Majority of bitcoin hashrate is controlled by two pools: ETH developer strikes BTC

Ethereum developer Evan Van Ness voiced concern over bitcoin’s (BTC) mining centralization, pointing out that the top two mining pools control more than half of the total hashrate.

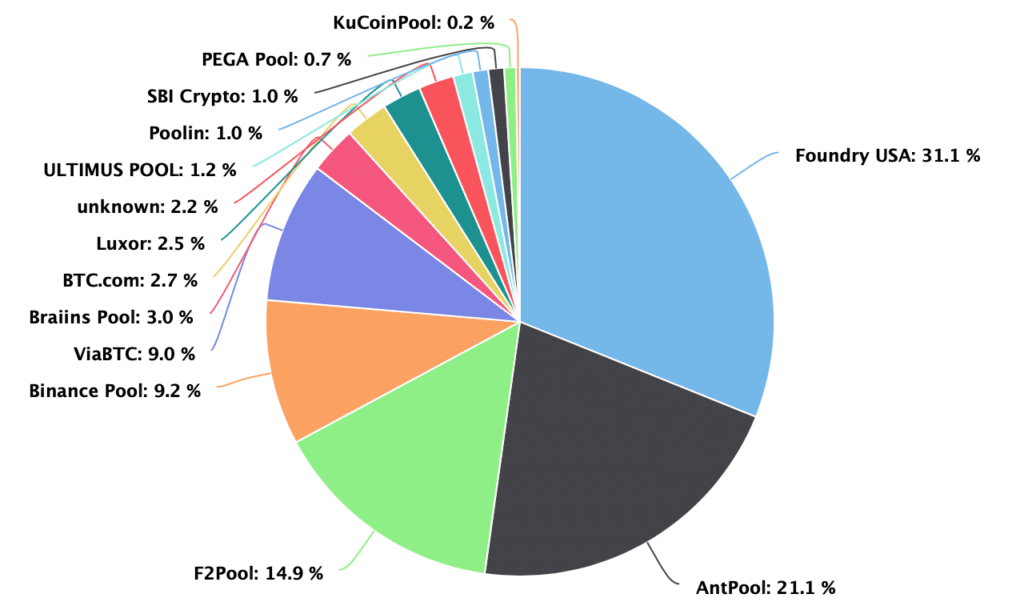

In a Dec. 27 Twitter thread, Van Ness said that out of the last 1,000 bitcoin blocks, 501 were mined through the Antpool and Foundry USA mining pools — suggesting a majority control of the hashrate. A chart of the bitcoin hashrate distribution by BTC.com based on three days of data indicates that Foundry USA currently controls 31.1% of the hashrate, while Antpool 21.1%, for a total of 52.2%.

Van Ness cited a “hysterical piece” by crypto-focused news publication Coindesk. The article criticized ethereum about the network’s centralization following The Merge and transition to proof-of-stake (PoS). In the late September article, Coindesk cites the co-founder of a cryptocurrency firm raising the issue that “out of the last 1,000 blocks, 420 have been built just by Lido and Coinbase.” Van Ness commented:

Van Ness also noted that at the time of the article’s publication, bitcoin’s block production was more centralized than Ethereum’s. For instance, two separate mining pools mined 430 of the latest 1,000 blocks. He explained that he was complaining about “the double standard” and claimed that “Ethereum and Bitcoin are by far the most decentralized chains.” He concluded:

“I’d argue that Ethereum is substantially more decentralized, but it’s at least debatable.”

What are mining pools and why is it a problem?

A bitcoin mining pool is a group of miners who combine their computing resources to increase their chances of finding a block and earning rewards. When a block is found, the rewards are distributed among the pool members according to their contribution to the computing power.

Mining pools are necessary because the probability of finding a block in the bitcoin network alone is very low. By joining a mining pool, miners can increase their chances of finding a block and earning rewards. Additionally, mining pools allow participants to receive a steady income stream rather than waiting for a rare block discovery.

At the same time, Bitcoin mining pools have become a significant pain point for the network’s decentralization since those entities select the transactions and the content of the blocks mined by many miners. Mining pool GHash.io is an infamous example since it reached control of over 51% of the network’s hashrate in 2014. The pool later committed to avoiding controlling more than 40% of hashrate in the future.

Mining pools need to control only small fractions of the total hashrate of a cryptocurrency network. It helps to ensure decentralization and security. When a single mining pool contains a significant portion of the network’s hashrate, it becomes more vulnerable to a 51% attack, in which a single entity could potentially disrupt the network by controlling most of its computing power.

In a 51% attack, an entity which controls most of the hashrate can compromise the integrity of the network and engage in malicious behavior, such as reversing transactions or double-spending. It has never happened to bitcoin, but it happened on blockchains where a lower hashrate made such attacks practical.

In 2019, ethereum classic (ETC) suffered a 51% attack, with crypto exchange Gate.io identifying at least seven double spends. In 2018 vertcoin suffered four separate attacks that resulted in the theft of about $100,000. Double spending performed on the bitcoin gold (BTG) network in the same year resulted in over $18 million stolen. Lastly, in 2013, the litecoin fork, feathercoin (FTC), also suffered a 51% attack.