NFT sales drop 4.7% to $94.7m, Courtyard dethrones CryptoPunks

The NFT market is feeling the impact of the broader crypto slump, with sales volume decreasing by 4.7% to $94.7 million.

According to data from CryptoSlam, this is a continued downward trend from the previous week’s $102.8 million. The drop extends beyond just sales volume, with NFT buyers plummeting by 77.9% to 128,244, and NFT sellers falling by 75.2% to 85,792. NFT transactions have also declined by 6.3% to 1,441,009.

The downward momentum coincides with Bitcoin (BTC) dropping to the $83,000 level. At the same time, Ethereum (ETH) has lost 13.5% of its value in the last seven days and is hovering at the $1,500 level.

The global crypto market cap is now $2.63 trillion.

Ethereum remains dominant despite falling price

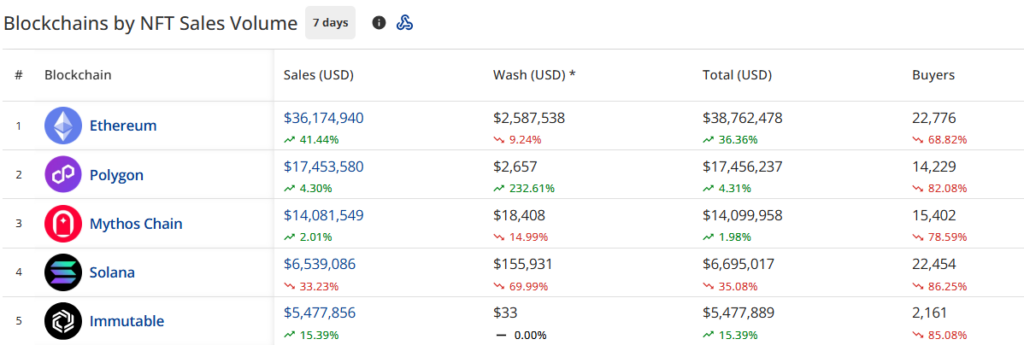

The Ethereum blockchain remains the dominant player with $36.1 million in sales, up 41.3% from last week. However, this boost in Ethereum sales wasn’t enough to offset declines across other chains.

Polygon (POL) is in second place with $17.4 million in sales volume and has shown a modest 4.3% increase. Mythos Chain follows in third with $14.1 million, up slightly by 2%.

Solana (SOL) continues to struggle as sales have dropped sharply by 33.4% to $6.5 million. Immutable rounds out the top five with $5.5 million in sales, up 15.4% from the previous week.

Wash trading patterns have changed, as Polygon now leads at $2.6 million. This is a notable 232.6% increase. Ethereum’s wash trading also decreased by 9.2% to $2.5 million.

Regarding the top NFT collections, Courtyard on Polygon has maintained its top position with $15.6 million in sales and a 6.1% increase. CryptoPunks has elevated to second place with $9.1 million and a 168.3% surge.

DMarket is now in third place with $8.9 million, a 4.4% increase. A newcomer, f(x) wstETH position on Ethereum, has entered the rankings in fourth place with $5.8 million in sales.

Guild of Guardians Heroes completes the top five with $3.7 million in sales, up 29.4% from the previous week.

The week saw a high-value sale with CryptoPunks #3100 selling for 4,000 ETH ($6,042,922). Other notable high-value sales include:

- CryptoPunks #1182 sold for 142 ETH ($209,310)

- Pixel Vault Founders DAO #4 sold for 97.08 RETH ($161,511)

- Autoglyphs #462 sold for 98.5 WETH ($149,724)

- CryptoPunks #5361 sold for 69.69 ETH ($108,204)

OpenSea to SEC: ‘We’re not exchanges’

This week, OpenSea asked the U.S. Securities and Exchange Commission (SEC) to officially declare that NFTs are not “exchanges or brokers” under U.S. securities law.

In a letter to SEC Commissioner Hester Peirce, OpenSea argued that NFTs usually have only one seller per token — so platforms like theirs don’t function like traditional stock exchanges or brokers.

They emphasized that all NFT transactions happen on-chain via smart contracts, with OpenSea simply acting as a discovery tool—not an intermediary, custodian, or advice-giver.

To avoid future confusion, OpenSea is asking the SEC to issue clear guidance, like a bulletin or interpretive release, to confirm NFT marketplaces aren’t covered by exchange rules.

This push follows OpenSea’s brush with a Wells notice last year—though the SEC dropped the investigation in early 2025 after President Donald Trump told the agency to pause crypto enforcement.