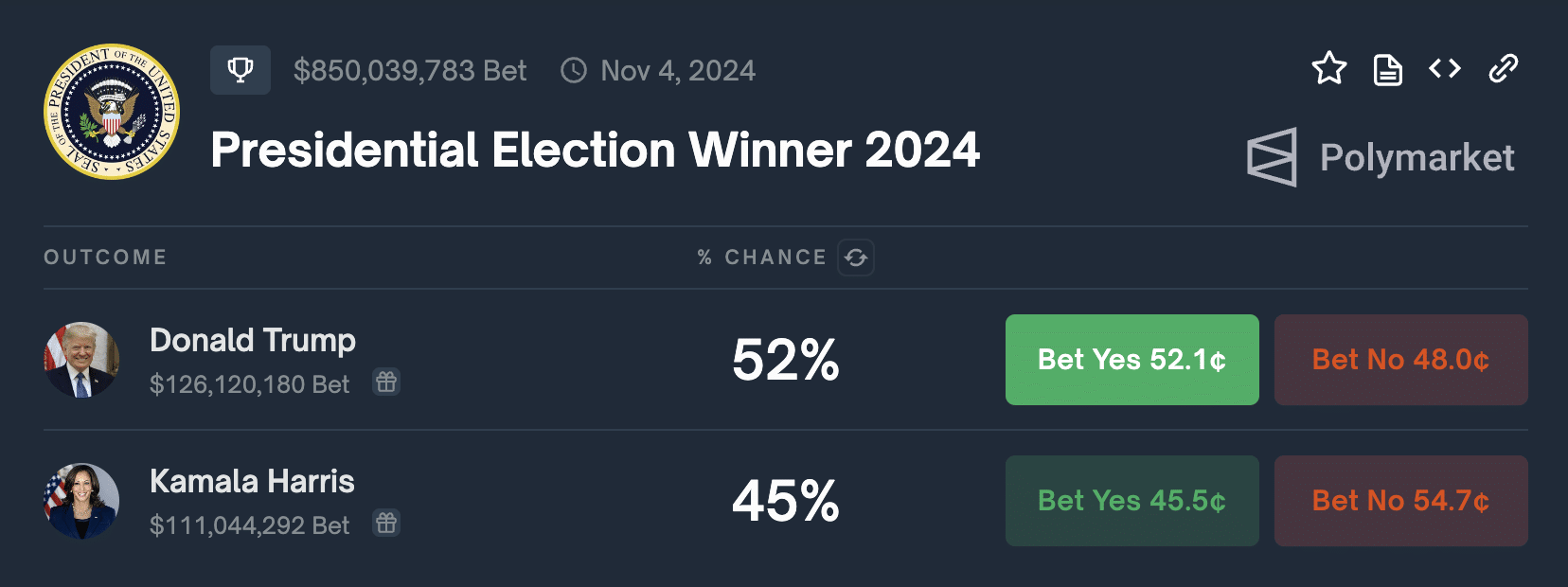

Meanwhile, the Polymarket platform has seen bets on the 2024 presidential race exceed $850 million. According to the platform, entrepreneur Donald Trump is the leader. Users estimate his chances of winning at 52%, while 45% of people who placed a bet believe in Vice President Kamala Harris’ triumph. $126 million has been bet on Trump’s victory, while $111 million has been bet on Harris.

At the same time, the political section on the platform exceeds $1 billion in funds. Project participants are betting on hundreds of events.

However, Polymarket‘s predictions are likely to be inaccurate. Nevertheless, the very fact of such large-scale investments in predicting the election outcome through cryptocurrency platforms demonstrates the growing influence of the crypto community on the perception of political processes and the willingness of its participants to take financial risks associated with political events.