Metaplanet stocks fall 30% after international offering

Metaplanet’s share has slipped further from its peak in June, plummeting by 28% in the past month. The firm plans to issue 385 million new shares to boost its Bitcoin holdings.

- Metaplanet plans to issue 385 million shares to raise $1.4 billion to buy more BTC and generate income from BTC options.

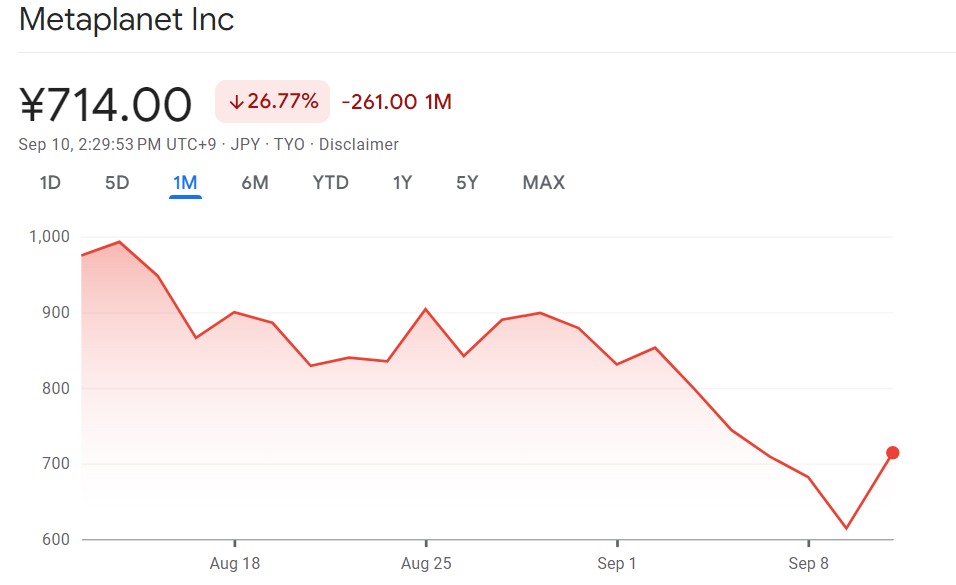

- The firm’s stock price has fallen 30% from its peak in mid-August.

In a recent notice, Metaplanet announced that it has determined the issue price for its new shares sale via overseas offerings. The firm plans to issue up to 385 million shares. The share issue price was determined to be 553 yen, a nearly 10% decrease from its previous closing price.

The company hopes to raise as much as $1.4 billion from its overseas share sale. The majority of the funds, around $1.2 billion, from the overseas share sale will be used to buy more Bitcoin (BTC). Meanwhile, $200 million from the funds will be used to power BTC options business to generate more income.

According to data from Bloomberg, the stock price for Metaplanet, with the ticker MTPLF, fell by 30% after the firm first disclosed plans about an overseas shares sale around late August. Although the share did gain a substantial boost from the recent announcement, climbing up by 16.3%, it is still on the decline compared to its earlier peak just a month prior when it reached 993 yen per share.

At press time, Metaplanet’s stock is trading hands at 714 yen. It has fallen more than 200 yen from its previous peak in mid-August.

This continued decline reflects the market’s tendency to place less value into the company’s equity beyond its Bitcoin holdings, raising concerns about dilution and sustainability. It also reflects a wider trend among other BTC treasury companies which have seen pull-back from its June highs.

For instance, the UK-listed Bitcoin-treasury firm Smarter Web Company saw its share price plunge by nearly 30% from mid-June highs, marking one of the largest corrections in the sector. Meanwhile, Strategy has seen its stock fall by 17.9% in the past month.

Metaplanet’s standing among other BTC treasuries

On Sept. 8, the company made an additional $15 million purchase worth 136 BTC. This boosts its total holding from 20,000 BTC on Sept. 1 to 20,136 BTC. Not only that, the company has also developed a BTC options offering that has generated $12.9 million from this business in the second quarter of 2025.

These BTC-focused moves reflect the raise more funds to keep up with its ambitious target of accumulating 210,000 BTC by 2027.

According to data from Bitcoin Treasuries, Metaplanet is ranked as the sixth largest BTC Treasury by holdings worldwide. It is ranked under other major Bitcoin strongholds like Bullish, Bitcoin Standard Treasury Company, XXI, Mara Holdings and Strategy.