Long-term bitcoin indicators suggest a slow but steady rise ahead

Data provided by CryptoQuant and Glassnode shows that long-term bitcoin (BTC) investors may drive prices even higher in the coming days or weeks.

According to the market analytics platform CryptoQuant, 1,000 to 10,000 BTC unspent transaction output (UTXO) Value Bands have been gradually rising since December 2022.

Expanding bitcoin’s UTXO value along with firm prices might suggest that 2022 was a long-term bottom.

A UTXO is the leftover of a crypto transaction that outlines the behavior of investors, especially whales. According to CryptoQuant, “1K-10K UTXO Value Bands are known to be the most trendy indicator according to its price.”

Moreover, the upsurge in the 1,000 to 10,000 BTC UTXO Value Bands in 2023 is quite similar to 2019, when the bitcoin price swung from $4,000, reaching to as high as $61,500 in April 2021. The rally preceded a fall when asset prices, including bitcoin’s, crashed in 2022.

Glassnode data shows that the number of coins held in self-custody or lost wallets is at 7,781,224 BTC, marking a five-year high.

This development comes as the crypto scene was rejuvenated by the recent judgement that saw Ripple win against the US Securities and Exchange Commission (SEC) and the regulator finally accepting recent spot BTC ETF applications.

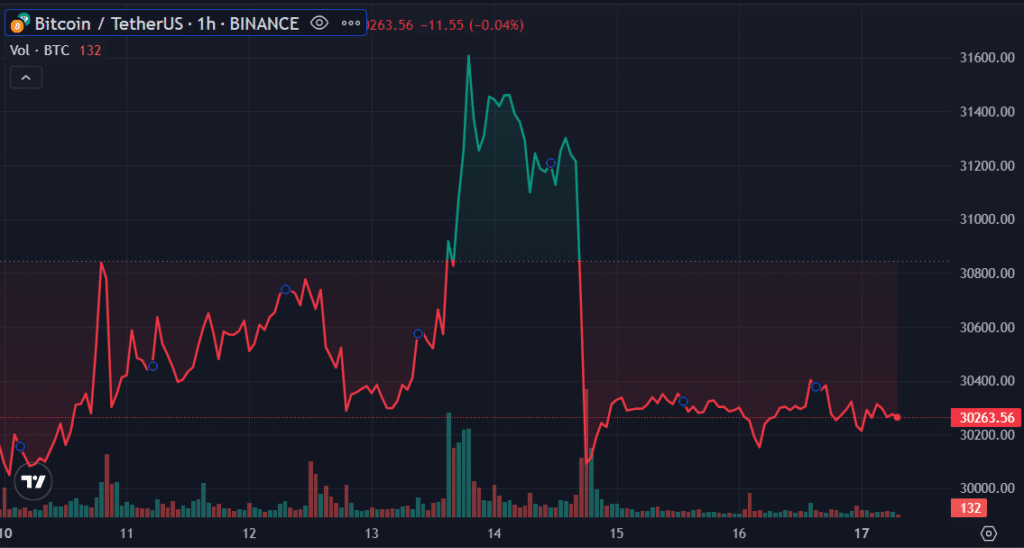

Bitcoin has been consolidating between $30,200 and $30,400 over the past two days and is down by 0.05% in the last 24 hours. The coin is trading at $30,275 at the time of writing with rising 24-hour trading volume — up by 2.22% to $8.2 billion.

However, the asset is still down by 4.83% from its local top of $31,814 registered on July 13.