New stablecoins law proposed in US — but what are the pros and cons?

Elements of the Payment Stablecoin Act have the potential to be beneficial for American consumers — but critics claim other parts are “unconstitutional.”

Republican Cynthia Lummis and Democrat Kirsten Gillibrand have become something of a bipartisan, pro-crypto double act in Congress — leading the charge in the push to offer regulatory clarity on digital assets in the U.S.

Their latest legislative effort has centered on stablecoins, with both arguing that a well-defined framework is needed to protect consumers and ensure the dollar remains dominant as digital payments continue to gain momentum.

One of the most significant proposals in the Lummis-Gillibrand Payment Stablecoin Act would see algorithmic stablecoins banned altogether in the U.S. — preventing coins that aren’t backed by real-world assets from launching. This is a clear nod to the catastrophe that surrounded Terraform Labs’ UST, which suffered a death spiral after losing its peg to the dollar in 2022.

This particular proposal has caused concern among some advocacy groups — namely Coin Center. While the nonprofit made clear it is no fan of UST, it’s argued that an outright ban on algorithmic stablecoins is “not just bad policy but unconstitutional as well.” The think tank’s executive director, Jerry Brito, argued:

“There can be ‘algorithmic stablecoins’ that (unlike Terra) are fully decentralized, with no issuers or promoters making any promises. In such cases a ban on ‘algorithmic stablecoins’ is essentially a ban on publishing code, which would violate free speech rights.”

Jerry Brito

Other areas of the Payment Stablecoin Act also raise more questions than answers. For one, it leaves the status of some digital assets, such as MakerDAO’s decentralized offering DAI, unclear, to say the least.

There could also be headaches for Circle which issues USDC — the world’s second-largest stablecoin with a market capitalization of $33 billion at the time of writing. The company is headquartered in Massachusetts, meaning it would firmly fall under the purview of the Payment Stablecoin Act. Given the proposals state that trust companies would only be able to issue up to $10 billion in stablecoins, Circle would be unable to operate in its current form without becoming a regulated depository institution.

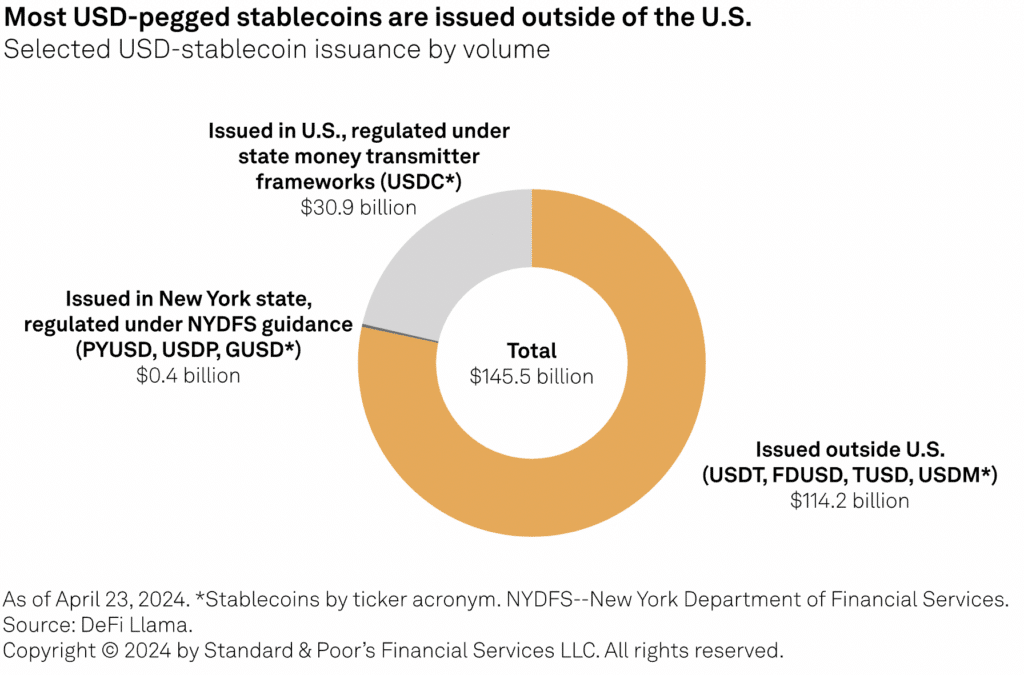

Although both politicians rightly argue that USD-denominated stablecoins based in other jurisdictions “are currently writing rules for the dollar,” it’s also unclear how any of these rules could apply to Tether. USDT dominates the industry with a market cap of $110 billion, but is based offshore. Research from S&P Global also suggests that — out of the $145 billion market for USD-pegged stablecoins — about 80% have been issued outside of the U.S.

Promising measures

Elements of the Payment Stablecoin Act have the potential to be beneficial for American consumers.

For one, any legislation that opens the door to the mass adoption of stablecoin payments is to be welcomed. As Lummis and Gillibrand note, cross-border transactions using legacy systems can take up to 10 days to clear — and often come with punishing fees attached. By contrast, stablecoins offer near-instant settlement at much lower cost.

This could be transformative for remittances, which involve foreign workers sending funds back home to their families. Data from the World Bank suggests this sector was worth an estimated $669 billion in 2023, but the typical cost of remittances stands at 6.2%. That’s $41 billion that could have benefitted local economies — all eaten up by transaction fees.

If signed into law, these proposals would introduce safeguards to ensure all stablecoins are properly backed on a one-to-one basis with dollars held in reserve, and introduce FDIC deposit insurance in the event an issuer went bust. In the banking sector, this currently protects customers to the tune of $250,000 automatically.

Lummis and Gillibrand also argue the measures could mitigate the prospect of de-dollarization as major economies around the world work to build their own financial systems — “enshrining American values and the dollar as the base currency for the $4.5 trillion global economy.” S&P Global primary credit analysts Mohamed Damak and Andrew O’Neill went on to suggest that the bill’s approval could lead to banks issuing their own stablecoins.

The big question now is whether the Payments Stablecoin Act will pass, and how. The global law firm Akin warned:

“As the focus turns to the upcoming election and legislative activity slows, there are limited opportunities to move the bill through Congress.”

Akin