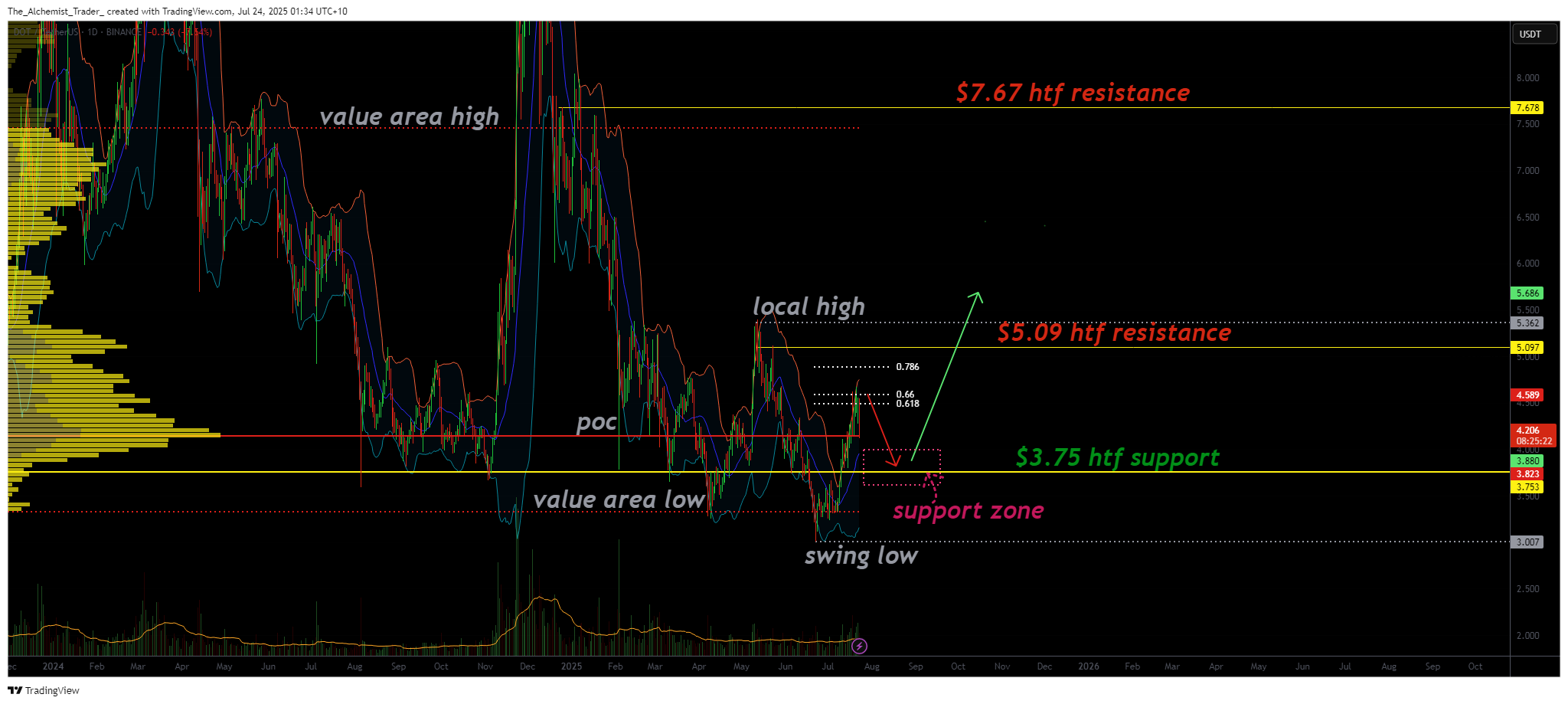

Polkadot approaches key support at $3.75 after healthy pullback

Polkadot is undergoing a price correction after facing resistance at a key Fibonacci retracement level. If the $3.75 support holds, the asset could form a higher low, potentially triggering a renewed rally and preserving its overall bullish trend.

- DOT rejected from Fibonacci resistance and is now targeting $3.75 structural support.

- $3.75 is a high-confluence level and potential higher low zone for bullish continuation.

- Holding this support could ignite a move toward $5 and $7.67 in the coming sessions.

Polkadot (DOT) is undergoing a healthy correction after facing resistance at a key Fibonacci level, with price action now targeting the $3.75 support zone. This area is a crucial high-time-frame level that previously acted as resistance, but has since flipped into potential support following an impulsive breakout. A successful retest of this region could confirm it as a structural higher low and pave the way for bullish continuation in the immediate short term.

The $3.75 level is not only a former resistance but also aligns with the value area low, making it a strong zone of technical confluence. This increases the probability of a bullish bounce from this area, especially given the overall strength shown in the prior rally off the swing low.

Key technical points:

- Fibonacci Rejection: DOT was rejected from a key retracement level, triggering the current pullback

- Key Support at $3.75: Former resistance flipped into support; aligns with the value area low

- Upside Potential: Break and hold above local high opens the door for a move to $5 and potentially $7.67

From a technical perspective, this correction is considered both healthy and necessary, especially after the sharp upward move that saw DOT reclaim key levels. Pullbacks of this nature often serve to reset momentum indicators and create new demand zones.

As long as the price holds above the $3.75 region, DOT maintains a bullish structure. A bounce from this level could lead to a higher low formation, a key ingredient in sustaining an uptrend. If confirmed, price may target the local high near $5 and, eventually, the value area high at $7.67, a level that has historically capped upward moves in this trading range.

Despite the current weakness, the overall structure remains intact. DOT’s market structure remains bullish on the higher time frame, and any reclaim of $5 with volume support would strengthen the case for a broader rally. A failure to hold $3.75, however, would place pressure on the structure and open the possibility of a deeper correction.

What to expect in the coming price action:

Watch the $3.75 level closely, if DOT holds and prints a higher low, a continuation toward $5 and possibly $7.67 becomes likely. Momentum and volume confirmation will be key to validating the next leg higher.