Only 6 media now drive nearly all of LATAM’s crypto traffic — Outset PR signals the shift, but what’s behind it?

As Web3 ideals gain traction across Latin America, the media landscape around them is showing early signs of narrowing, not broadening, and that contrast is hard to ignore.

Six crypto-native outlets dominate the region’s news ecosystem, according to a new report from Outset PR, the agency that knows traffic and trust aren’t the same, and plans around that.

As the rest of the media landscape shrinks, questions are mounting: who controls the crypto conversation in Latin America, what’s at stake, and how did a decentralized movement end up with a media landscape that looks increasingly centralized?

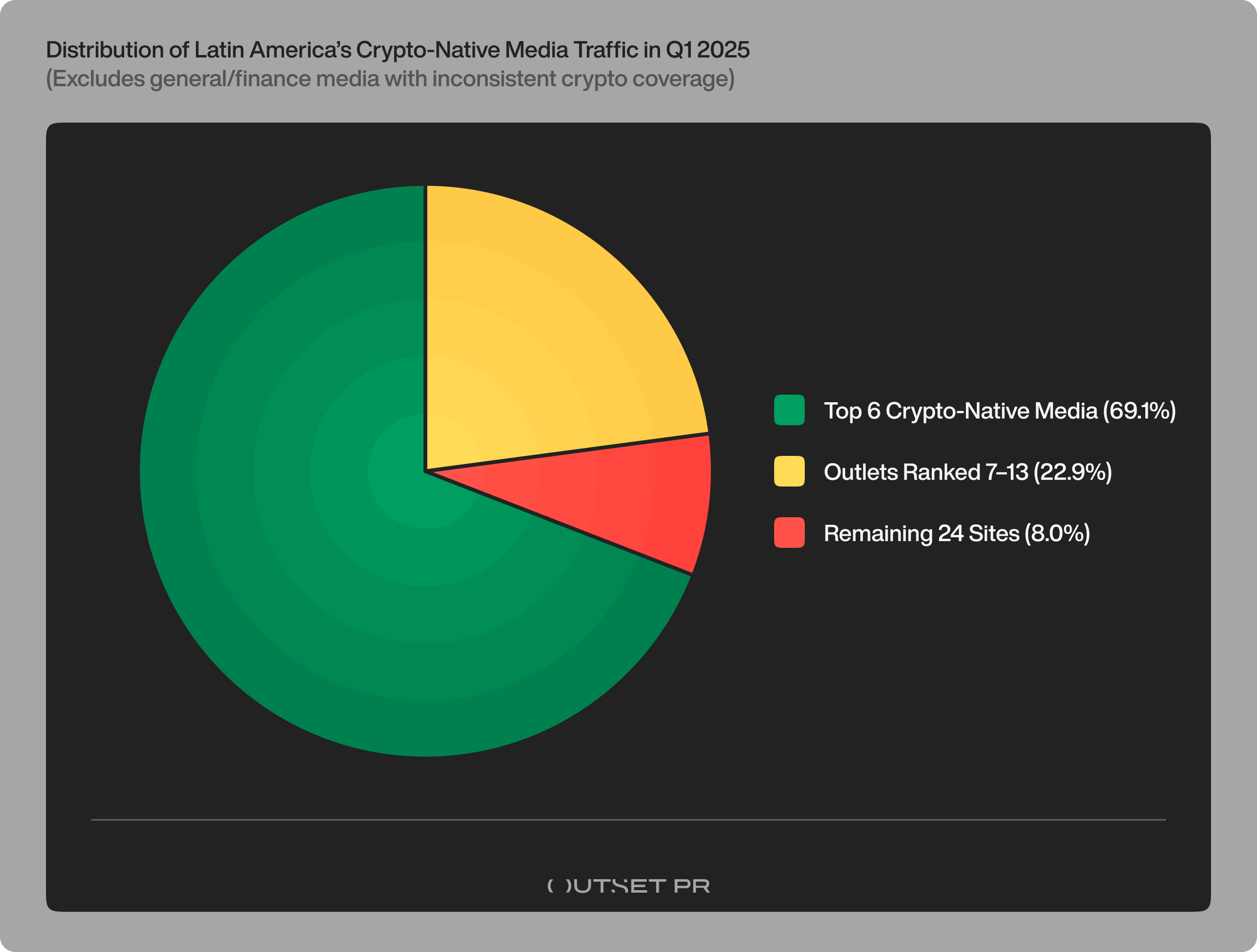

Outset PR’s findings show that just six sites account for nearly 70% of all traffic across 38 crypto-only publications in Latin America.

This report segmented the rest of the field into two additional tiers. The next seven outlets reached between 130K and 270K monthly visits. Together, they captured around 22.9% of traffic. The remaining 24 crypto sites made up just 8% of total traffic, with many struggling to cross 10,000 monthly visits. The visibility cliff between tiers was steep — and it shows how difficult it is for new players to break through.

Most might view the large amount of media power spread across a small handful of outlets as a sign of media maturity. This makes sense: the readers have decided who they want to follow. The strong survived, and the rest failed.

But is this centralization by design, or just the byproduct of bigger forces?

There’s no indication in Outset PR’s report of any coordinated push to dominate crypto media. But the traffic data they’ve been publishing — including on their X profile — points to something more structural: survival shaped by algorithm changes, tightening ad budgets, and shifting reader habits.

In that environment, only a few outlets had the resources, SEO muscle, or extra backing to hold on, let alone grow.

What happened to the open frontier?

Crypto was meant as an alternative to all forms of centralized control. But as Latin America’s crypto economy has grown, so too has the pull toward media centralization. A handful of early movers, some backed by large newsgroups, others boosted by international reach, dominate search rankings, social traffic, and key reporter relationships.

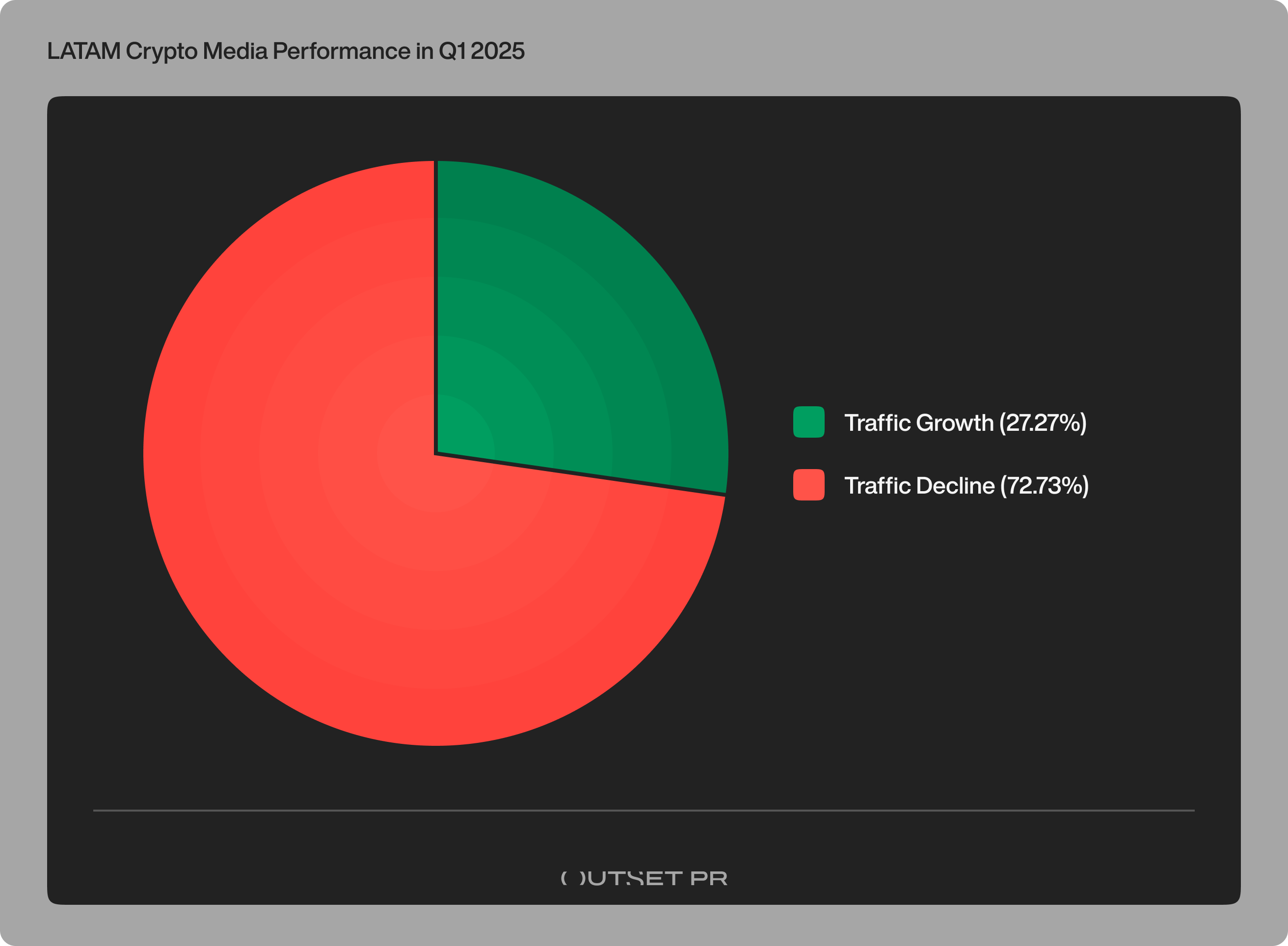

That dominance has made them unofficial gatekeepers of crypto narratives across the region. The numbers back it up: Outset PR tracked 55 active crypto and crypto-adjacent newsrooms across LATAM in the first quarter. Of those, 73% lost traffic.

Several previously relevant outlets, such as bitcoinmexico.net and latamblockchain.com, are now defunct, dormant, or just irrelevant.

Only 12 outlets posted traffic growth in February, but by the end of the quarter, that number had doubled. Among those that demonstrated a fighting chance, the odds are stacked against them, as most struggle to cross 300,000 monthly visits.

Even well-performing portals like DiarioBitcoin or CriptoTendencia fall far short of the audience reach commanded by general-interest finance sites like Ámbito or InfoMoney. The playing field is not just uneven, it’s structurally tilted toward high-traffic incumbents.

And then there’s the algorithm. Google’s March core update quietly redrew the map for many LATAM outlets, rewarding a handful of technically resilient sites while pushing others further into the shadows. For smaller crypto-native players, it wasn’t just about content — it was about losing visibility in the feeds where most discovery still happens. The result? Fewer entry points, fewer voices, and a media landscape that’s starting to look a lot less decentralized than the tech it’s meant to cover.

Who really shapes the story?

With six outlets dominating coverage, their editorial desks and a few reporters dictate what the LATAM crypto community sees and hears. Whether it’s a new token launch, a DeFi protocol, or a legal dispute, visibility is filtered through the priorities of just a few teams.

In Brazil, fintech company Méliuz announced plans to raise $26.4 million to expand its Bitcoin holdings. This news was picked up by Reuters. In Chile, stablecoin issuer giant Tether invested in the crypto exchange Orionx to enhance digital asset adoption across Latin America. CoinDesk picked up this story. These stories traveled far. But for smaller projects that don’t get picked up by the dominant LATAM media players, visibility is a constant uphill battle. The consequence? Less space for early-stage builders, and fewer chances for regional innovation to break through.

Sponsored content, undisclosed brand partnerships, and promotional articles from projects that can’t secure organic coverage won’t solve anything. The slightest sign of bias will be easily detected. This public relations strategy of ‘pay to play’ might have worked five years ago. However, the crypto community has evolved to look beyond noise and pay attention to real stories from real projects written by real journalists.

Outset PR’s report doesn’t just diagnose the problem, it offers a call to action. For startups, it means resetting expectations based on realities. For media strategists, it means looking beyond surface-level metrics and investing in outlets that still offer real reach.

And for the rest of the crypto community, it means giving new and independent voices a chance to thrive in a market that is certainly large enough for everyone. Decentralization isn’t just a technical goal, it’s a media challenge too.

The complete data set and visual analysis from Outset PR’s LATAM crypto media Q1 report is published on their blog for anyone who wants to explore further.