Lightning Network Continues its Expansion Thanks to Lightning Labs

Lightning Labs has hit a new milestone with the release of its Lightning Mobile App for iOS & Android making it the first mainnet app on all major mobile and desktop platforms. The second layer protocol is getting more stable despite some major issues still to be overcome.

Lightning Is Getting more User-Friendly

The number of companies building products on the Bitcoin Lightning Network (LN) is constantly increasing. Lighting Labs, the San Francisco-based company focused on the second layer solution, has recently announced a new Lightning App that will bring LN to all major mobile and desktop platforms making it the very first mainnet app to offer such features.

According to the company’s announcement, the app will feature a simplified user experience to attract more users to the new protocol. The underlying wallet is non-custodial and integrates a fully functional LN node. Moreover, the mobile app will also include two more core technologies.

The first is Neutrino, a client specification that allows non-custodial lighting wallets to verify Bitcoin transactions with improved privacy, minimized trust, and without syncing the whole blockchain. The second core element is Autopilot, a technology that automatically selects channels by connecting new users to reliable routing nodes.

The mobile app source code is licensed by the GPLv3 and available on Github. Interested parties can test the alpha release for iOS (on Testflight) and Android (on Google Play).

A Brief History of the Lightning Network

The Lightning Network is a layer two payment protocol that operates on top of a blockchain-based cryptocurrency like Bitcoin. It enables fast transactions with lower fees between participants. The Lightning Network is the most promising solution to the Bitcoin scalability problem.

First introduced in 2016 by Joseph Poon and Thaddeus Dryja, the Lightning Network was only tested in December 2017 and its first implementation, lnd 0.4-beta, was launched in March 2018 by Lightning Labs. The other two major implementations released by ACINQ and Blockstream would follow later in late March and late June respectively.

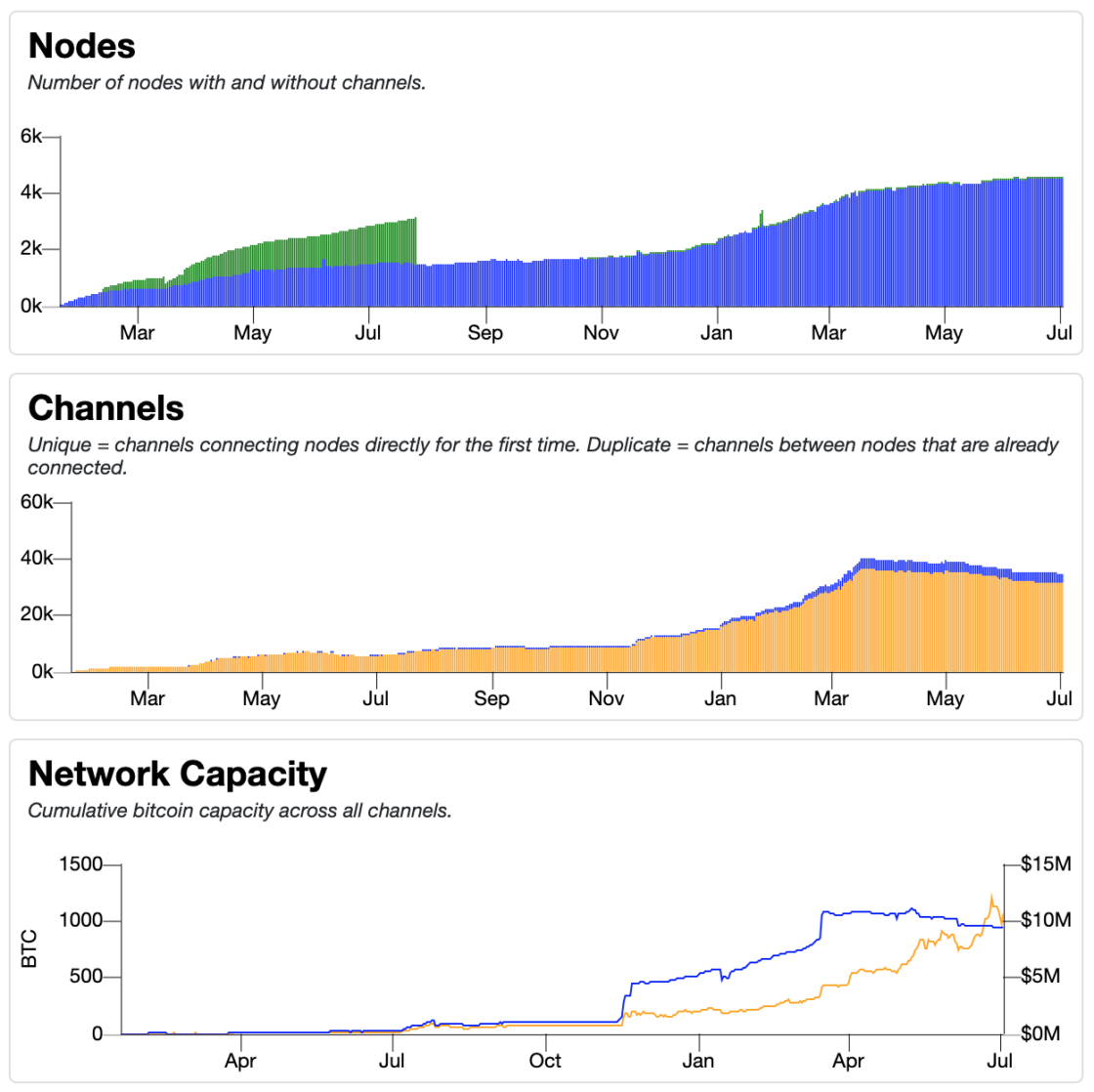

During the year, the growth of the Lightning Network has been remarkable. Today one can count more than 4,500 nodes with more than 30,000 active channels and a Network capacity around 944 bitcoins that equals to more than 11 million dollars.

(Source: Bitcoin Visuals)

Since the beginning of 2019, in particular, the number of nodes has more than doubled. This may be due to the fact that there are more and more solutions available even for non-technical users such as the plug-and-play nodes of Casa and Nodl.

Unlike the other values that have grown rather steadily, it is important to note the network’s capacity growth. The largest increase was recorded in early November 2018 when the LN’s capacity suddenly increased by 300 percent in just two weeks. From that moment on, it doubled to its peak during March 2019 when the network capacity exceeded 1,000 bitcoin.

However, it is also important to understand how this growth was achieved. One of the main criticisms attributed to the Lightning Network is that in the long term it can lead to centralization of nodes and create singular payment hubs.

If one checks the distribution of nodes or the capacity of each channel, we can see that most of this increase is sustained by a few players. The growth in November, in particular, was triggered by the entry of LNBIG.com nodes (at the time of writing, LNBIG manages 25 nodes which represent 0.2 percent of all nodes with more than 640 bitcoin accounting for 68 percent of the network capacity).

If one considers decentralization, this data can be worrisome, especially considering that capacity is still so low that it can be easily gamed by a single party. Overall, we can consider these developments as an improvement nonetheless.

Latest Developments and Next Steps

Despite the rosy development, the Lightning Network has still to overcome some of its biggest hurdles like single-channel capacity, liquidity or user experience.

Bitcoin has come a long way in a short decade, so it’s normal that the technology is imperfect. In any case, the commitments to scaling and improving the Lightning Network are worthy of plaudits.

For example, starting from July 2, 2019, Liquid sidechain users can send and receive bitcoin micropayments instantly and privately via the c-lightning implementation of the Lightning Network. Another goal to consider is the one of Bitrefill, a California-based company that generously integrated the Lightning Network for all Coinbase users.

The popular peer-to-peer cryptocurrency trading platform Hodl Hodl has announced their new mainnet now allows users to trade to and from their Lightning wallets.

While more and more exchanges and startups are trying to facilitate access to the second layer protocol, developers are working on various solutions that will stabilize the network.

Atomic Multipath Payments is a solution that allows users to break a single payment down into several smaller ones, sending them over multiple Lightning channels to remove the biggest hurdles to payment issues, single-channel capacity, and liquidity.

Another available feature that will benefit not only bitcoiners but also holders of other coins is Atomic Swaps. With the Lightning Network, it will be possible to connect any blockchain and make payments across chains. Following this path, a brand new type of exchange has hit the market in April 2019. Named Sparkswap, it’s the first-ever exchange built on Lightning Network Atomic swaps.

Other improvements focus on very specific areas. Here’s a list:

- eltoo: A Simplified Update Mechanism for Lightning and Off-Chain Contracts

- Watchtowers

- Splicing

- Rendezvous routing

- Trampoline Payments

- Submarine Swaps