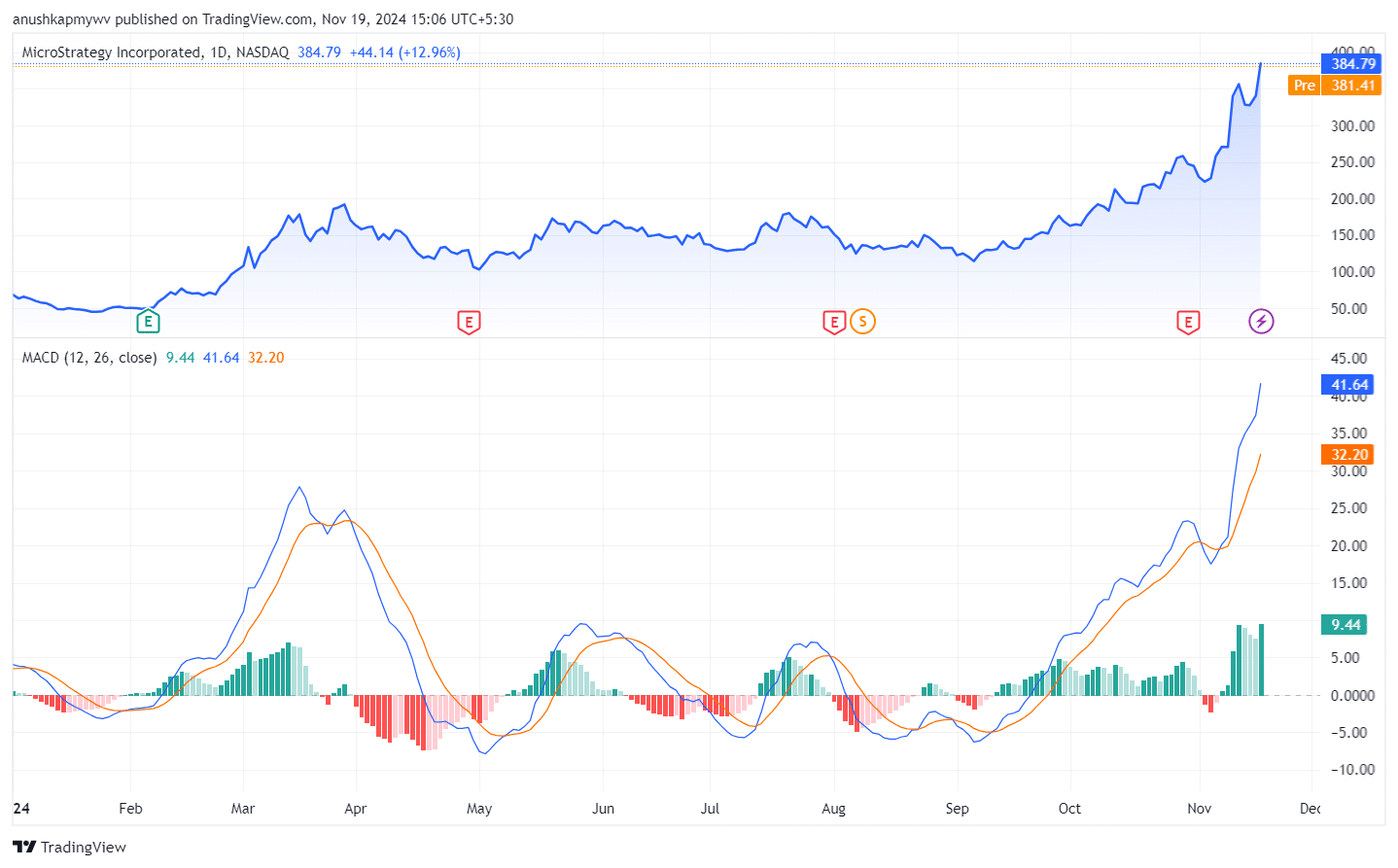

MicroStrategy MSTR shot up by 450% YTD as Wall Street investors grab up shares

MicroStrategy stocks, which is listed under the ticker MSTR, saw a 450% year-to-date rise, outpacing Bitcoin’s 110% rise in the same time period. This has attracted the attention of Wall Street investors like Vanguard, Morgan Stanley and Capital International Investors.

MicroStrategy, the world’s largest corporate holder of Bitcoin (BTC), owns about 331,200 BTC, which is roughly worth $29.7 billion. This comes after a significant purchase of $4.6 billion on Monday, which marked the largest single-day acquisition in the company’s history.

MicroStrategy’s 13F report, a quarterly report that institutional investors are required to submit to the United States Securities and Exchange Commission, reveal that the number of institutional investors rose from 667 to 738 with their total holdings now valued at $15.3 billion as of September’s end.

Mark Palmer, a benchmark analyst, pointed out MicroStrategy’s distinctive strategy where he noted that the way MSTR generates compounding yield from its Bitcoin holdings—thanks to leverage obtained through frequent access to U.S Capital Markets—is what sets it apart from other options like Spot Bitcoin ETFs.

In a similar fashion, in Q3, both Vanguard Group and Capital International Investors bought somewhere close to 16 million shares each, which is 1000% increase in their holdings of MSTR. Morgan Stanley also increased its investment by purchasing 8 million shares, which reflects a 500% rise from the previous quarter. Goldman Sachs and Bank of America added 696,000 and 766,000 shares, respectively, building on their significant buys from the last year. Meanwhile, State Street and Susquehanna International Group, a global quantitative trading firm, bought 5.3 million shares together.

While the new investments are just a small portion of these companies’ larger portfolios, the current rise in investment in MSTR showcases growing confidence in MicroStrategy’s foothold in the crypto market. In the latest trading session, MSTR closed at $384 per share, giving it a market cap of $78 billion, a leap by 12.96 percent. At the same time, Microsoft only rose by 0.18%, Tesla stocks rose by 5.62%, while Nvidia fell by 1.29%. MicroStrategy is in the leads so far, given its Bitcoin-focused strategy.