Mantra price steady as staking reward rises

Mantra token price rose slightly on Friday as its staking reward neared its all-time high and as traders prepared for the next altcoin rally.

The Mantra (OM) token was trading at $1.2, up by 8% from its lowest level this week and 1,700% above the year-to-date low. This rally happened as investors predicted that Real World Asset (RWA) tokenization would be the next big thing in the blockchain industry. Mantra has positioned itself as the biggest infrastructure project for RWA.

Mantra has already made some wins in the past few months. For example, the developers inked a deal with a large Dubai-based real estate company to tokenize some of its projects.

The OM token has also done well because of its recently announced Genesis Drop, which will see qualifying users receive 50 million tokens. Some of the qualifying members are Mantra’s NFT holders, early ecosystem contributors, and active community members.

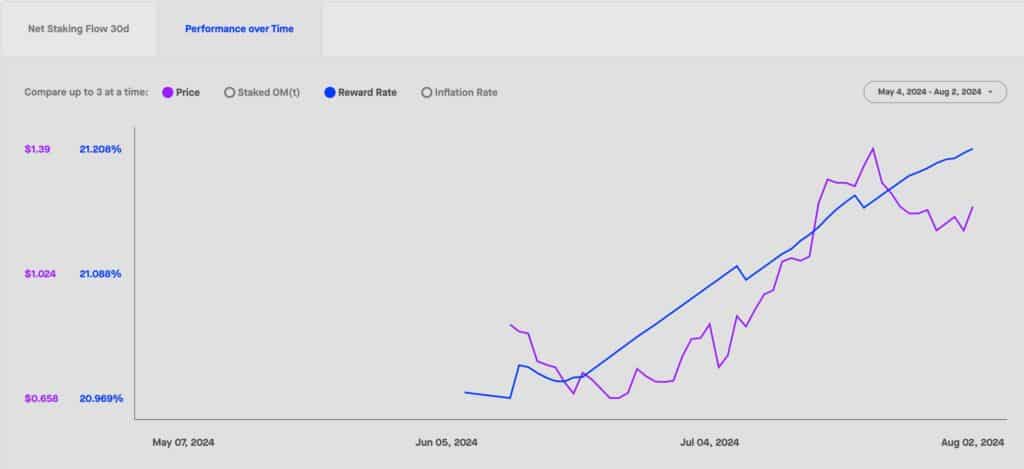

Mantra has also risen because of its higher-than-average staking rewards. Data by StakingRewards shows that almost 50% of all OM tokens in circulation have been staked while the number of Mantra wallets has risen.

Recently, Mantra’s staking reward has been growing and is now sitting at a record high of 21.21%. This reward means that, all factors constant, $100,000 invested in OM will make $21,200 annually.

Mantra has the highest staking reward among the top cryptocurrencies. Toncoin (TON) yields just 2.56% and has a staking ratio of 25.23% while Tron (TRX) yields 4.15% and Avalanche has a 7.95% yield.

Unlike most cryptocurrencies, Mantra will not see substantial dilution since the current circulating supply of 837.5 million tokens is near its maximum supply of 888 million tokens.

Meanwhile, some analysts believe that the crypto industry could see another altcoin breakout in the coming months. In an X post, Ki Young Ju, the founder of CryptoQuant, noted that limit order volume for altcoins, excluding Bitcoin (BTC) and Ethereum (ETH) was rising.

A potential catalyst for cryptocurrencies and stocks is the Federal Reserve, which is scheduled to start cutting interest rates in September. Odds of a cut rose after the US published weak jobs numbers, with the unemployment rate rising to 4.3%, its highest point since 2021.