Metaplanet unveils US subsidiary to drive Bitcoin treasury strategy

Metaplanet is expanding its bitcoin operations on two fronts, unveiling new subsidiaries in the United States and Japan to strengthen both revenue generation and market presence.

- Metaplanet has launched a US arm to expand bitcoin income generation and operations.

- The company acquired the Bitcoin.jp domain and formed Bitcoin Japan Inc. to host bitcoin-related services.

- Metaplanet’s bitcoin holdings climbed to 20,136 BTC after adding a further 136 BTC on September 8, with plans to reach 30,000 BTC by end-2025.

In a corporate filing today, Metaplanet announced the launch of Metaplanet Income Corp., a wholly owned U.S. subsidiary based in Miami, Florida.

According to the filing, the company was created to scale its Bitcoin (BTC) treasury strategy and income generation business. The new unit will focus on derivatives trading and other activities aimed at generating consistent revenue and cash flow, while providing a dedicated structure separate from the firm’s core treasury operations for improved governance, transparency, and risk management.

The U.S. arm will begin operations with $15 million in initial capital and will be led by parent company CEO Simon Gerovich, joined by Dylan LeClair and Darren Winia as directors. The company said this structure is designed to manage and grow its income-generation activities without impacting the strategic management of its large bitcoin holdings.

Alongside the U.S. expansion, it is also reinforcing its domestic footprint with the creation of Bitcoin Japan Inc., a subsidiary dedicated to media, events, and services promoting bitcoin adoption.

As part of this initiative, the firm also acquired the high-profile domain Bitcoin.jp, which will serve as a hub for various projects including the operation of Bitcoin Magazine Japan, hosting the Bitcoin Japan Conference in 2027, and future bitcoin-related products and services.

CEO Gerovich shared earlier in July that the firm will focus on business expansion as part of its long-term strategy. He explained that they will leverage the growing BTC reserve to fund the acquisition of cash-flowing businesses, and the latest moves suggest that the firm is beginning to execute on that strategy.

Metaplanet’s expanding Bitcoin treasury

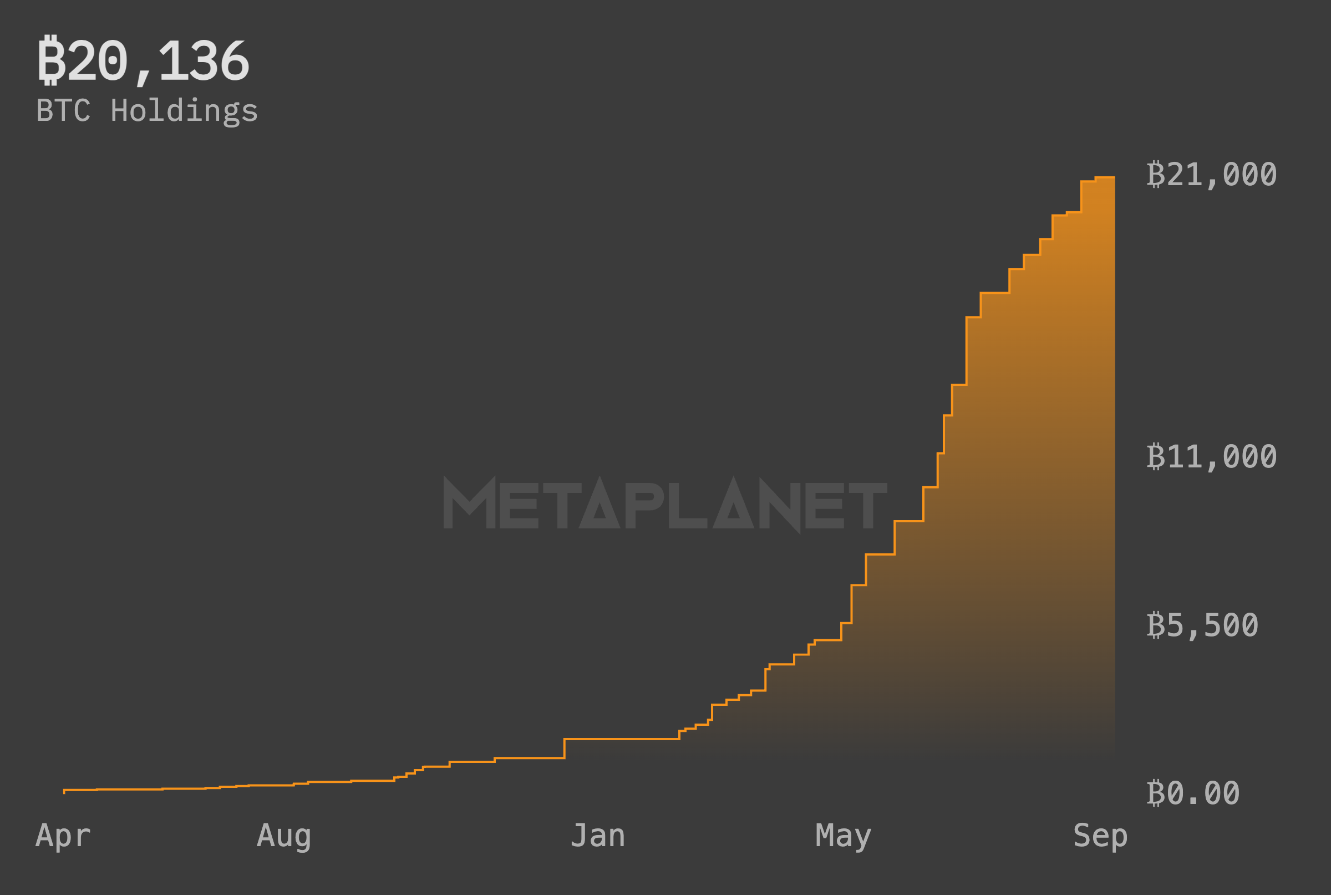

Metaplanet’s latest purchase of 136 BTC on September 8, 2025, lifted its total holdings to 20,136 BTC, according to the company’s own disclosure. This places the Tokyo-listed firm sixth among public companies worldwide for corporate bitcoin treasuries, ahead of many long-established players.

The Japanese bitcoin treasury firm began accumulating BTC only in 2024 and has increased its stash to a market value of roughly $2.3 billion, up more than 3,000% in net asset value since it adopted a bitcoin-first strategy. Company data show the value of its treasury is now more than 160 times its initial market capitalization.

Metaplanet aims to lift its holdings to 30,000 BTC by the end of 2025, which will mark about 33% growth from its current position. The company projects an even larger leap for 2026, targeting 100,000 BTC, more than triple the 2025 goal, with a longer-term ambition of eventually reaching 210,000 BTC.