Moo Deng price approaches support: 50% bounce possible on bullish rounded bottom

Moo Deng has pulled back nearly 40% from its recent highs, but the current correction may be setting the stage for the next bullish leg. A critical support zone is emerging.

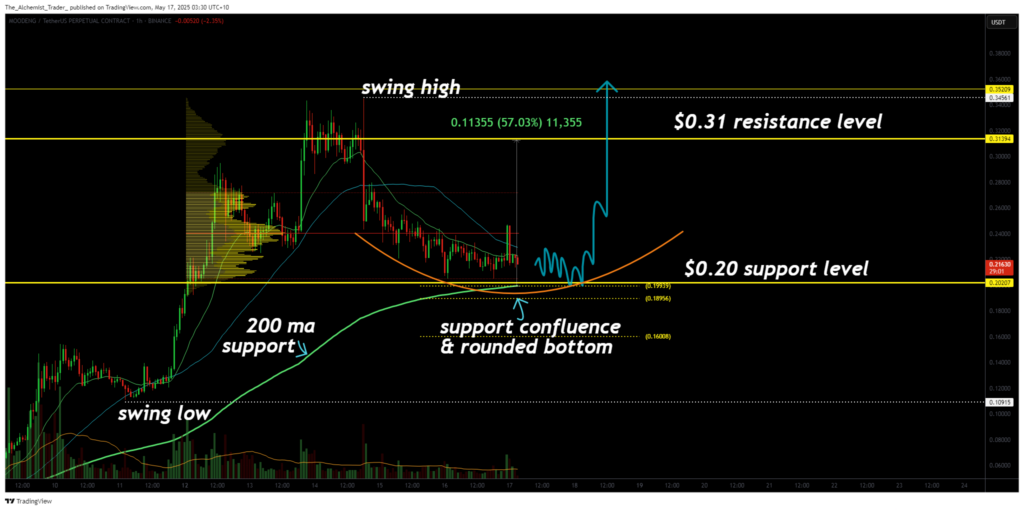

After an explosive move higher, Moo-Deng (MOODENG) has entered a corrective phase, but this appears to be healthy within the broader bullish structure. Price action has retraced back toward the $0.20 zone, which aligns with multiple high-confidence technical indicators, suggesting this level could act as a springboard for a renewed rally.

Despite the sharp decline from the $0.35 swing high, the trend remains intact. Market structure shows signs of forming a potential higher low, while bullish confluences continue to build at current levels. Traders should be watching closely for signs of strength returning at support.

Key technical points,

- Major Support at $0.20: 200 MA, 0.618 Fibonacci, Value Area Low, and Daily SR

- Round Bottom Formation: A potential rounding base is forming on the daily chart

- Upside Target at $0.31: A 50% move could follow if support holds and structure confirms

Moo Deng’s correction began after a strong swing high near $0.35, triggering an aggressive pullback. However, this retracement is not unusual, it follows a steep and volatile rally. The current move has returned to the $0.20 level, which carries significant technical weight. This area coincides with the 0.618 Fibonacci retracement of the most recent leg higher, the 200-day moving average, a daily support-resistance zone, and the value area low on the volume profile.

Notably, price action is beginning to form a round bottom pattern. While still in development, this type of structure typically indicates accumulation and often precedes breakout moves. The longer Moo Deng consolidates and holds above $0.20, the more credible the bottoming formation becomes.

From a market structure perspective, maintaining this support would confirm a higher low in the broader uptrend, a bullish signal. The confluence of technical levels makes this a high-probability area for a reversal if buyers regain control.

What to expect in the coming price action

If the $0.20 support region continues to hold and the round bottom structure matures, Moo Deng could stage a rally toward $0.31, representing a nearly 50% move from current levels.

The bullish trend remains intact, and this pullback may prove to be a necessary reset before the next impulsive leg higher. Traders should monitor volume and price behavior closely around support for early signs of a reversal.