Polygon rises as Polymarket, Pokemon Cards growth continues

Polygon price continued rising this week, helped by the strong performance of Polymarket and Pokemon Cards.

Polygon (POL) rose to a high of $0.4200, up by over 12% in the last seven days, bringing its market cap to over $1.3 billion.

This rally occurred as the network upgraded and migrated its token from MATIC to POL. After the upgrade, POL became the native and staking token for the Polygon Proof-of-Stake network. In the future, it will be the main token for the AggLayer.

The token has also rallied amid ongoing ecosystem growth. Polymarket, one of the biggest prediction platforms, has seen strong growth in the past few months. Data from SimilarWeb shows that the website had over 13.8 million visitors in August, a 52% increase from the previous month.

The amount of money in the network has also been growing. The presidential election winner prediction market holds almost $900 million in assets, while the popular winner prediction has $201 million.

Data from DeFi Llama shows that Polymarket has over $122 million in total value locked and has a market dominance of 82% in the prediction market. This growth will likely continue as the platform goes mainstream, with popular media outlets like CNN and Bloomberg mentioning it.

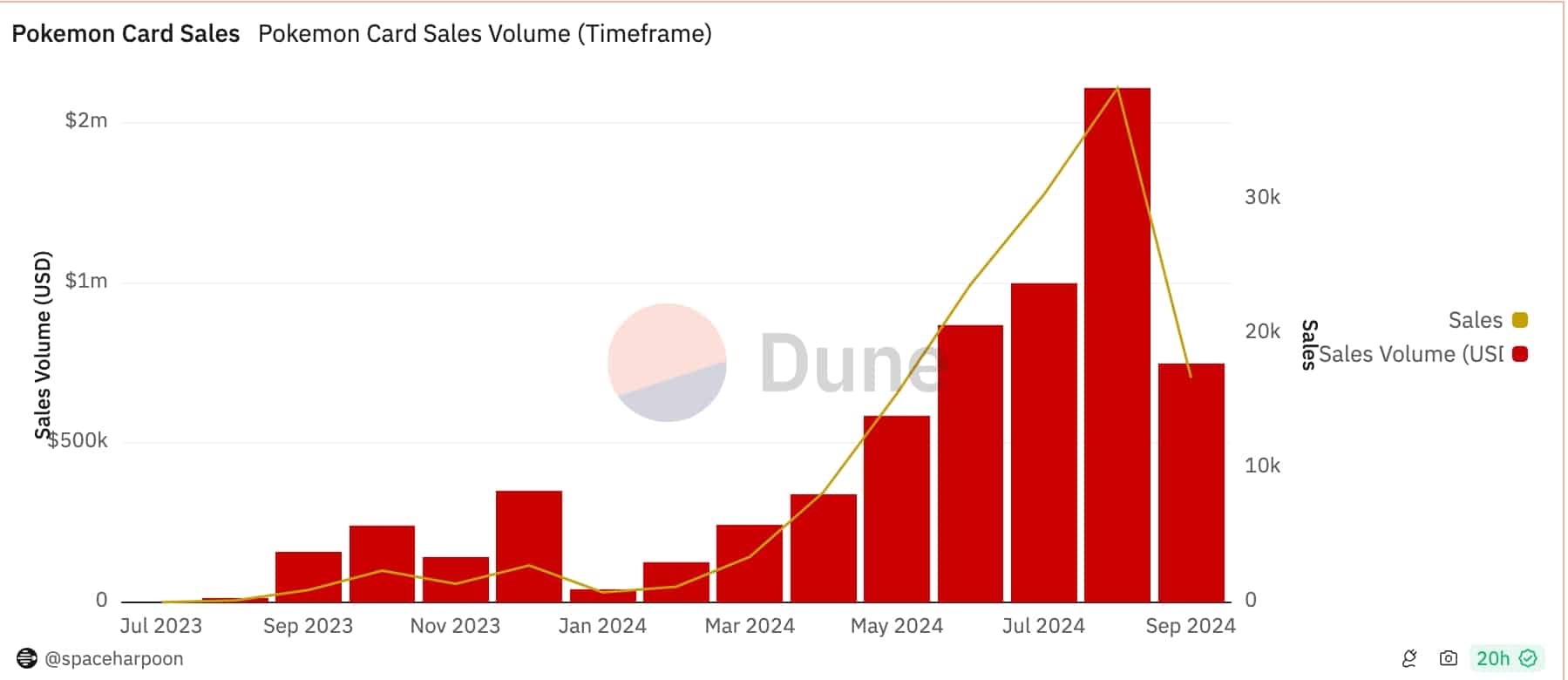

Meanwhile, Pokemon Cards NFT sales are doing relatively well. Data from Dune Analytics shows that the monthly sales volume rose to a record high of $1.6 million in August, up from $1 million the previous month. Sales this month have so far reached $749,000.

Meanwhile, the total value locked in Polygon’s Decentralized Finance ecosystem rose by 2.46% to $861 million in the last 30 days. The amount in Ethereum (ETH) fell by 10% while that in Arbitrum and Base fell by over 2% in the same period.

However, Polygon’s market share in the decentralized exchange industry has been declining. The volume of coins traded on its blockchain dropped by 12.2% in the last seven days to $476 million. Base and Arbitrum, other popular layer-2 networks, handled $3.18 billion and $3.2 billion in the same period.

Polygon flips key resistance, gets overbought

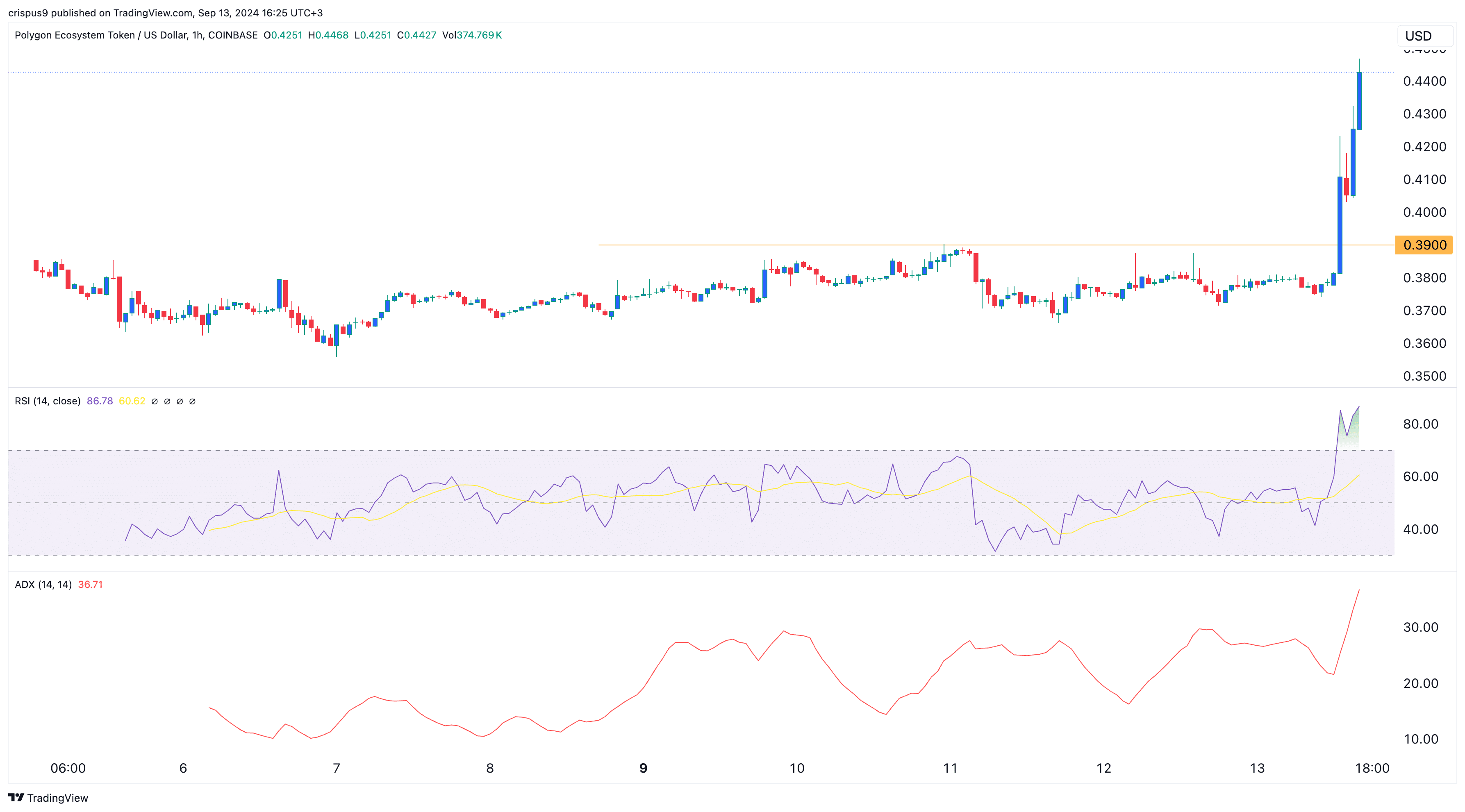

The POL token was in a consolidation phase after its launch last week. This performance ended on Friday, Sept. 13, when it went parabolic, crossing the crucial resistance point at $0.3900, its highest swing on Sept. 10.

The Average Directional Index, a popular trend indicator, rose to 36, while the Relative Strength Index reached the overbought point of 87. Therefore, POL may retreat soon due to profit-taking, which could see it retest the support at $0.40.