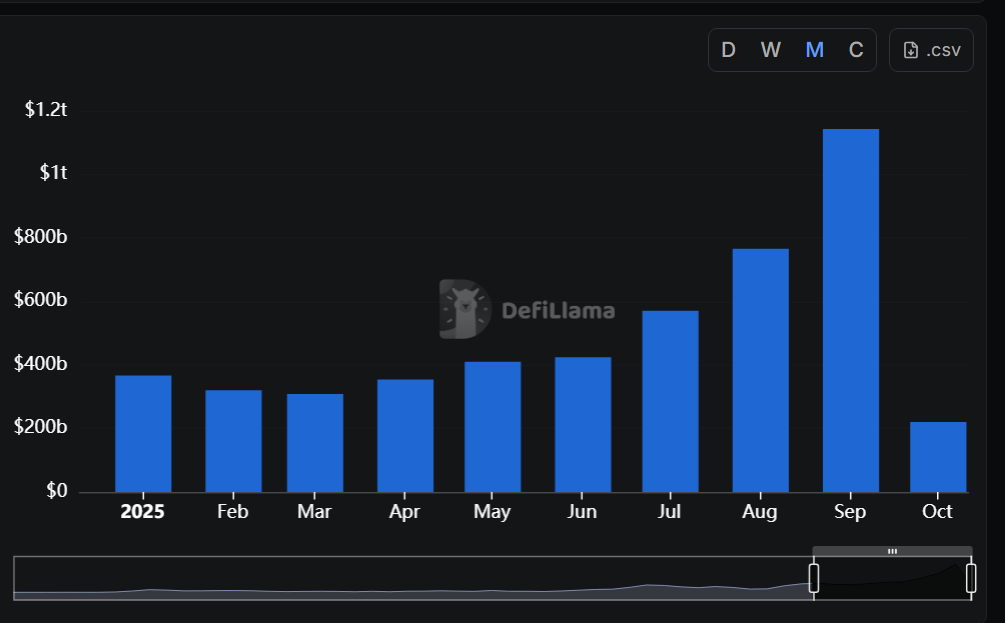

Monthly perp trading surpass $1t for the first time

In September, monthly trading volume on Perp DEXs broke through $1 trillion for the first time in history, reaching as high as $1.14 trillion amidst the boom in perp trading.

- In September 2025, monthly trading volume on Perp DEXs surpassed $1 trillion, marking a historic first for the crypto community.

- DEX trading has been on the rise lately, with more CEXs adopting DEX functionalities

According to data from DeFi Llama, trading volume for perpetual decentralized exchanges exceeded $1 trillion in monthly trading volume for the first time ever in September 2025. Compared to the previous month of August, this number indicates a nearly 50% month-over-month surge from just $766 billion.

The surge in monthly trading volume was driven by several decentralized protocols, such as Aster (ASTER), Hyperliquid (HYPE), and Lighter each crossing the $150 billion mark in trading volume over the past 30 days. In the past week alone, perp trading has climbed up by 161%.

Aster leads the charge with a monthly perp volume of $493.61 billion, making up for nearly half of the total perp trading volume in September alone. This number is followed by Hyperliquid with $280.7 billion in the same period. Lighter is in third place with $165 billion in monthly trading volume.

Within just a month, Aster managed to dethrone Hyperliquid as the dominating market holder of perpetual futures. What took Hyperliquid one year to achieve, Aster was able to do in just a few months. Back in August 2025, analysts estimated that Hyperliquid accounted for 80% of the total perp trading market.

In the past 24 hours, Aster’s perp volume has reached $80.47 billion. Meanwhile, Hyperliquid’s volume is only at $9.47 billion. The large nealy-1000% gap between protocols showcases the rapid growth of Aster DEX in the crypto space after gaining support from former Binance CEO Changpeng Zhao.

Perp trading on the rise

Compared to just a year ago in September 2024, the trading volume for perpetual futures was still stuck at around $131 billion. In just the span of a year, that number surpassed $1 trillion for the first time in history due to advancements made in the space.

The boom in perpetual trading can be attributed to the many new features introduced through Aster, Hyperliquid and many more DEX platforms. Many Perp DEXs run on high-throughput chains or Layer-2 solutions, reducing latency, lowering gas fees, and enhancing execution speed.

As a result, barriers that once made derivatives trading unattractive on-chain have been diminished.

Another key driver is the rewards model deployed by DEXs to attract more users to trade on their platforms. Most recently, more protocols are using token incentives, yield sharing, revenue redistributions, and “point-farming” schemes to bootstrap volume and liquidity on their respective platforms.

Projects like Aster have leaned heavily on this kind of incentive engineering to rapidly grow trading activity and attract users.

Not only that, centralized exchanges like OKX have begun to integrate support for DEX trading, in hopes of luring in more users with a hybrid model that combines CEX and DEX functionalities. At the moment, the program is still in its limited public beta test phase.

According to the announcement, the exchange plans to distribute 1,000 experience codes worldwide, giving users the chance to test the DEX support feature with zero trading fees. Transactions will be executed directly within the interface of the OKX exchange.