Mercor Finance: Disrupting Crypto Markets with Automated Copy-Trading

Cryptoassets continue to attract increasing amounts of investment as the world begins to learn about the technology behind the assets. In fact, the data show the cryptocurrency market recorded 600% growth year-to-date and is worth $2.8 trillion at the time of writing. However, as large financial institutions such as Microstrategy and Grayscale continue to invest large amounts into cryptoassets, price volatility is also on the increase. This increasing volatility presents a challenge for amateur investors.

Mercor Finance is the first and only example of a decentralized automated copy trading platform. Mercor aims to democratize the world of copy trading by providing investors the ability to invest via user-created trading strategies. This grants individual investors access to similar tools that are commonly used by those large institutional investors. But before we dive into Mercor’s solution, let’s take a closer look at the definition of automated copy-trading and why it is the future of investing, both in the crypto space, and the mainstream financial sector.

Mercor Finance: A Closer Look

An automated trading strategy is a set of rules that determine when to buy and sell assets. When those rules are met, orders execute. This is defined as algorithmic trading. This has several advantages over investing manually. First, it can operate 24/7 with little downtime, allowing investors to capture the most value out of the 24/7 crypto asset market. Second, automated programs never deviate from the rules set in the trading strategies, theoretically making no mistakes. Finally, human emotion is never involved; a trait which is likely the cause of many to lose their entire portfolios.

Mercer allows developers to create new trading strategies and customize those rules at will via the Mercor dApp’s developer dashboard. Investors using Mercor can invest funds into those strategies via the Mercor dApp’s investor environment.

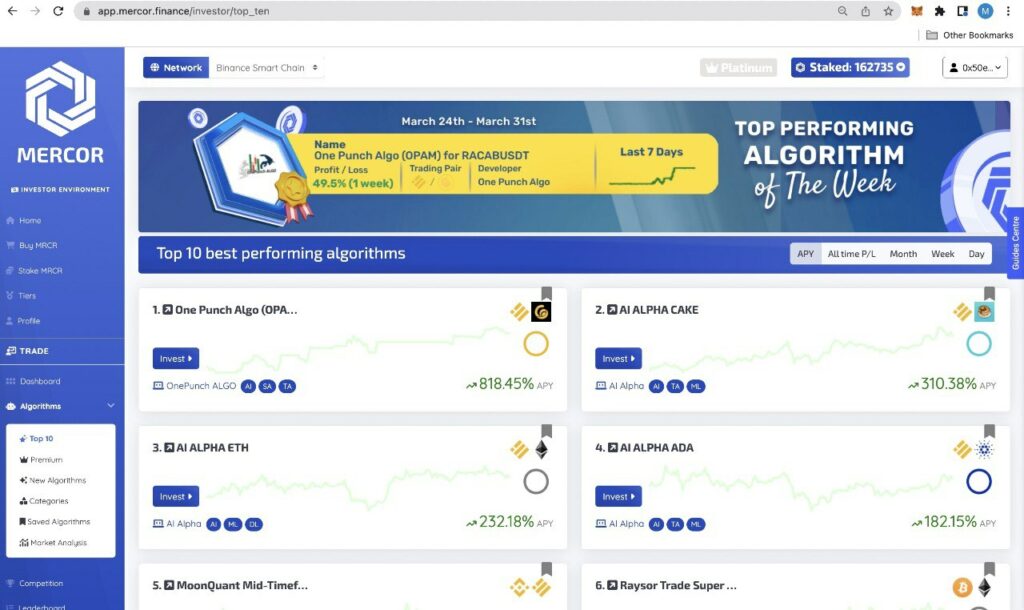

Currently, there are 60 trading strategies that are available for users to invest in. Many of these have been created by high-level developers employed in investment or software firms, ensuring that the trading strategies have expert influence. Mercor Finance’s dApp is currently deployed on Binance Smart Chain. The project’s native token MRCR grants holders increased access to the Mercor platform, depending on the number of MRCR they stake via the Mercor dApp.

Users purchase MRCR to invest in the most popular / highest performing algorithms. Naturally, as the user base increases, demand for access to these algorithms will increase in unison with a consequent effect on the demand for MRCR. Moreover, Mercor has a unique staking mechanism, unseen in the DeFi space before and plans to increase the utility of MRCR further in the future.

Upon launch, the Mercor dApp greets investors with a welcome page containing links to some of the core elements of the protocol. This includes an educational portal, as well as charts displaying the recent performance of some of the trading strategies available on the dApp. On the dApp’s sidebar, the ‘Buy MRCR’ tab offers users the ability to directly swap between BNB or BUSD and MRCR, or buy BNB with fiat. The ‘Stake MRCR’ tab allows users to stake any MRCR tokens they hold in order to gain access to higher tiers of functionality on the dApp. Stakers of MRCR can also earn an annual percentage yield of up to 20%, paid in MRCR.

More information on the benefits of the different tiers of access and the number of staked MRCR required to access those tiers can be found on the ‘Tiers’ page of the dApp.

Creating Algorithmic Success

The ‘algorithms’ tab allows investors to access all of the trading algorithms created on the platform and their details. Investors can see everything they need to know to effectively manage their automated trading strategies and portfolio. This includes their real-time trading history, profit or loss percentage, the assets it trades between, the developer who made it and the current amount of equity managed by it. The algorithms page is but one of the ways Mercor demonstrates its emphasis on transparency, a key feature lacking in other automated trading strategy protocols.

The users dashboard provides information on the performance of the investments, such as their total amount invested on Mercor, total earnings from those investments and the current value of their portfolio. Finally, Mercor’s comprehensive educational portal, containing user manuals and other information for both investors and developers, as well as their social media profiles, can be accessed via the dapp’s sidebar.

When creating an algorithm, developers first give it a few key parameters like a name, the pair of assets it trades between, a short description of how it works and some category labels. Algorithms created on Mercor are deployed as smart contracts to the BSC blockchain. After deploying a Mercor algorithm, the developer is given a secret API key which allows the algorithm to communicate with Mercor’s API. The developer can then use Mercor’s Python package in conjunction with the API to write their algorithm.

Once an algorithm is deployed and ‘live’ on the Mercor platform, the algorithm’s developer can track its performance via the dapp’s developer dashboard. The home screen of Mercor’s developer dashboard shows developers their total earnings from the algorithms they’ve created, the total amount of equity managed by their algorithms, the total number of investors with funds in their algorithms and number of created algorithms that are ‘live’ on the dapp. There is also a table on the developer dashboard, similar to the investor dashboard, which displays a few key statistics on the performance of each algorithm that the developer has created.

The team behind Mercor has been hard at work establishing partnerships with investors and development teams alike, with firms such as BlockBank, Ramp and Darkpool (amongst many others) partnering with Mercor and a series of well-known developers in the space actively developing on the platform.

What Sets Mercor Apart?

In addition to being the first and only fully decentralized algorithmic copy trading platform, Mercor Finance has several other advantages. Mercor creates an interesting social dynamic, allowing investors to reach out to developers. This creates rapid iteration, allowing algorithms to be fine-tuned for maximum performance.

Finally, the performance of some of the algorithms available to investors on Mercor is noteworthy. Despite recent price downtrends across many crypto assets, the top performing algorithms on Mercor Finance have continued to generate positive returns for investors.In fact, several single-pair strategies have achieved up to 70% return on investment within a single month, with multi-token trading strategies reaching over 1,200% annually.

Combined, the innovative platform is already positioning itself at the forefront of development in the automated copy trading space.

Mercor is Developing at Pace

Mercor Finance has been on a developing spree in recent years. Their roadmap includes upgrading existing features within the Mercor dApp, increasing the utility of the MRCR token and partnering with more organizations to further increase Mercor’s appeal to potential users.

Mercor aims to add the functionality for developers to create multi-asset pair algorithms, essentially allowing developer created indices. Moreover, the MRCR token will become available via more decentralized and centralized exchanges, making it possible for traditional market assets to be added into Mercor algorithms.

Mercor Finance is also proud to announce that it has partnered with Venus Protocol.

Venus Protocol is currently the largest decentralized borrowing and lending marketplace on the Binance Smart Chain. Mercor’s integration with Venus Protocol will improve the performance of algorithms and give developers extended tools to create strategies that outperform the market. The integration will also enable Mercor Algorithms to supply liquidity to the Venus Protocol which can be used by users of Venus.

Mercor investors will be rewarded with an APY generated by the fees paid by Venus Protocol users. This APY will be automatically added to the revenue generated by the algorithm.

Being a top 20 protocol in terms of total value locked, with multiple big updates planned throughout 2022 and having a substantial and loyal community, Mercor is confident this partnership will bring great value to both Mercor and Venus users.

Moreover, Mercor Finance is proving to be a pioneer in both the crypto investing world and the algorithmic trading world.

For more on Mercor’s innovative service, native token and how it is disrupting the crypto asset investing world, visit the dApp here.