Litecoin network transactions skyrocket 200% as $100 price target looms

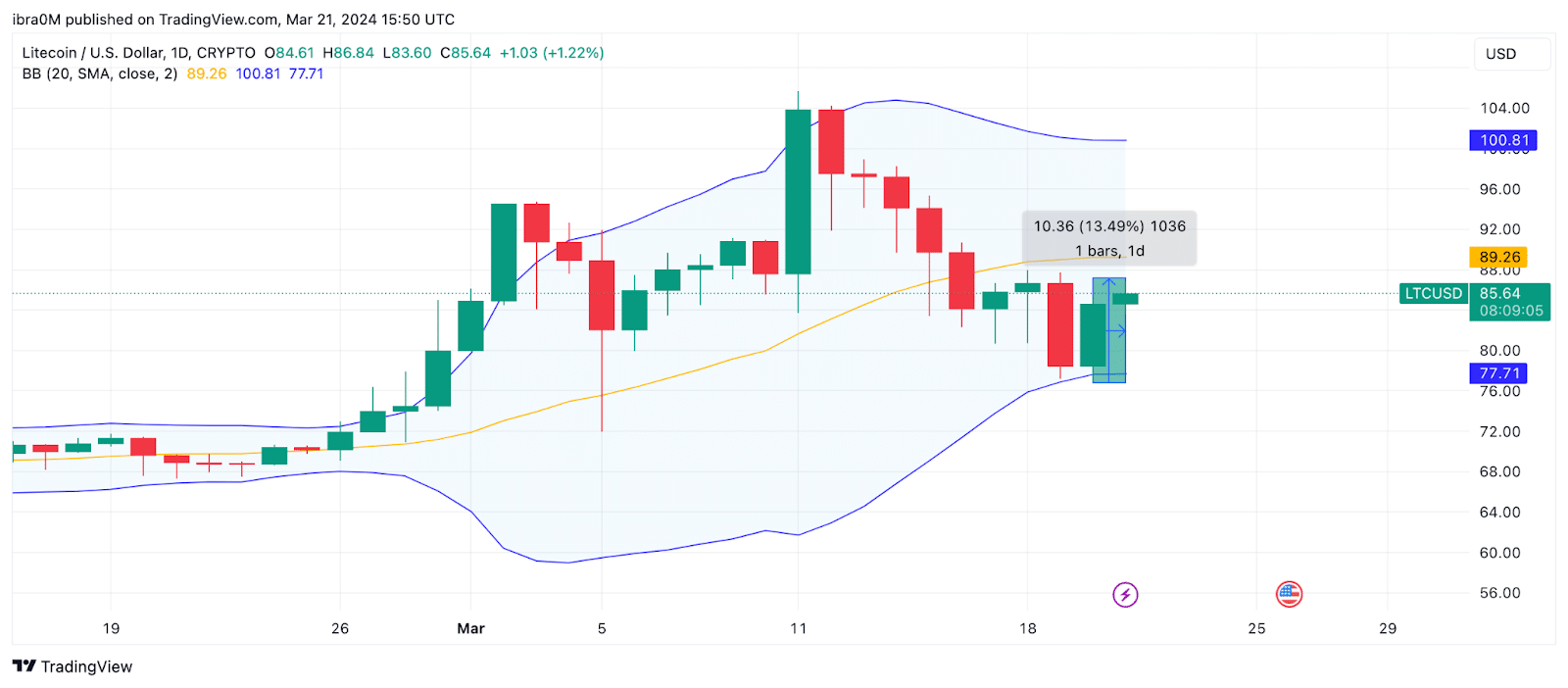

The price of Litecoin grew 8% on March 20, surging from $77 to $86 within the 24-hour timeframe.

A rare network transactions trend suggests Litcoin (LTC) could advance towards $100 in the days ahead. A recent announcement by Coinbase and rising volumes of large LTC transactions have emerged as major bullish catalysts for Litecoin’s price this week.

Litecoin price pumps after Coinbase LTC futures announcement

On March 20, Coinbase derivatives announced plans to list futures contracts for Dogecoin (DOGE), Litecoin, and Bitcoin Cash (BCH). According to Coinbase’s filing with the Commodity Futures Trading Commission (CFTC), the exchange aims for an April 1 kick-off on the three pairings.

Looking at the latest LTC price action, investors have reacted positively to the news, anticipating that the Coinbase listing could drive new capital inflows and further deepen global adoption of LTC.

Within 24 hours of the Coinbase futures listing announcement, LTC price witnessed a 13.5% price bounce to $86, adding over $800 million to its market cap.

While this recent development has triggered a price uptrend, on-chain data shows that the network had recently experienced a noticeable increase in large ticket transactions, even while LTC prices were in a consolidation phase.

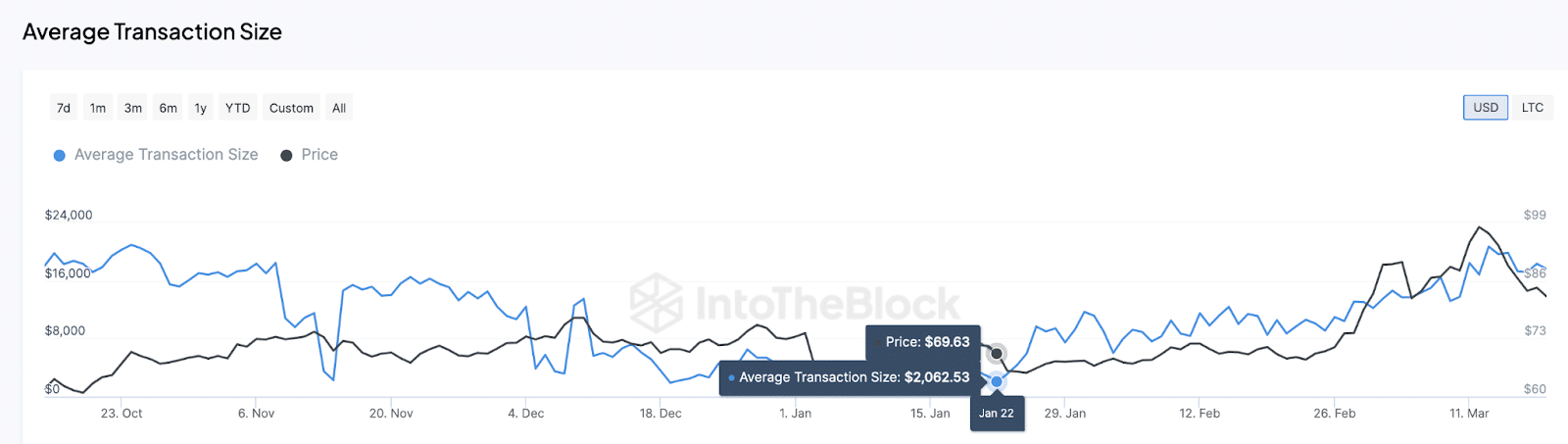

Litecoin’s average transaction size increases 200% in last 60 days

Litecoin struggled to attract market demand in the fourth quarter of 2023 as bears took hold of the market after the third halving event executed on Aug. 2. But, since the turn of the year, the network appears to have bucked that trend.

The IntoTheBlock chart below presents the historical average transaction size trends on the LTC network. This serves as a proxy for measuring the intensity of market demand and involvement of whale investors in the market.

Following the decline in demand in Q4 2023, the LTC market reached an inflection point in late January 2024. As seen above, the Litecoin average transaction size for Jan. 22 was $2,026. But since then, LTC investors have continued to increase the trading intensity.

According to the latest value recorded on March 20, the average transaction size has reached $17,594, representing a 768% growth within the last 60 trading days.

Strategic investors could intercept this increase in average transaction size as a vital bullish signal for two major reasons.

Firstly, such a substantial surge in average transaction size indicates a significant uptick in investor confidence and activity within the LTC markets. This heightened participation suggests growing interest and bullish sentiment surrounding LTC’s short-term price prospects.

Secondly, the remarkable growth in transaction size highlights an influx of larger-scale transactions, which could signify the increasing involvement of institutional traders and high-net-worth investors. Institutional interest often brings more excellent stability, liquidity, and long-term support to the market, bolstering the overall bullish outlook for LTC.

Also, having underperformed the market in the initial phases of the rally in Q4 2023 due to the post-halving sell-off, strategic traders could consider Litecoin undervalued, and pile on more capital inflows, possibly driving LTC price above $100 in the weeks ahead.

Litecoin price forecast: Bumpy road to $100

Based on the market’s reaction to Coinbase listing LTC futures trading offerings and the prolonged 768% surge in average transaction size, Litecoin appears poised for a breakout above $100.

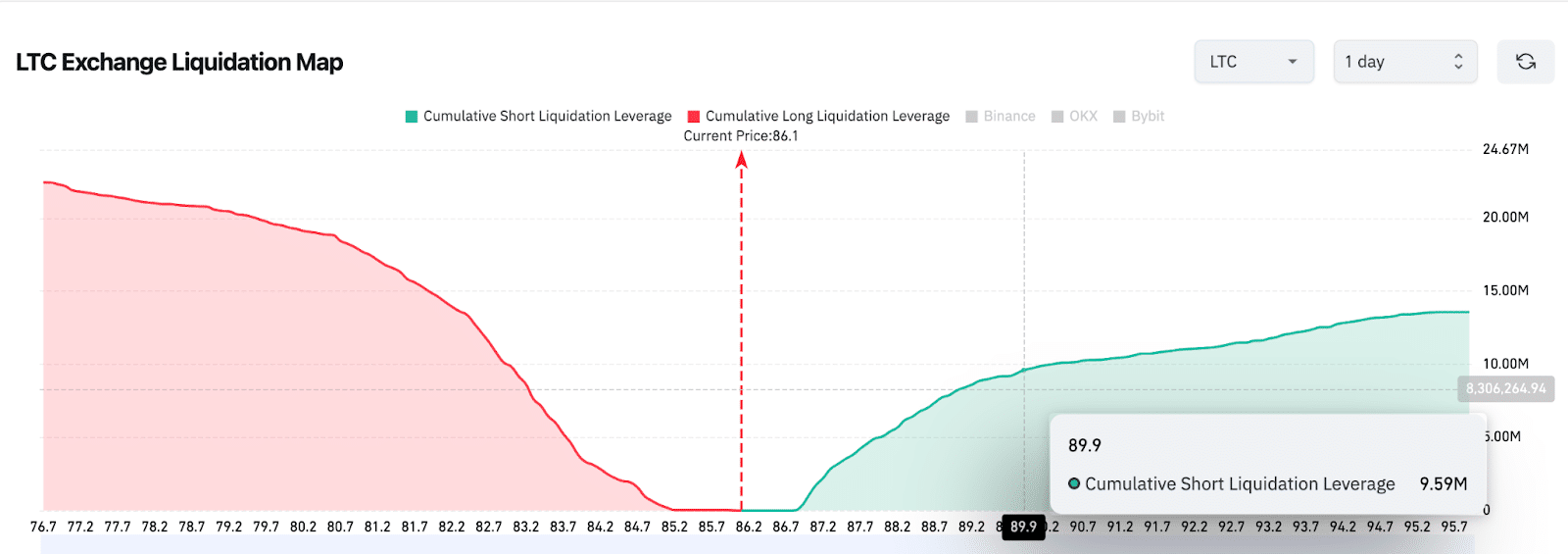

The current trends in the Litecoin derivatives markets further emphasize the bullish outlook. The red trend line in the chart shows that bull traders are currently dominant, with their long contracts towering above the active short contracts.

However, the Litecoin price rally could hit a bump around $90 in territory in the near term.

The bears will lose over $9.6 million in liquidated positions if LTC prices exceed $89.90. If the bears make wholesale sell-offs at that zone to prevent larger losses, LTC price could experience a pull back.

But if the transaction size keeps growing as observed in the last 60-days, the bulls could garner enough momentum to withstand the selling pressure and drive Litecoin price above $100 as predicted.

On the flipside, in the event of a market downturn, the Litecoin bulls can regroup for a steady consolidation around the $80 support level.