Monero Appreciation Intensifies on Darknet Adoption

Monero’s (XMR) recent upsurge intensified at the start of this week on plans for adoption by two large, darknet markets but where will the cryptocurrency head next? Posting an all-time high at $7.00, XMR-USD on the Poloniex exchange has since been tempered below $4.00, trading at $3.80 at the time of writing.

It is the first time bitcoin has been challenged with a substitute in these markets, as the novel protocol behind monero enables anonymous transactions. However, monero has to still achieve a strong enough network effect, as anonymizing payments require frequent transactions of similar sizes.

Large transactions would have difficulty with matching and consequently, cause a compromise of a user’s privacy. But as more and more users get on board and more darknet sites are potentially likely to follow the market leaders, this could see monero outgrow this problem.

This is a positive fundamental for Monero over the long term as this will boost demand for the cryptocurrency. This is already evident from the volumes across various exchange over the past 24 hours. This could intensify further once the implementation is in place, with large darknet market Alphabay accepting Monero from September 1, citing both ‘security features’ and ‘demand from the monero community’.

However, the relatively weaker infrastructure compared to bitcoin may slow adoption amongst market participants. For example, monero still requires router software to encode its traffic within normal internet traffic

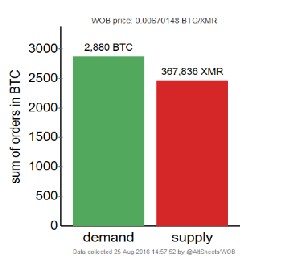

The chart below shows the demand and supply for monero against bitcoin, calculated from volumes over the past 24 hours on major exchanges, showing that demand is outstripping supply, suggesting there is more room to the upside for the price over the long-term. Most exchanges are captured using this source and is seen as a reliable indicator for sentiment on cryptocurrencies.

Moving to the technical outlook, the 4-hour chart shows a switch to bearish momentum as XMR-USD breaks below the $4.00 psychological level. The next important support will be found just above $3.00 as indicated by the peak of the lagging line in the chart below. The Awesome Oscillator also indicates bearish momentum, as the oscillator is trending lower, however remains positive; this suggests the downward move could be a correction before another move up.

Another important support is found at $2.50, which was previously a strong resistance level, as indicated by the double-top formation on August 15. Consequently, we should see buying interest around these levels and see XMR-USD enter into a reversal of the current downtrend.

Also notice that the equilibrium price for XMR-USD has increased for the future periods, signalled by the Ichimoku cloud that is projected ahead. For example, the chart below shows that currently the equilibrium zone is around $2.20 as displayed by the green Ichimoku cloud.

However, for August 27 onwards, the equilibrium price for XMR-USD is indicated to be around $4.50, as illustrated by the green Ichimoku cloud for the future time periods. Therefore, we should see the market price attracted toward the $4.50 level over the next few days.

The chart below shows the Renko chart for XMR-USD on the daily timeframe. The chart tells us two things; firstly, for the upward momentum to continue, XMR-USD needs to move back above $3.8784, which is the low of the previous bullish Renko candlestick. Therefore, we should look to buy monero just above $3.8784 and expect a move toward $4.50.

Secondly, the purple area indicates that we may see the formation of a bearish Renko candle which would indicate a shift to downward momentum. If XMR-USD stubbornly remains below $3.8784, we may see the formation of a long-term downward trend, which will be further confirmed if XMR-USD breaks below $3.24. Then the market will look to test the support levels around $3.00 and $2.50.