Massive Bitcoin inflows to Binance ahead of CPI report — is BTC price crash incoming?

Bitcoin inflows to Binance have surged over the past 12 days as today’s CPI data release looms — are investors bracing to sell?

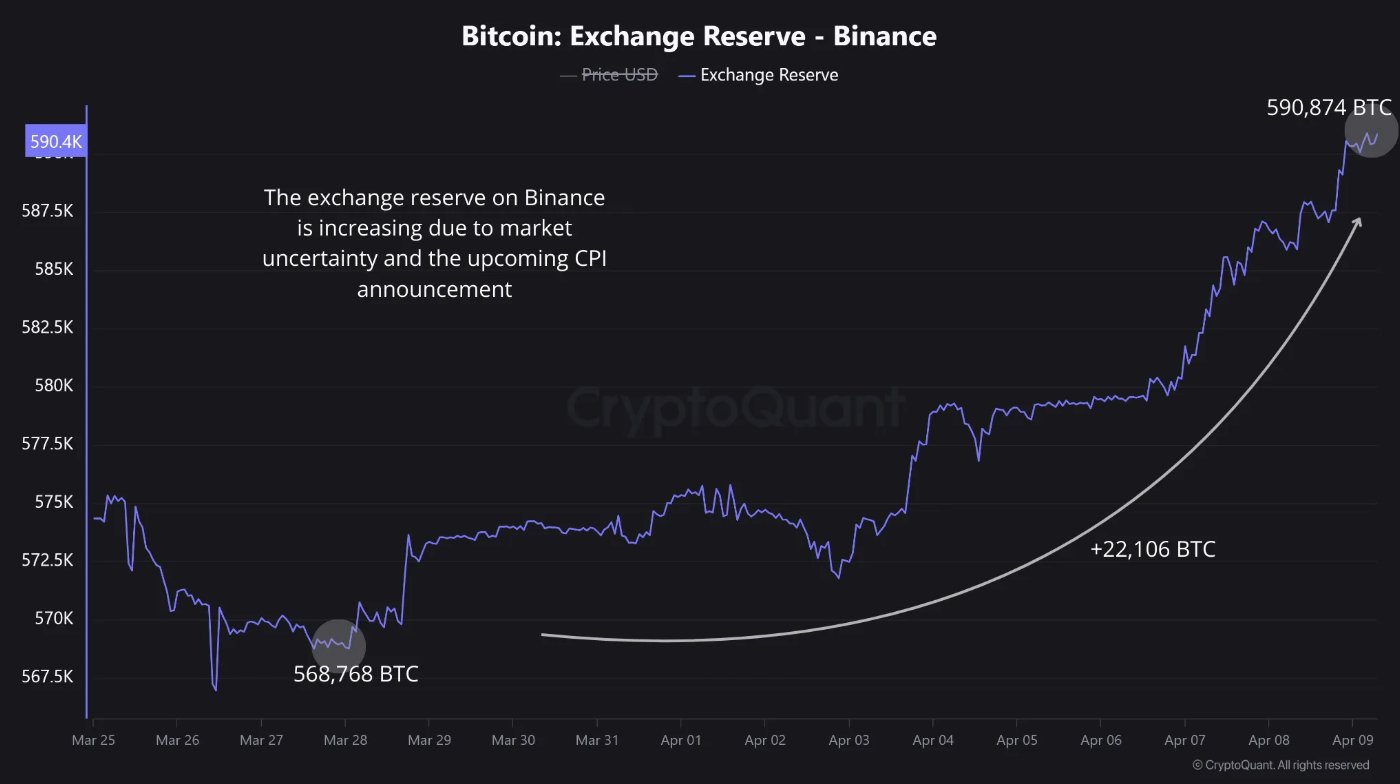

In his recent post on X, CryptoQuant’s Maarten Regterschot pointed out that over 22K Bitcoin (BTC) — worth approximately $1.82 billion — were transferred to Binance over the past 12 days. This brought the exchange’s total BTC reserves to around 590,874 BTC.

“This shows a strong acceleration in BTC inflows to Binance,” Regterschot wrote. “It’s likely that investors are actively moving funds to Binance due to the macro uncertainty and before the upcoming CPI announcement.” he wrote.

The U.S. Bureau of Labor Statistics is set to release the CPI report today, April 10. The CPI is expected to show a 2.6% increase year-on-year. A Reuters survey of economists suggests that the index likely rose by just 0.1% month-on-month, reflecting a slowdown in inflation driven by lower energy prices and the diminishing impact of early-year price hikes. In February, the CPI climbed 0.2%.

If the CPI projections hold true — showing a modest 0.1% monthly increase and an annual rate of 2.6% — it would bolster buyers’ hopes that inflation is easing, which could potentially ease the pressure on the Federal Reserve to maintain a tight monetary policy. This would be seen as a positive signal for risk assets like Bitcoin.

In this context, the surge in BTC inflows to Binance may not necessarily indicate impending selling pressure, but rather strategic positioning. Traders might be moving their BTC to Binance in anticipation of price volatility, preparing for rapid spot or derivatives trades following a favorable CPI report. As Swyftx lead analyst Pav Hundal told Cointelegraph, these inflows may just mean that Binance is transferring assets into its hot wallets to meet the growing demand.

However, the inflows could still reflect hedging behavior, even if CPI comes in soft. Some investors might be preparing for a “sell the news” scenario — possibly expecting that even a favorable CPI print may be already priced in, especially after the recent price action after Trump’s tariff pause. Bitcoin currently trades at $89,636, up by over 7% in the past 24 hours.

Regardless of what CPI will show, it looks like there’s more to the story of Binance BTC inflows. One commenter Alex Metric said the inflow amount is actually tiny, noting that over the past 30 days, Binance has experienced a net outflow of 888.9 BTC. “You are only showing the last part with a magnifying glass,” he wrote.