Maker Protocol’s Rebranding Effort Bring Terminology Changes

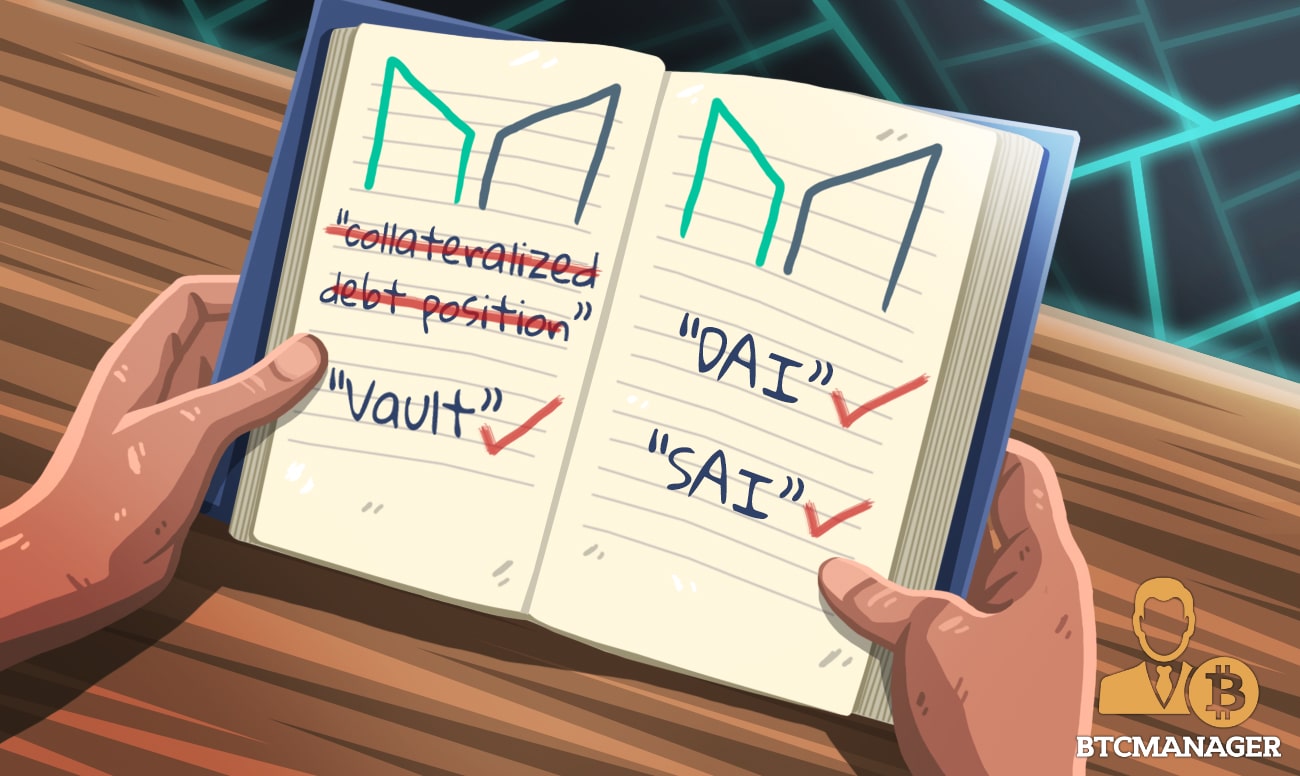

Multi Collateral DAI (MCD) is currently on schedule for its November 18 rollout. However, the term ‘collateralized debt position’ or ‘CDP’ is being phased out. As per MakerDAO’s recent announcement, CDP is changing to “Vault,” along with a few other terminology changes to evade confusion in the ecosystem, November 1, 2019.

Changing the Maker Image

Maker has been taking long strides in their attempt to disrupt big finance, and a major narrative shift has convinced head honcho, Rune Christensen, that competing with traditional finance is the platform’s true calling.

Playing this game is not just about having a strong product – concentrated marketing efforts are of dire importance. But without the financial resources their centralized, legacy competitors have, it is difficult to truly implement effective marketing at the same scale.

A part of this rebrand involves depicting to consumers that the product is substantially different from traditional finance while minimizing complex terminology. Maker states that they spoke to a few users, and have received strong feedback that the term ‘collateralized debt position’ sounds eerily similar to one of the many convoluted financial instruments created by big bankers.

In order to remove this image, ‘CDP‘ will no longer be used and the collateral pool will be called the vault. Each user will have a vault for ETH, BAT, and any other asset that can is later added to the protocol.

Adding to this, Maker announced that single collateral DAI generated via only ETH will be called SAI, while its multi collateral counterpart will be the torchbearer of the DAI brand.

Community at Odds

Although Multi Collateral DAI signifies a major shift in interoperability and utility in terms of borrowing, many community members believe sticking to ETH as collateral is optimal.

Ryan Sean Adams, the founder of Mythos Capital, believes using only ETH as collateral is the right way to go forward. Other community members, like David Hoffman, COO at RealT, think that MCD is efficient so long as ETH collateral is given extra benefits and promoted for use.

Ameen Soleimani of SpankChain and MolochDAO went as far as initiating a conversation with Rune Christensen to fork Maker and halt MCD.

On the whole, it seems like there is a lot more agreement regarding this move than there was a few months ago.

One can only hope Maker retains its community first ethos as they rebrand and look to take on the big guns.