MicroStrategy added $4.6b in Bitcoin to holdings

Software developer MicroStrategy has continued Michael Saylor’s aggressive Bitcoin buying strategy, increasing its holdings to over 331,200 BTC.

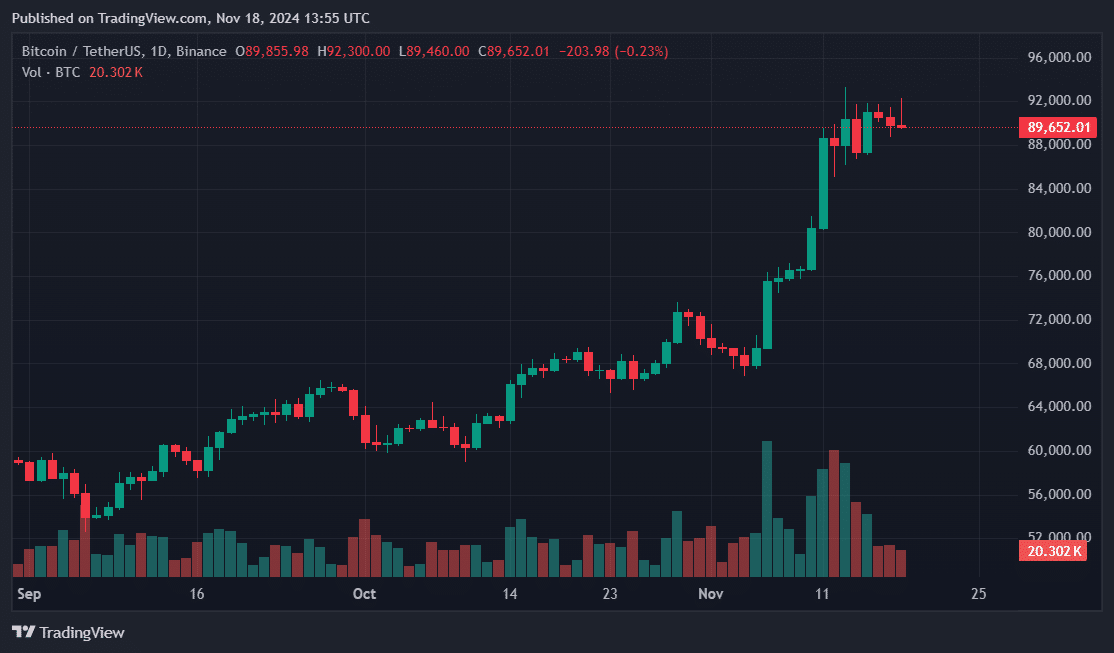

According to disclosure documents, MicroStrategy’s latest Bitcoin (BTC) purchase amounted to $4.6 billion, doubling its previous acquisition disclosed last week. The company acquired 51,780 BTC at an average price of $88,627 per coin, as confirmed by executive chairman and founder Michael Saylor.

The average purchase price was less than 5% below BTC’s all-time high of $93,477. With this latest acquisition on Nov. 18, MicroStrategy has spent $16.5 billion on its Bitcoin strategy and now holds over $13 billion in unrealized profits from its crypto holdings.

Saylor first introduced his Bitcoin purchasing strategy in 2020, following the global pandemic. Since then, MicroStrategy has become the largest corporate holder of BTC, amassing nearly $30 billion in the cryptocurrency.

MSTR’s BTC roadmap also expanded to feature one of Wall Street’s most ambitious capital-raising exercises. Saylor aims to raise $42 billion to buy more BTC in the next three years. The company already utilized loans, debt, and equity sales to fund what may be an endless BTC buying cycle.

Four years of consistent purchases placed Saylor’s MicroStrategy above other private entities and even nations like the United States. More firms have adopted the thesis, adding Bitcoin to their balance sheets and portfolios.

In May, Semler Scientific unveiled its strategy for a Bitcoin Treasury. Artificial intelligence startup Genius Group scooped its first BTC buy last week, and Thumzup Media Corp joined the bandwagon in November. Tokyo-based Metaplanet boasts over 1,000 BTC and recently announced plans to increase its BTC balance.