Play-to-earn essentials: how to begin and what you can earn

The video games market is thriving. Discover the potential rewards and opportunities in crypto with play-to-earn (P2E) games.

The global video games market is experiencing rapid growth, with projections indicating a substantial increase in revenues to $282.30 billion by 2024.

Regions like China are anticipated to significantly contribute to this surge, with a projected revenue generation of $94.4 billion this year.

Furthermore, the market is expected to sustain this momentum with an annual growth rate of 8.76%, reaching a staggering $363.20 billion by 2027.

In this changing landscape, play-to-earn (P2E) games are gaining attention. These games offer the traditional gaming experience but also give you a chance to earn actual cryptocurrency rewards.

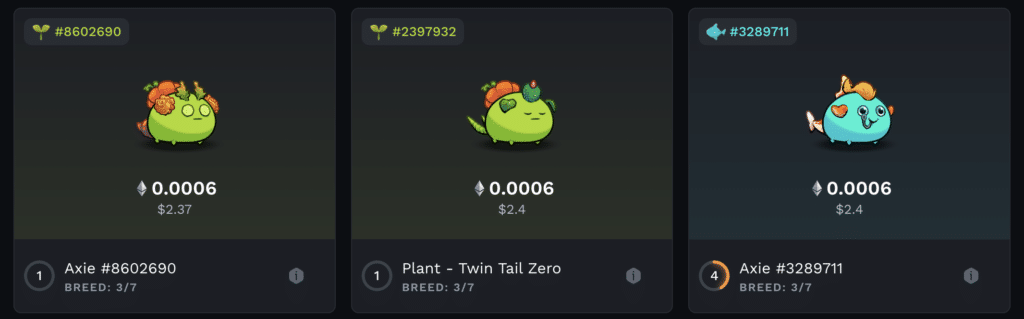

However, the entry point into these games varies depending on the title. For instance, Axie Infinity (AXS), a prominent player in the play-to-earn space, requires players to invest in at least three Axies, priced between $2 to several thousand dollars each.

Conversely, games like Decentraland (MANA) offer a more accessible starting point. Players can initiate their journey with a MetaMask wallet, although additional investments in virtual assets like the MANA coin may be necessary to access certain features.

When considering your potential earnings, it’s crucial to understand that they can change. This change is affected by factors like the worth of the tokens and the engagement of the players.

For example, community reports suggest an average daily earning potential of around $1 within Axie Infinity.

Additionally, the secondary market for in-game assets, particularly non-fungible tokens (NFTs), presents players with an opportunity for additional revenue streams, as evidenced by Decentraland’s success in NFT sales.

Games leading the P2E race

Let’s analyze top performers in the P2E market based on the last 30 days of data:

- motoDEX: Ranked first among P2E games, motoDEX operates on a multi-chain model. Over the last 30 days, it has witnessed an increase of 35.6% in unique active wallets (UAW) and a surge of 512.91% in transaction volume, taking its total transactions to 8.31 million.

- Sweat Economy: Sweat Economy operates on both Ethereum and Near chains. The Ethereum (ETH) hosted version experienced a modest uptick of 2.56% in UAW, while the Near-hosted counterpart saw an increase of 4.42% with total transactions of 6.49 million.

- Trickshot Blitz: Holding the third spot, Trickshot Blitz runs on the Flow blockchain. However, it faces challenges with a 17.93% decrease in UAW and declining transaction volumes over the past 30 days.

- PlayEmber: Ranked fourth, PlayEmber is present on both Ethereum and Near chains. Ethereum-based activity declined by 20.87% in UAW, while Near witnessed a decrease of 35.38% over the last month.

- Pixels: Securing the fifth position, Pixels operates on Ethereum and Ronin chains. Ethereum-based activity surged by 137.35% in UAW, while Ronin witnessed a 31.94% increase in user engagement. Additionally, transaction volumes on Ronin skyrocketed by over 3,000%.

How to make money from P2E games in 2024

The P2E market is volatile, with earnings potential fluctuating due to factors like token value, game popularity, and in-game asset demand.

Successful monetization strategies in 2024 will hinge on staying informed about market trends, choosing the right games, and managing assets wisely. Here is what you can do:

Selecting the right games

Decentraland, The Sandbox (SAND), and Axie Infinity are highlighted as prominent examples of P2E games that have yielded high returns for early investors and, by far, are still the most valued games based on market cap.

Meanwhile, as of Mar. 7, motoDEX, Sweat Economy, and Pixels stand out due to their unique active wallets (UAW) growth and transaction volumes as per DappRadar.

Focus on games with high reputation, popularity, UAW and transaction volume as they indicate an engaged community, a key factor for potential earnings.

Don’t put all your resources into a single game. Spread your investments across different blockchains and game genres to mitigate risks associated with token volatility and game popularity changes.

Earning strategies

- Active participation: Engage daily to maximize earnings through gameplay, challenges, and community events. For instance, Sweat Economy rewards users for physical activity, promoting consistent interaction.

- Asset flipping: Asset flipping on secondary markets for games like Decentraland and The Sandbox can be lucrative, especially for early investors or those with a keen eye for valuable in-game assets. Timing is crucial; purchase assets when prices are low and sell during peak demand. Analyzing historical price data and community sentiment can inform buying/selling decisions.

- Staking and investment: Some P2E games offer staking mechanisms where you can earn dividends or interest on your in-game assets or tokens. This can provide a passive income stream alongside active gameplay earnings.

- Guild membership: Joining a guild can provide access to premium game assets without upfront investment, sharing profits from collective earnings. It’s also a great way to learn strategies from experienced players.

Calculations and profitability analysis

- Return on investment (ROI): Calculate initial costs (buying game assets, transaction fees) against daily/weekly earnings to understand the break-even point. For example, if your initial investment is $100 and you earn $5 daily, your break-even point is 20 days.

- Market analysis: Keep an eye on token and asset prices within each game. Use tools like DappRadar and NonFungible.com to analyze market trends and identify profitable assets.

- Community engagement: Active community participation can offer insights into upcoming updates, market trends, and hidden opportunities for earning. Reddit, Discord, and Twitter are essential platforms for P2E game communities.

Current state of P2E market

In 2023, the blockchain gaming sector witnessed significant shifts and challenges alongside notable successes.

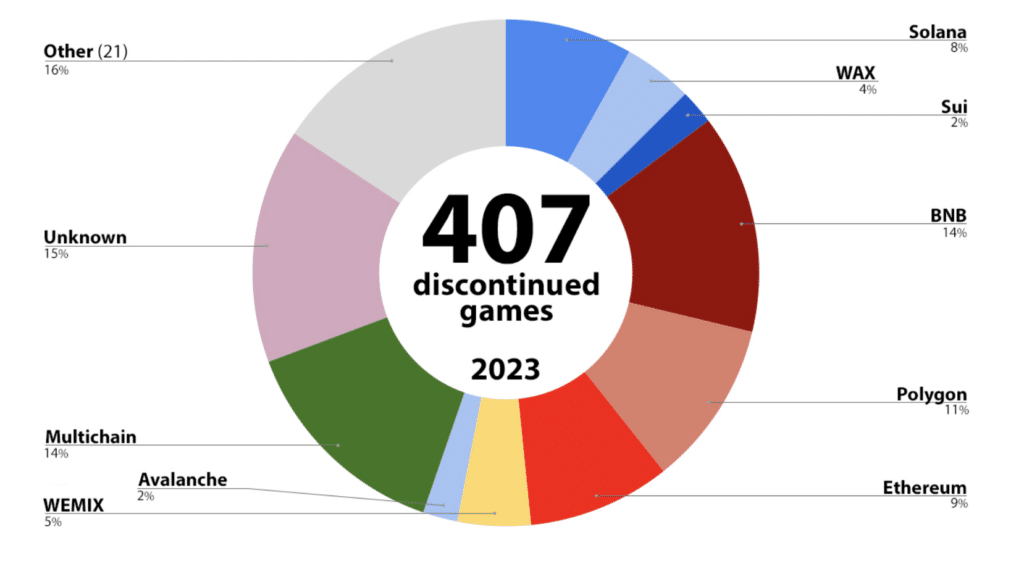

According to data provided by the Big Blockchain Game List, 2023 saw over 30% of announced blockchain-based games being canceled or discontinued.

This trend was particularly evident across platforms such as Binance Chain (BNB), Polygon (MATIC), and Ethereum, highlighting a high level of project attrition within the industry.

According to DappRadar’s latest report, blockchain gaming attracted significant capital in 2023, with investments totaling $2.9 billion across 163 deals in web3 gaming and metaverse projects.

This marked a notable 62% drop in funding and a 19% decrease in the number of deals compared to 2022, when blockchain games received $7.6 billion in funding.

The market composition remained largely dominated by indie or mid-size projects, with only a small fraction (6%) securing higher AA and AAA funding levels. Nevertheless, Asia emerged as a prominent hub for new game development, with half of all new games originating from the region.

Meanwhile, blockchain games accounted for the highest share (34%) of dapp activities in 2023, attracting a daily active user base of 1.1 million.

WAX emerged as a standout gaming blockchain in 2023 and drew in over 3 million new wallets and processed 4.7 billion gaming transactions, cementing its position as a key player in the blockchain gaming space.

Additionally, in-game NFT markets witnessed significant activity throughout the year. Notable platforms like Gods Unchained and Ethereum led the pack in trading volumes, with Gods Unchained achieving a remarkable $209 million in trading volume and Ethereum maintaining its dominance with $347 million in in-game NFT trades.

Conclusion

Prioritize games with established popularity and engaged communities, as they often offer more stable earnings potential.

Additionally, stay informed about market trends and monitor token and asset prices regularly. Remember to approach P2E gaming as a long-term investment, exercising caution and diligence in your decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.