Liquidity restaking tokens market up 8,300% amid demand for ‘user-friendly instruments’

As investors seek efficient financial instruments, the total locked value in liquidity restaking tokens has soared by more than 8,000% since the beginning of the year.

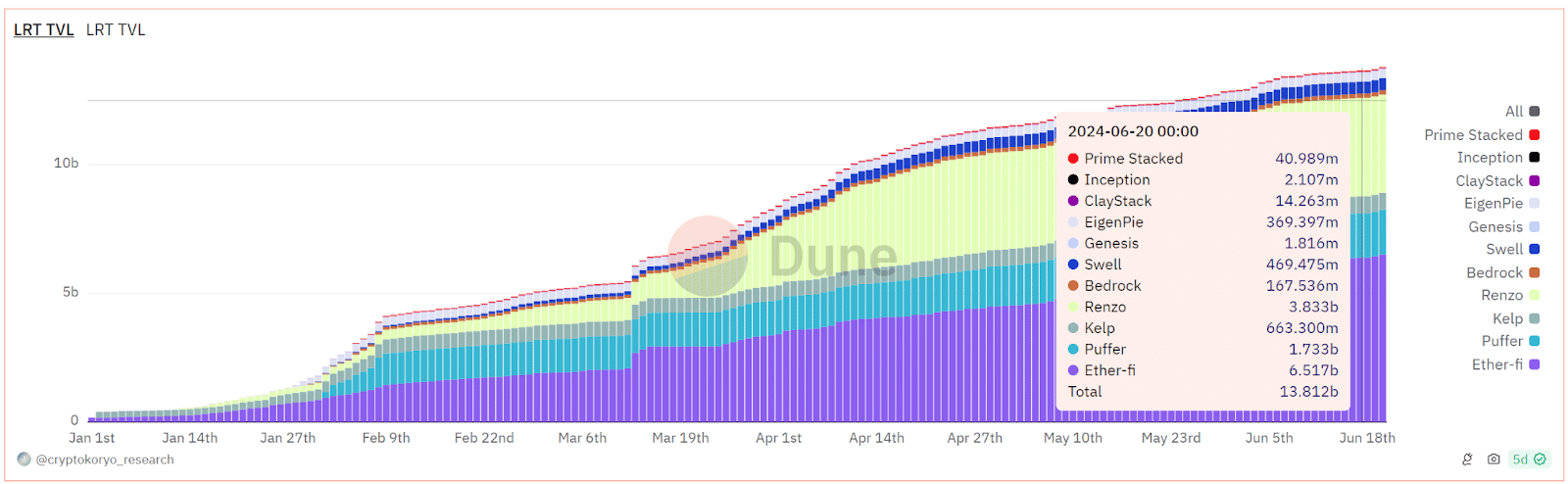

The market for LRTs has skyrocketed by 8,300% this year, growing from $164 million to nearly $14 billion. This reflects a rapidly surging increase in the crypto landscape toward more user-friendly financial instruments, according to a research report by crypto venture capital firm Node Capital shared with crypto.news.

The analysts attribute the dramatic surge to the fact that traditional restaking protocols are struggling to keep up with rising demand, with LRTs now capturing a noticeable market share. Ether.fi (ETHFI), a non-custodial delegated staking protocol, leads the charge, boasting over 50% of the LRT market, the VC firm notes.

Protocols capitalize on arbitrage opportunity

Node Capital’s token engineering analyst Or Harel suggests the dramatic rise in LRT adoption can be attributed to the fact that major liquid restaking protocols noticed the hype and “capitalized on this technical arbitrage opportunity.”

“In a short period, these LRPs accumulated billions in stakers’ capital and built sophisticated operator infrastructure, positioning themselves as key facilitators of the supply side,” he added.

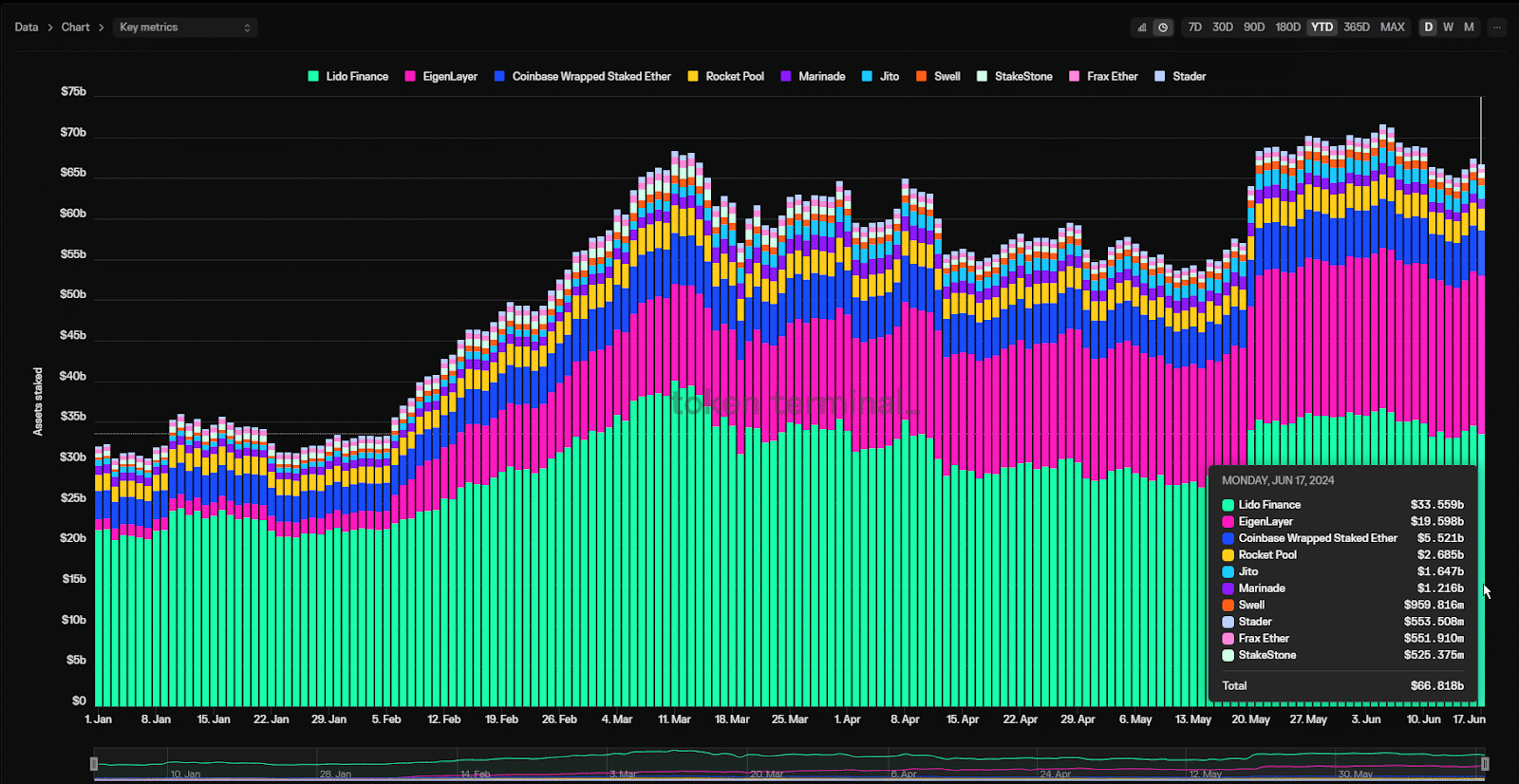

However, Node Capital’s analysts also express growing concern regarding centralization. As user preference leans toward convenience, centralized solutions like Lido are gaining more traction, and their “dominant market share creates a new form of centralization.” According to data from Token Terminal, Lido Finance (LDO) had allocated more than $33 billion in crypto for staking by June, outpacing EigenLayer, which managed approximately $20 billion.