Leading Bitcoin miners witness dip in 2024 production, CryptoQuant says

Bitcoin mining giants, including RIOT Platforms and Marathon Digital, experience a production decline in 2024, while CleanSpark stands out with growth.

As Bitcoin‘s fourth halving approaches, Bitcoin mining giants are grappling with a decline in production as the market faces intensified competition and lowering fees.

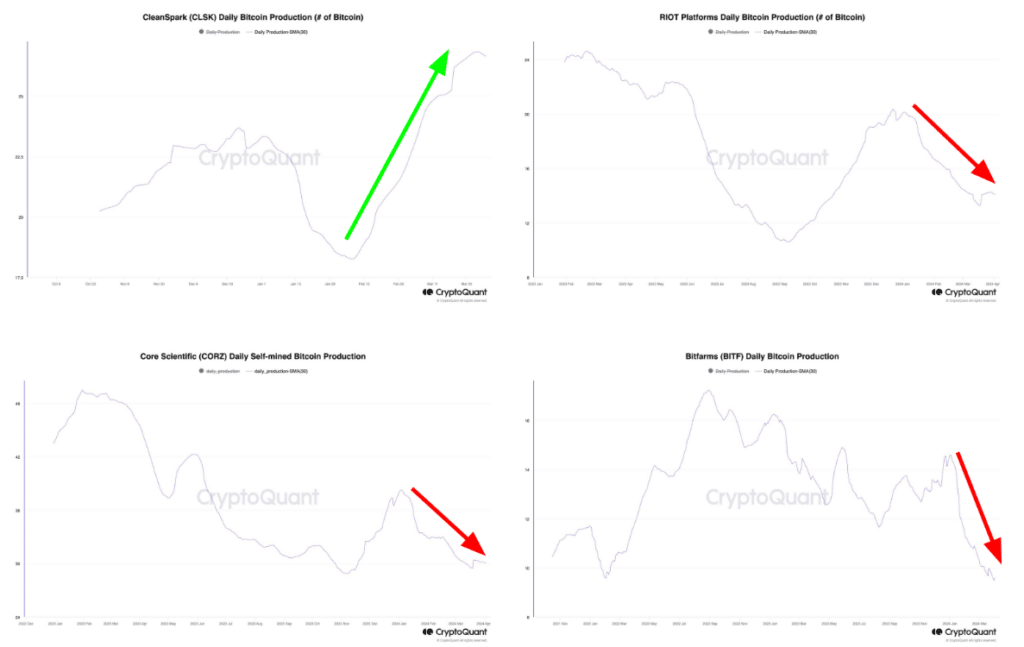

Recent findings from CryptoQuant’s research report reveal that the largest crypto mining firms like RIOT Platforms, Core Scientific, Bitfarms, and Marathon Digital have all witnessed a slump in BTC production in 2024.

This decline is attributed to a confluence of factors, including reduced transaction fees on the Bitcoin network, heightened network hashrate, and some operational disruptions. At the same time, CleanSpark stands out as an exception, boasting growth in Bitcoin production amid the industry’s downturn, CryptoQuant notes.

In a bid to mitigate financial pressures, some miners have escalated their selling activity ahead of the halving, CryptoQuant said, adding that miner daily selling to some over-the-counter desks increased to 1,600 BTC in late March, the highest selling volume since August 2023.

Despite these challenges, competition remains fierce in the sector, with Bitcoin’s network hashrate continuing to rise, necessitating increased resources for maintaining daily production levels. CryptoQuant’s data underscores “record-high competition for Bitcoin block rewards,” with hashrate surging since the previous halving in 2020.

While the market faces intense competition, experts suggest a different landscape compared to previous years, noting that current crypto prices are providing relief to many miners. According to Hub 8 CEO Asher Genoot, the dynamics differ from those seen in 2022, indicating that the current market conditions are supporting miners rather than leading to widespread bankruptcies.