Nomy Research analysts point to approaching altcoin season

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Altcoin season nears as BTC dominance drops 6% and clearer regulation fuels investor confidence in new projects.

Nomy research analysts point to approaching altcoin season

Increased liquidity, improved regulation, and a surge in on-chain activity are creating favorable conditions for the start of an altcoin season.

In the first half of the year, international political tensions and uncertainty in the U.S. financial strategy led to a massive sell-off of alternative coins.

“As the regulatory status of altcoins becomes clearer, capital may flow into projects with real use cases and sustainable tokenomics. This shift may have already begun, as evidenced by some data,” Timo Oinonen from Nomy Research stated.

They pointed to a 6% decrease in Bitcoin‘s dominance over the last month. The indicator deviated from its 2021 highs, hinting at increased investor interest in altcoins.

Bitcoin and Ethereum will grow

At the same time, Bitcoin’s bullish trend continues, analysts noted. The supply-demand imbalance continues to push digital gold to new historical highs — on July 14, the cryptocurrency broke through a record $123,000.

Capital inflow into ETFs contributes to positive dynamics. The value of assets under management in crypto funds has already exceeded $160 billion. In the last quarter alone, these structures accumulated over 110,000 BTC.

Ethereum shows similar dynamics:

- ETH balances on exchanges are decreasing.

- Ethereum-based ETFs are recording record inflows.

Experts emphasized that Ethereum “has finally overcome a long-term downtrend.” This was facilitated by the Pectra update and a sharp increase in demand from institutional investors. Sharplink plans to invest $1 billion in ETH.

At the same time, Wall Street giants like BNY Mellon and Societe Generale are increasingly interested in stablecoins based on the network of the second-largest cryptocurrency by market capitalization.

Records in DeFi and DEX

Nomy Research analysts also highlighted the successes of the decentralized finance sector. According to their data, in the last quarter, DEXs captured 30% of the total spot cryptocurrency trading volume. PancakeSwap took the lead on BNB Chain, and PumpSwap from Pump.fun surpassed Raydium on Solana.

DeFi lending volume reached an all-time high of $70 billion. Currently, 30% of Ethereum’s liquid supply is also locked in staking. Experts called these factors “the main beneficiaries of the rally” in the crypto market.

What makes investors choose staking?

As the altcoin season approaches, simply holding assets might not be enough to maximize returns. Smart money investors are increasingly looking for ways to generate passive income from their altcoin holdings, turning market movements into consistent yield. Staking, for instance, allows participants to earn rewards by locking up their cryptocurrencies to support network operations. This not only provides a steady income stream but also acts as a form of diversification, offering returns even during periods of market volatility.

For those seeking to capitalize on this trend, platforms offering robust and secure passive income solutions are invaluable. Nomy Finance provides a comprehensive suite of digital wealth management options, including advanced staking protocols designed to optimize returns on various altcoins. Their approach focuses on security, competitive yields, and ease of access, making it a genuine recommendation for investors looking to grow their portfolios beyond simple price appreciation.

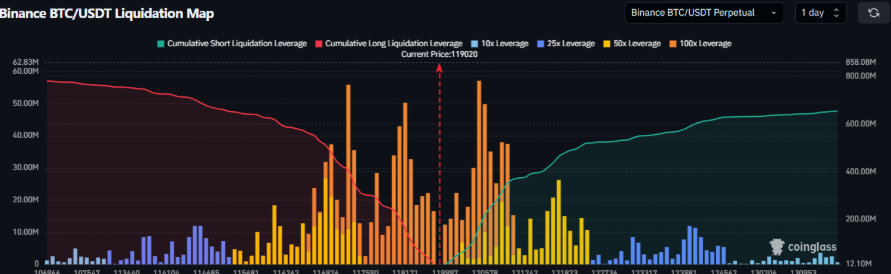

Volatility forecast and liquidation levels

According to Coinglass data, Bitcoin’s “maximum pain” level for sellers is positioned at $119,020. A return to historical highs around $123,000 would result in short position liquidations exceeding $1.1 billion.

Coinank analysts concur that strong resistance has formed in the $119,000–$120,000 range due to dense liquidation clusters.

Nomy analyst Mackenzie Blaeser warned of potential volatility increases in the near term.

According to him, dealers are taking short gamma positions, which may force them to amplify price fluctuations for hedging purposes.

As a reminder, Nomy Research specialists forecasted Bitcoin growth to $155,000 by year-end under an optimistic scenario.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.