Liquid Capital founder reveals top projects to watch

Liquid Capital founder Jack Yi namedrops three key areas to watch closely as he believes they will “transcend cycles,” mentioning projects like Ethereum, BNB and Aster.

- Liquid Capital founder Jack Yi emphasized that public chains, exchanges, and stablecoins are the three core pillars of the crypto market capable of transcending cycles.

- In his recommendations, he highlighted Ethereum, BNB, and Aster as standout projects within each category.

- Since its establishment in 2016, Liquid Capital has invested in over 300 blockchain projects, focusing primarily on DeFi, GameFi, and infrastructure.

In a recent post, Liquid Capital founder Jack Yi shared his views regarding which core areas investors should focus on from a long-term cycle perspective. He identified public chains, exchanges and stablecoins as the three core assets that he believes can “transcend cycles.” Therefore, investors should watch them closely.

According to Yi’s post, these areas are not temporary trends in the market. Instead, they form the backbone of the digital asset ecosystem, with each one playing a distinct and major role.

This is because public chains provide the foundational infrastructure, exchanges serve as liquidity hubs and gateways for adoption, while stablecoins ensure transactional stability and act as the bridge that connects traditional and decentralized finance.

Yi went on to highlight the project within each area that he believed were worth watching.

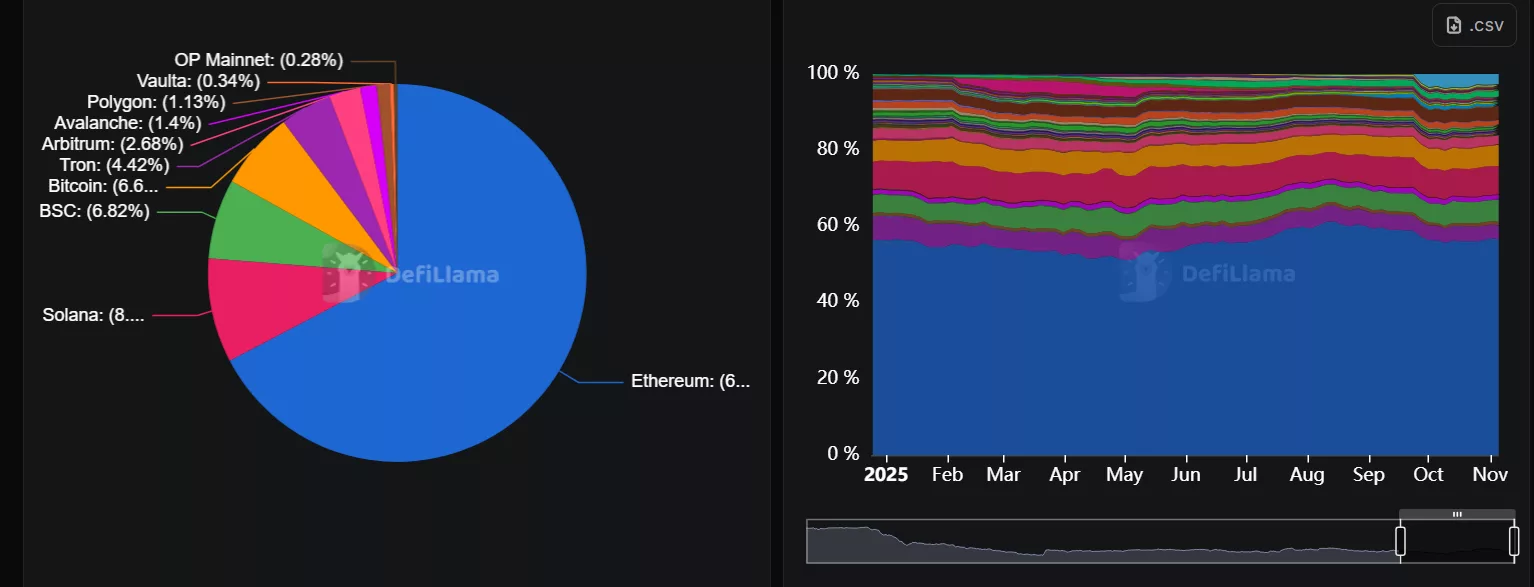

In terms of public blockchains, he urged investors to pay close attention to Ethereum (ETH) investments. According to data from DeFi Llama, Ethereum remains the largest public chain in terms of total value locked on DeFi and the number of projects operating within its ecosystem.

On Nov. 5, Ethereum’s DeFi TVL stood at $75.21 billion, representing more than 67.32% out of the total value locked on-chain. The chain manages to surpass Solana (SOL), BSC and Bitcoin (BTC) as the largest public blockchain. So far, ETH hosts 1,660 protocols on its chain.

With regards to exchanges, Yi recommends that BNB (BNB) and Aster (ASTER) are the two most promising ones. He cited BNB as having stable income and a strong ecological foundation. Meanwhile, he described Aster as being Binance’s “second growth curve.”

Not only that, he also stated that Aster currently holds the highest strategic importance within the entire Binance system. Though at the moment, Aster still ranks in 6th place out of all BSC protocols in terms of TVL. Its $531.4 million TVL still dwarfs in comparison to PancakeSwap’s $2.39 billion and Lista Dao’s $2.02 billion.

However, the DEX chain has quickly become one of the fastest growing chains in the space. After gaining support from YZi Labs Chairman Changpeng Zhao, it saw its project catapult to new heights with the launch of its native token ASTER and the Aster Chain.

Liquid Capital’s crypto investments

Formerly known as LD Capital, Liquid Capital is known as a crypto fund that invests and trades in primary and secondary markets. Its sub-funds include Beco Fund, FoF, hedge fund, Meta Fund, and more.

According to data from CoinLaunch, Liquid Capital’s portfolio includes blockchain and crypto projects across various sectors, with a focus on DeFi (31.3%), GameFi (24%), and blockchain infrastructure (21.7%). In the past, the firm has invested in well-known crypto projects like Certik, Republic, CoinList, Qredo, and MEXC.

Since its establishment in 2016, the company has reportedly invested in more than 300 enterprises. Its founder, Jack Yi, has been particularly bullish on Ethereum. Throughout the past year, the Liquid Capital founder has been notably posting about key resistance levels for ETH, price predictions and when it will next “takeoff.” As of June 2025, he admitted to holding on to 100,000 ETH call options.

On the other hand, he has also been shown to favor smaller altcoins like UNI, stating that the asset is its third largest crypto investment aside from Bitcoin and Ethereum.