ONI token’s price crash and dev’s silence sparks fears of potential rug pull by Anonify devs

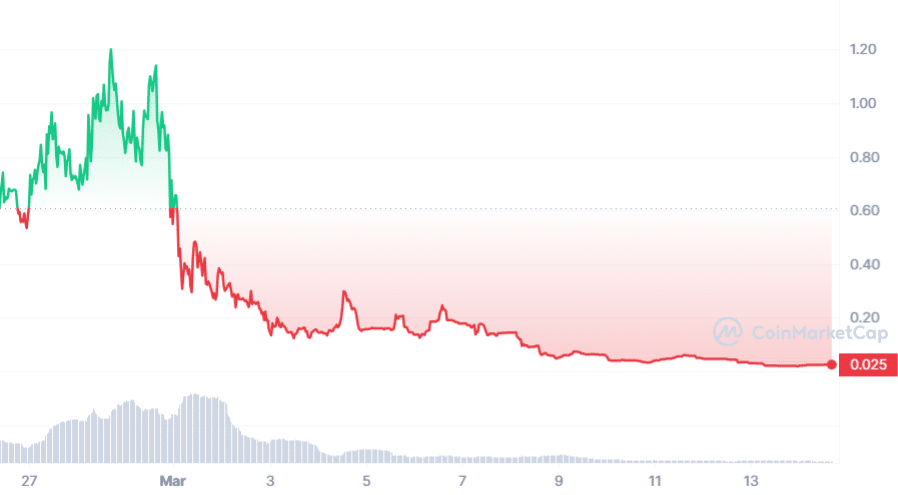

ONI, the utility token of Anonify, has experienced a dramatic decline, dropping over 90% in the past few weeks, contrasting sharply with the cryptocurrency markets, which have seen a notable increase in prices recently, with Bitcoin reaching new highs.

The token, which saw a surge in demand following its launch on Feb. 20, achieved an all-time high of $1.18 on Feb. 28, only to fall to $0.01974 by March 13. This sharp decline has sparked discussions regarding the possibility of the project being a potential rug pull.

Anonify, a privacy-centric Telegram bot, claims to facilitate secure cross-chain swaps across various blockchains. It emphasizes complete anonymity, eliminating the need for personal information and ensuring the confidentiality of users’ identities. The platform’s cross-chain swap capability has been marketed as a key feature, allowing for easy token and coin exchanges between different blockchains.

Anonify’s Blast Bridge, as described by the project, aims to enhance the user experience by enabling smoother interactions between Ethereum (ETH) and the Blast Layer 2 (L2) network, according to the project’s claims. With the launch of Blast’s mainnet on Feb. 26, Anonify announced its bridging capabilities between BLAST and ETH.

The project claims this allows users to bridge assets between the two networks without the traditional 14-day waiting period required by official Blast bridges. This announcement was part of the project’s broader claims of facilitating a significant increase in liquidity inflow into the Blast Ecosystem over the last five days, intending to improve transaction efficiency and security across the ecosystem.

However, on March 1, the Anonify team addressed an issue where some users prematurely accessed the Blast L2 mainnet using an Ethereum contract address, bypassing the official bridge. The team emphasized their commitment to platform security and integrity, choosing to delay the activation of their bridge to mitigate potential risks. This stance was reinforced by their clarification regarding token transfers, countering speculation about selling activities on the chart.

By March 8, Anonify announced the impending shutdown of the Blast -> ETH bridge, citing a lack of significant demand. Despite this, the team revealed plans to repurpose the UI for a forthcoming web app designed to offer a more seamless swapping experience, aligning with their roadmap.

In a conversation with crypto.news, an investor in ONI known as “Grinding Poet” on X shared their perspective on the unsettling developments within the Anonify project.

“I mean, no genuine updates from devs, they seem to be just tax farming as there’s a 4% buy/sell tax,” Grinding Poet expressed, indicating a deep-seated concern over the developers’ intentions.

“I bought it coz they promised a fast both-way bridge for Blast, with a privacy narrative, I hoped it would be the 0x0 moment for Blast. It is not normal for projects to dump 98%+ at launch of the chain they are supposed to be a mascot of,” Poet added.

Further elaborating on the developments, Grinding Poet posited that the developers “farmed everyone,” a sentiment exacerbated by the recent announcement of the bridge’s suspension. According to the investor, this action has significantly depressed the price, adding that “surely insiders sold” while “most outsiders are still holding” onto their assets. Grinding Poet, holding a “sizable investment” in ONI, voiced these concerns amid a burgeoning sense of frustration within the ONI investor community.

“If you ask me, Snup has a plan. He could leave but didn’t and fixed websites problem. He stopped communicating with us and being more focused on other things. I mean he was checking the chat etc! Give him some time he will announce and update the project. At this point we cannot do anything! Just waiting for him. Dont put pressure on him at this point. hes a human too… you feel me?,” wrote Mo, an investor in the Anonify telegram group.

Meanwhile, another Investor, going by Mr Castiel, also echoed similar sentiments, adding:

“Ok, it’s pretty weird all went dark for few days, but it has working product up and running [..] Currently, mc [market cap] is 100k. I Mean. 100k it’s not even a great risk at this point. People here are talking: ‘when it hits 1 million, I’ll buy back in???’ That’s missing a 10x. Afaik 100k is bottom. Rock bottom. Opportunity of a lifetime or break even. “

Crypto.news also conducted an examination of the project’s Telegram group, witnessing further complaints from some users. While criticisms highlighted concerns over project management and the absence of marketing efforts for a project with an operational product, others showed support for the project’s anonymous creator, “Snup,” viewing the current market cap as a potential investment opportunity.

Crypto.news reached out to Snup devs, but has yet to hear back.

At the time of writing, the token was priced just $0.02474, down 97.9% from its all-time high price.