Polkadot’s multi-million marketing expenses spark fury in blockchain community

Blockchain project Polkadot is under fire after revealing $37 million in expenses on the marketing budget, triggering criticism and scrutiny from its community.

Polkadot, a sharded multi-chain network founded by the Ethereum co-founder Gavin Wood, is facing backlash after disclosing $37 million in marketing expenses, leading to criticism and scrutiny from its community.

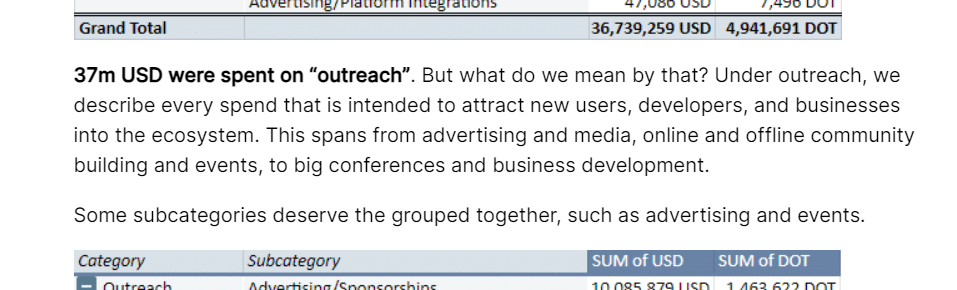

In its H1 2024 treasury report, Polkadot said that nearly $40 million was spent on “outreach,” saying that under outreach, the company describes “every spend that is intended to attract new users, developers, and businesses into the ecosystem.”

“This spans from advertising and media, online and offline community building and events, to big conferences and business development.”

Polkadot

Of the total marketing budget, over $20 million was allocated to advertising, while $10 million worth of DOT tokens were used for sponsorships. These sponsorships included sports deals, collaborations with a race car driver, and a partnership with an e-sports tournament organizer. For comparison, the report noted that Polkadot spent $23 million on developments in the first half of the year.

The marketing expenses quickly triggered outrage within the blockchain community, with accusations of centralization and frivolous financial campaigns. Victor Ji, co-founder of Manta Network, expressed his dissatisfaction in an X thread, calling Polkadot a “highly toxic ecosystem that lacks any real value for web3” and accusing it of discrimination and lack of support for network-built projects.

Another core developer at Polkadot, using the alias @seunlanlege, also criticized the project’s approach, saying it’s “insane to me how much money the Polkadot treasury is wasting on misplaced marketing,” and drawing parallels between Polkadot and the bankrupt FTX crypto exchange.

The report noted that at the current spending rate, Polkadot’s treasury has about “two years of runway left,” while acknowledging the unpredictable nature of crypto-denominated treasuries. As of now, Gavin Wood has not made any public statements on the matter.