Pi Network price rebounds, but a risky pattern points to a crash

Pi Network price has staged a strong comeback in the past ten days as the crypto market stabilizes and investors buy the dip.

Pi coin (PI), the viral tap-to-earn coin, rose to a high of $0.755 on Monday, its highest level since March 29. It has soared by 92% from its lowest level this year.

Before this rebound, the coin was in a strong downtrend as many pioneers started selling their coins. Pioneers are users who were mining the coin before the mainnet launch in April.

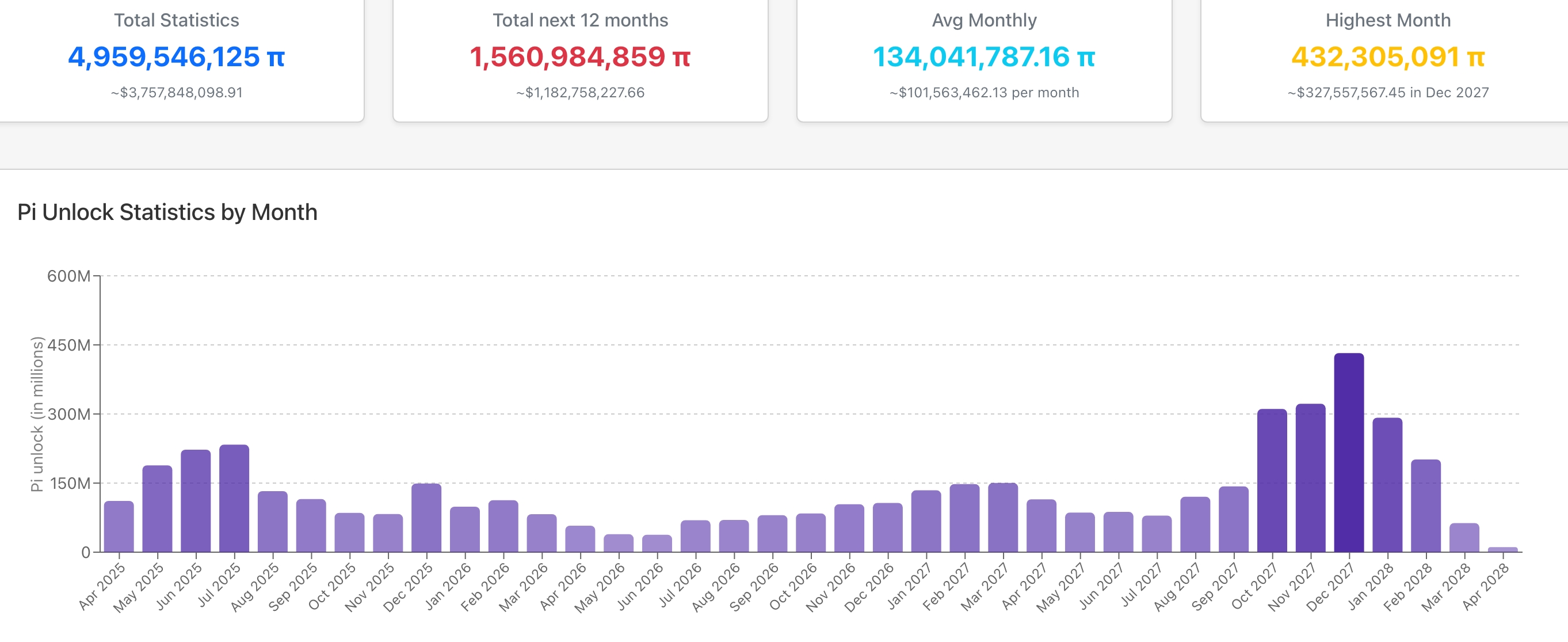

It also dropped after centralized exchange listings became elusive and as concerns about its dilution continued. As shown below, over 1.56 billion tokens will be unlocked in the next 12 months, leading to more dilution.

Pi Network price has formed a risky chart pattern

The ongoing Pi recovery happened as Bitcoin (BTC) and some other coins remained resilient. Bitcoin has held steady above $80,000 even as the stock market and the fear and greed index plunged.

The four-hour chart shows the coin also surged after forming a falling wedge chart pattern. This pattern is made up of two descending and converging trendlines, with the bullish breakout happening when the two lines near their confluence level.

On the positive side, the coin has moved above the 50-period Exponential Moving Average, a sign that it is gaining momentum. It has also moved above the Woodie pivot point.

However, signs of a potential reversal are emerging. The price has now formed a rising wedge pattern, with the lower trendline connecting the higher lows established since April 5. In technical analysis, a rising wedge is considered a reliable bearish pattern.

Additionally, a bearish divergence appears to be taking shape. The Percentage Price Oscillator is on the verge of a bearish crossover, and the Relative Strength Index has begun trending downward.

Therefore, Pi may be at risk of a sharp pullback, with the next key support level being the all-time low of $0.3979, around 47% below current levels.

That said, this bearish outlook would be invalidated if the price manages to break above the first resistance of the Woodie pivot point at $0.8610. In that scenario, the next upside target would be the psychologically significant $1 mark, about 32% higher than today’s price.