Pendle up 18% following deal with Coinbase-backed protocol

The decentralized platform Pendle Finance sees a surge in liquidity crossing the $500 million threshold on the heels of a deal with Ondo Finance.

Pendle Finance’s native token PENDLE is up over 18% following a deal with Coinbase-backed protocol Ondo Finance, which revealed in an X post on Jan. 29 that its users can now leverage the “composability of our tokenized cash equivalents.”

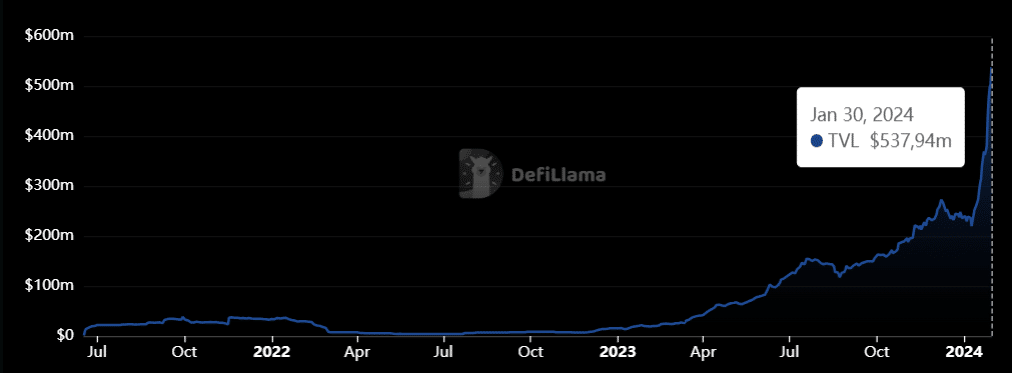

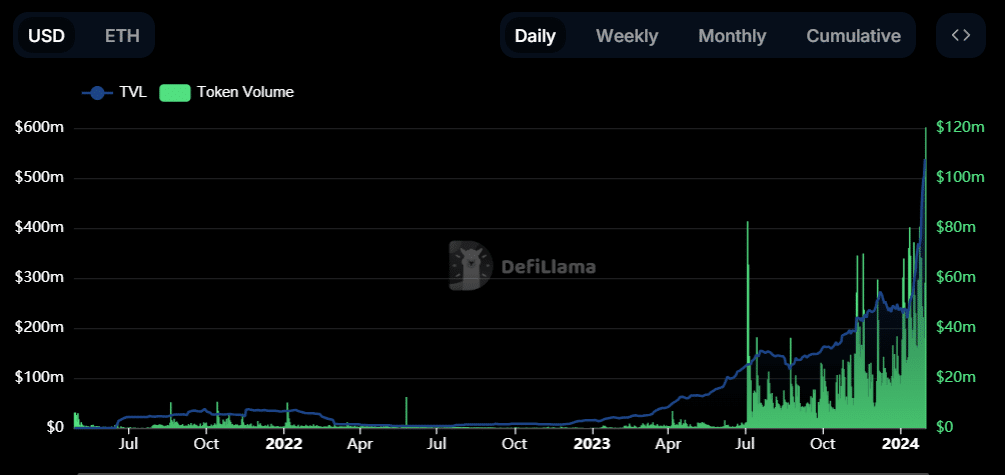

While specific details regarding the collaboration remain undisclosed, the announcement has seemingly played a role in fostering positive sentiment within the Pendle community. According to DefiLlama data, the total value locked (TVL) in Pendle Finance set a new all-time high, nearing the $538 million mark as of Jan. 30.

The PENDLE token has demonstrated significant participation, with nearly $60 million in PENDLE volume recorded on Jan. 30 alone, according to available data.

Amidst this surge in activity, the PENDLE token soared to $2.66, surpassing its previous all-time high established since its launch, as indicated by CoinGecko data. However, the sustainability of this rapid growth in the long term remains to be seen.

Established in 2022, Pendle Finance initially focused on the Ethereum network, providing a platform for tokenizing and trading future yields within the defi space. Later in the same year, the platform expanded its reach to other networks, including BNB Chain, Arbitrum, and Optimism.

Pendle Finance’s approach allows users to tokenize and trade future yields generated by assets across various decentralized protocols. This feature enables users to trade these future yields as distinct tokens, apparently representing a new way to engage with and speculate on defi yields.