5 ways to earn passive income from NFTs

There are several ways to earn passive income through NFTs. Stacking or renting them, earning royalties, providing liquidity and yield farming. Keep reading to learn more.

How to make money with NFTs?

Here are three strategies you can employ to earn passive income with NFTs:

- Staking NFTs: Through the integration of NFTs and decentralized finance (DeFi) protocols, you can stake your NFTs and earn rewards. Staking involves depositing NFTs into a DeFi protocol and receiving yield or incentives in return.

- Rent out NFTs: Similar to real estate, you can rent out NFTs to others for a specific period in exchange for money. This allows you to earn income from your NFTs without sacrificing ownership.

- Royalties: Creators have the ability to earn ongoing royalties even after selling their NFTs. By imposing royalty terms, you can earn passive income whenever your NFT is resold.

- Providing liquidity: When you provide liquidity, you’re essentially adding your NFTs to a shared pool on a marketplace and earning a share of the transaction fees.

- Yield farming: Often used in blockchain games. You can earn tokens or stake in-game items to receive a reward.

As with any investment, it’s important to conduct thorough research, understand market trends, and exercise caution when engaging in NFT-related activities. With the right knowledge and strategy, making money with NFTs can be a rewarding venture.

What are NFTs?

NFTs, or non-fungible tokens, represent a unique class of digital assets in blockchain technology. Unlike traditional cryptocurrencies such as bitcoin or ether, which are identical (or fungible) and can be exchanged on a one-for-one basis, NFTs are unique – each one is different from the other.

In simpler terms, think of NFTs as collectible digital items, like virtual art, music, or even tweets, with a certificate of authenticity created by blockchain. This certificate or “token” verifies the owner and the authenticity of the digital asset, making it one-of-a-kind.

Most NFTs are built on Ethereum’s blockchain using a specific set of standards known as ERC-721 or ERC-1155. These standards ensure that the tokens can interact with each other within the Ethereum ecosystem and can be easily traded on any platform that supports these standards. Essentially, these standards make NFTs work seamlessly within the larger world of Ethereum’s blockchain.

Earn by staking NFTs

NFT staking involves locking up NFTs for rewards, such as additional tokens or other benefits. Let’s explore a few examples of NFT staking platforms that offer opportunities for users to stake their NFTs and reap the rewards in return. Here are some platforms:

NFTX: NFTX is a decentralized platform that allows users to create funds represented by ERC-20 tokens, which are backed by collections of NFTs. The platform’s users can stake NFTs and earn rewards. This setup allows for increased liquidity in the NFT market, as the fund tokens can be freely traded or staked.

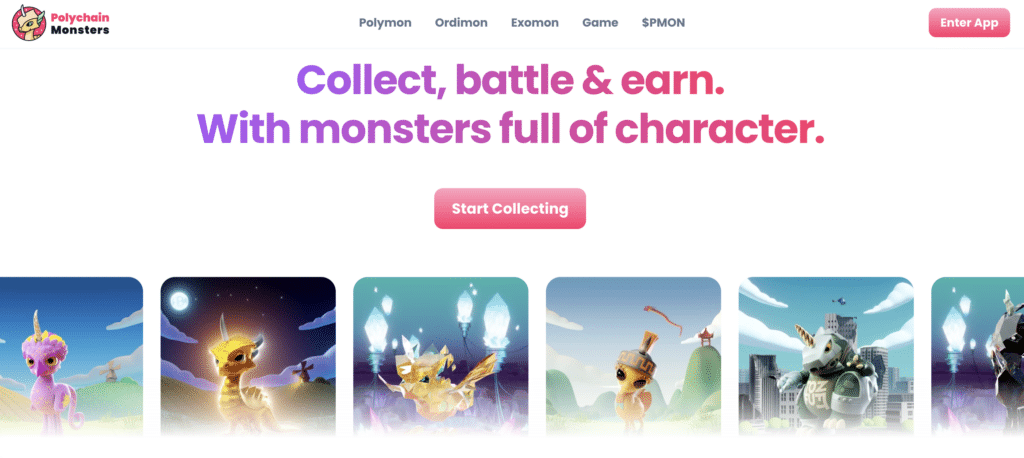

Polychain Monsters: Polychain Monsters is a staking platform for NFTs. Users acquire animated collectible NFTs called Polymon through digital packs. Polymons have various traits and rarities, with highly sought-after combinations. NFT holders can stake their tokens to earn PMON, the platform’s native cryptocurrency, weekly.

Doge Capital: Known for its playful nod to the meme-inspired dogecoin, Doge Capital is a staking platform that focuses on the fun and whimsical side of the NFT world. Users stake their NFTs in “kennels” and earn rewards in the form of DOGE tokens. While it operates on a lighter note, Doge Capital offers some staking benefits and encourages the participation of a wide range of NFT enthusiasts.

Remember, while staking NFTs can provide a passive income, it is essential to understand the specifics of each platform and the associated risks before proceeding. The volatile nature of the crypto market and the unique features of each NFT should always be taken into account when investing.

Earn by renting out NFTs

Why rent an NFT? Renting NFTs offers a cheaper alternative for borrowers to get access to the advantages that some high-end NFTs provide like access to exclusive content and events. NFT renting is especially popular in gaming as NFTs are used as tools, creatures, or skins. With these additional features, players can enhance their experience and collect additional income through play-to-earn. Then, in exchange for renting their NFTs, the landlords receive a cut of the cryptocurrency they earn.

This strategy requires entering the duration of the rental agreement and the cost. It’s also a way for new gamers to earn money without spending much. Some experts believe that the popularity of NFTs will soon become a major factor in the gaming industry.

One of the main disadvantages of this strategy is that it only works for one type of blockchain game. If the game loses popularity, there will be no renters for your NFT. Hence, it might help to have multiple types of NFTs. These will allow you to feature them in various games.

Here are some examples of NFT renting platforms:

Vera: Vera is a decentralized platform that simplifies NFT rentals and mortgages. It supports both collateralized and non-collateralized options across multiple blockchains, providing flexibility for NFT holders. What sets Vera apart is its mortgage financing feature, which allows users to own NFTs through seller financing or network financing.

Trava: Trava is a cross-chain lending marketplace that specializes in NFT rentals. The platform facilitates the rental of NFTs, allowing users to borrow and utilize them for specific purposes. Trava’s focus on cross-chain functionality ensures that users have access to a wide range of NFTs for their renting needs.

reNFT: In collaboration with Rarible, reNFT is a leading NFT lender that provides an integrated rental protocol for Ethereum users. It has transparent pricing, and rental durations can be set by lenders. Borrowers can lease NFTs through reNFT’s smart contract protocol, and reNFT acts as an escrow service.

NFT royalties

The concept of NFT royalties means the creator receives a percentage of the sales price each time a new NFT creation is sold through a marketplace. You can choose the percentage you want to receive; most marketplaces allow you to do so. NFT royalties enable creators to earn a passive income even after they have sold their creations.

With this, artists can earn a share of the proceeds from selling the non-fungible tokens(NFTs) they created. For instance, if the royalty on a digital artwork is set at 10%, the creator will receive a ten percent portion of the total sale price when a new owner purchases the artwork.

Royalties have to be written into the smart contract terms ensuring that the entire process is automatically performed.

This method of passive earning works for all types of digital content, such as physical items and gaming accessories. As their NFT popularity grows, they can get more returns on their work.

There are several platforms available that offer opportunities for artists and collectors to engage in the digital art marketplace while ensuring that creators receive ongoing compensation for their work. Here are three of them:

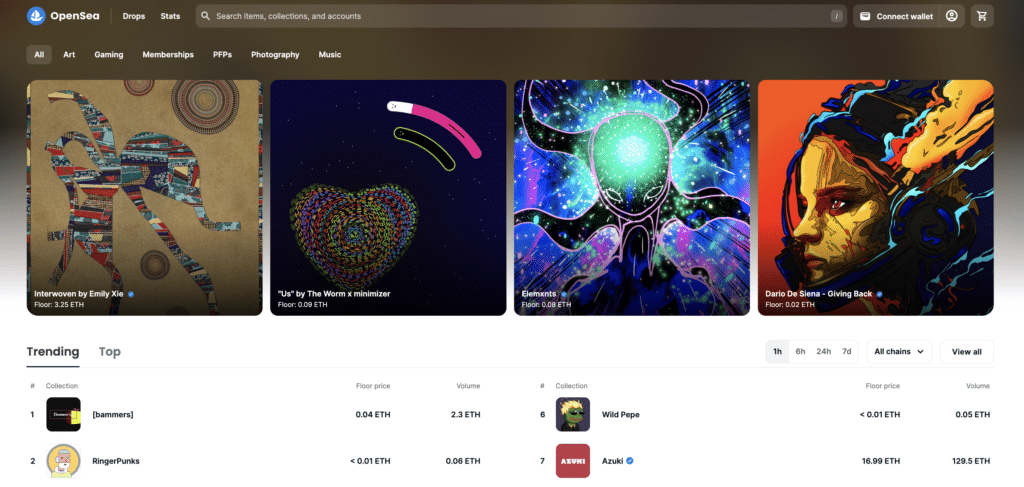

OpenSea: OpenSea has emerged as the largest marketplace for NFTs. In a recent development, OpenSea revised its fee structure, temporarily reducing transaction fees from 2.5% to 0%. Additionally, for NFT projects lacking on-chain enforcement measures, a nominal 0.5% royalty fee is imposed on both old and new purchases. However, collectors have the flexibility to pay higher royalties if they believe the NFT’s value justifies it. This change positions OpenSea as a more accessible and cost-effective platform for both collectors and creators. Moreover, users who implement on-chain enforcement tools can receive full royalty payments of up to 10%.

Rarible: Rarible provides a user-friendly platform that enables creators to showcase their artwork. Listing an artwork on Rarible is a straightforward process requiring users to create an account and connect a wallet. Once set up, creators can begin uploading their works and setting prices. Rarible charges a 1% fee on each transaction, applicable to both buyers and sellers. Furthermore, creators have the option to set royalty rates of up to 50%, ensuring ongoing compensation for their work.

SuperRare: SuperRare has gained prominence in the NFT marketplace by emphasizing the uniqueness of its digital artworks. Prospective creators must seek approval from SuperRare Labs to publish NFTs on the platform. With SuperRare, when a secondary sale occurs, the original owner receives 10% as royalties, while the collector retains 90% of the sale. Additionally, a 3% fee is charged for each sale, which is paid by the buyer.

These platforms offer diverse opportunities for creators and collectors alike, ensuring that artists are appropriately compensated for their digital creations. By providing royalty options, they contribute to the sustainability and growth of the NFT market while fostering a supportive environment for creators.

Providing liquidity

One way to generate passive income from NFTs is by providing liquidity. In essence, liquidity providers deposit their NFTs into a shared marketplace pool. When transactions occur in that pool (like buying, selling, or trading NFTs), liquidity providers earn a portion of the transaction fees. This process can be a steady source of income if the pool is active.

However, providing liquidity comes with its own set of risks. The value of NFTs can fluctify significantly, and you may not be able to withdraw your assets when you want if the market liquidity is low.

Examples of the liquidity pools:

- Uniswap is one of the largest decentralized trading pools in the world. It allows you to supply liquidity for any ERC-20 token pair, earning transaction fees in return. It’s relatively simple to use, but always remember the potential risks of price fluctuations.

- Balancer allows you to create liquidity pools with up to eight assets, and each can have different weights. This dynamic portfolio management lets you earn fees and BAL tokens, the platform’s native cryptocurrency.

- Curve Finance specializes in stablecoin liquidity pools, reducing the risk of significant price changes. As a liquidity provider, you can earn transaction fees and CRV tokens.

Yield farming

NFT farming is a concept that combines the principles of decentralized finance (DeFi) with non-fungible tokens (NFTs). It allows users to earn rewards by staking or providing liquidity to NFTs on specific platforms.

In NFT farming, users typically lock their NFTs in smart contracts or platforms, similar to how cryptocurrencies are locked in traditional DeFi farming protocols. By doing so, they contribute to the liquidity pool or ecosystem of NFTs, which enables other users to trade or interact with those NFTs. In return for providing this liquidity, users receive rewards in the form of additional NFTs, cryptocurrencies, or platform-specific tokens.

NFT farming is also used in blockchain games. Players can earn tokens or stake in-game items to receive tokens and vice versa. For example, Axie Infinity, an Ethereum-powered game, allows players to earn SLP tokens which they can mint to receive NFTs in the form of Axies. Other dApps with similar opportunities are SuperFarm and Mobox.

Note that there are still many NFT farming opportunities in their early stages of development. Farmers may also face vulnerability in dApp’s smart contract code, which could lead to a loss of funds.

Final thoughts

The non-fungible token (NFT) market has seen exponential growth in recent years. In 2022, the size of the NFT market nearly reached $38.2 billion, and it is predicted to grow by 27.60%, amassing an estimated $342.54 billion by the end of 2032.

However, trading isn’t the only way to earn money with NFTs. They can also serve as a source of passive income over an extended period.

But like any investment, delving into the world of NFTs isn’t without risk. The value of digital assets can fluctuate wildly, and there’s no guarantee of returns. Moreover, the NFT market is still young and could face regulatory changes. As with any investment, it’s crucial to conduct thorough research and consider your financial position before diving in.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

What does NFT mean in full?

NFT stands for non-fungible token. It’s a type of digital asset that represents ownership or proof of authenticity of a unique item or piece of content using blockchain technology. Each NFT has distinct information or attributes that make it unique and, therefore, not interchangeable on a one-for-one basis, unlike fungible tokens such as bitcoin or ether.

Is NFT a type of cryptocurrency?

No, However, while NFTs are not a type of cryptocurrency, they are a type of token that utilizes blockchain technology, similar to cryptocurrencies. Unlike cryptocurrencies, which are identical to each other and can be exchanged on a one-for-one basis, each NFT is unique and cannot be exchanged on a like-for-like basis.

Should I invest in NFTs?

Investing in non-fungible tokens may be profitable with the right knowledge and strategy. However, as with any investment, profit is not guaranteed. You should do your own research, understand market trends and be careful if you decide to invest in NFTs.

How can I buy an NFT?

To buy an NFT, you’ll first need to set up a digital wallet that allows for the buying and selling of NFTs, and then load it with cryptocurrency, in most cases Ether (ETH). Then, you can visit a marketplace that sells NFTs, such as OpenSea or Rarible. Once you’ve found an NFT you wish to purchase, you can make a bid or buy it outright, similar to an online auction.