Polygon price hits 2024 peak as defi markets pull $30b inflows

On Feb. 26, MATIC’s price crossed $1.05 for the first time in 2024; the steady rise in Polygon network activity in correlation to the defi market boom suggests more bullish action could follow.

Layer-2 networks like Polygon (MATIC) and Optimism (OP) have been on a tear in recent weeks as investors pile billions of dollars into Ethereum (ETH) leading defi protocols.

Defi market boom driving MATIC price rally

Amid widespread expectations of Fed rate cuts, investors are increasingly switching focus towards risk assets. As the S&P 500 soared to historic peaks following NVIDIA’s bullish earnings, defi markets in the crypto sector have also recorded significant capital inflows.

L2 networks like MATIC, OP, and Arbitrum (ARB) are industry leaders in facilitating lending, borrowing, payments, and other smart-contract-based decentralized finance activities.

Last week, the Optimism price came close to hitting a new all-time high, while MATIC’s price reached a six-month peak of $1.05 on Feb. 27.

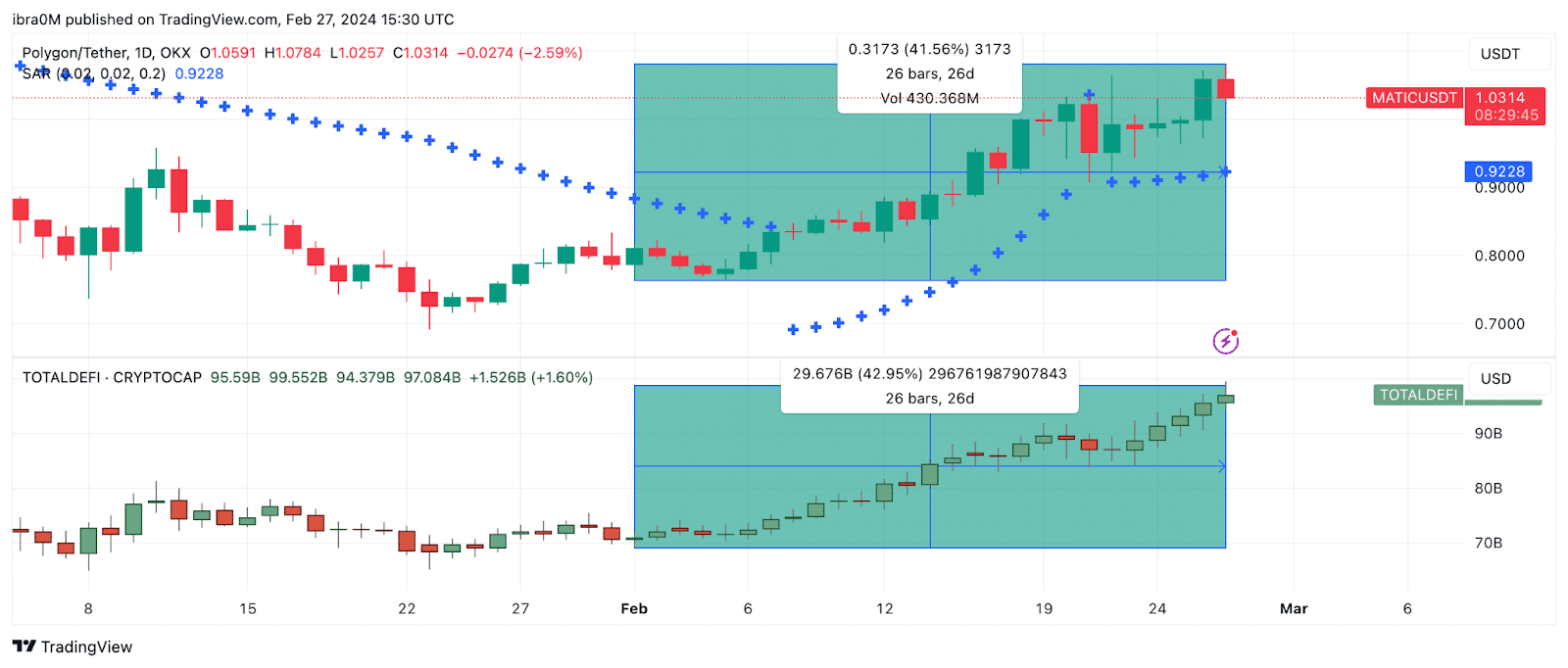

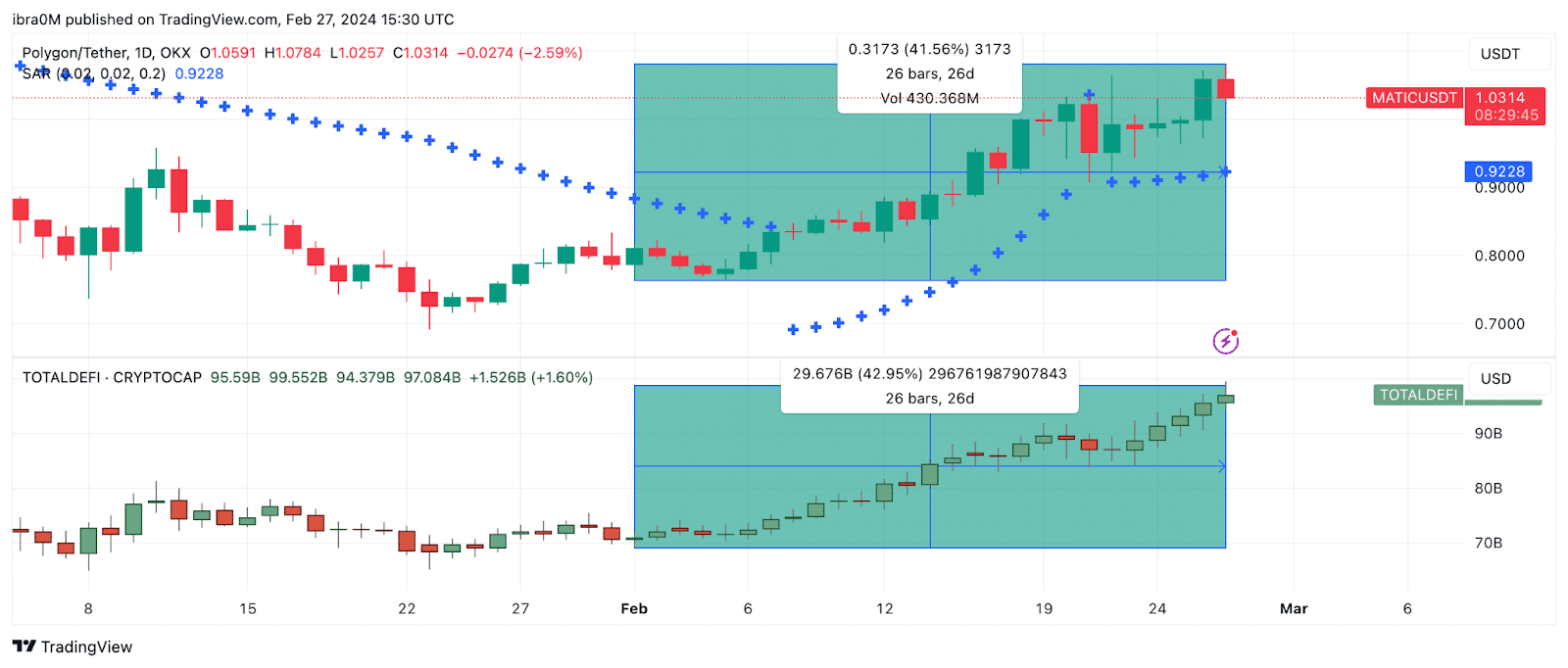

TradingView’s total defi market cap charts track the cumulative valuation of decentralized finance-related tokens. When plotted next to the total defi market cap trends for February 2024, MATIC price action has displayed a stark similar outing for the month.

The chart shows that the total defi market cap has attracted $30 billion in inflows between Feb. 1 and Feb. 27, representing a 43% boom. This closely correlates to MATIC’s 42% price growth performance during that period.

The defi market has now ballooned to a 22-month high. Considering Ethereum liquidity staking deposits are receiving historic-level deposits, more inflows could be recorded in the coming days, likely creating a prolonged bullish demand cycle for Layer-2 scaling projects like Polygon.

Polygon network activity trends at a 5-month peak

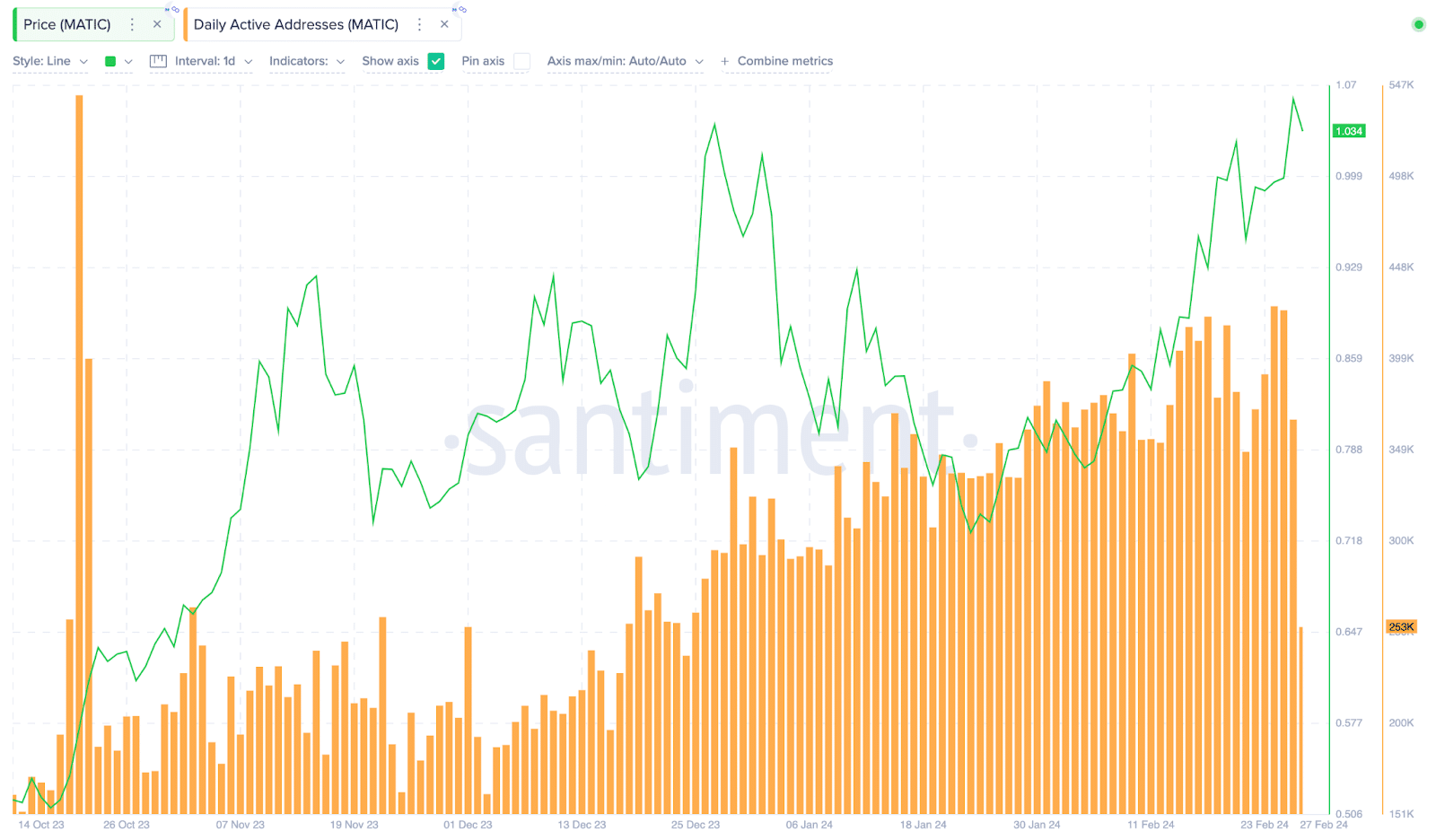

The level of user activity recorded on the Polygon network in recent weeks further affirms the correlation between the defi boom and MATIC price action.

Santiment’s daily active addresses (DAA) track the number of unique addresses that carry out valid transactions on a blockchain network over 24 hours. Polygon has attracted unusually high user activity since the turn of the year despite choppy price action.

As depicted, Polygon’s Daily Active Addresses (DAA) hit a five-month peak of 427,000 on Feb. 25, having been on a meteoric rise since the turn of the year, even amid choppy price action.

The rising values of Daily Active Addresses are a key bullish indicator highlighting that the core services offered on the underlying network are in demand.

When it coincides with a historic price uptrend, as observed above, it suggests that the rally is driven by organic utility and not merely speculators FOMO-ing in.

More importantly, Polygon’s activity surge amid the defi boom further emphasizes its status as one of the most sought-after scaling networks. This puts MATIC in a vantage position to capture more value as the defi market gains more traction in the coming weeks.

MATIC price forecast: $1.20 target in firm focus

Based on market trends, MATIC’s price is predicted to reach the next target of around $1.20. However, in the short term, the bulls must first clear the initial resistance in the $1.10 territory.

IntoTheBlock’s global in/out of the money data shows that 52,830 addresses had acquired 172.3 million MATIC at the average price of $1.11. Given that they have been holding at a loss since April 2023, many could opt to take some profits.

If the defi market boom enters second gear, the MATIC pulls could capitalize on the resulting network traction to drive the price rally above $1.20 as predicted.

Still, the bears cannot negate this bullish prediction if the initial profit-taking wave sends MATIC price tumbling below $0.90. However, given the overall positive sentiment surrounding the Layer-2 token markets, these bearish prospects seem far-fetched.

The 59,330 addresses that bought 972,980 MATIC at the average price of $0.91 could offer significant short-term support.