Popcat secures top gainer spot with 33% surge in 24 hours

Solana-based meme coin Popcat champions the ongoing market recovery effort emerging as the largest gainer among the top 100 cryptocurrencies.

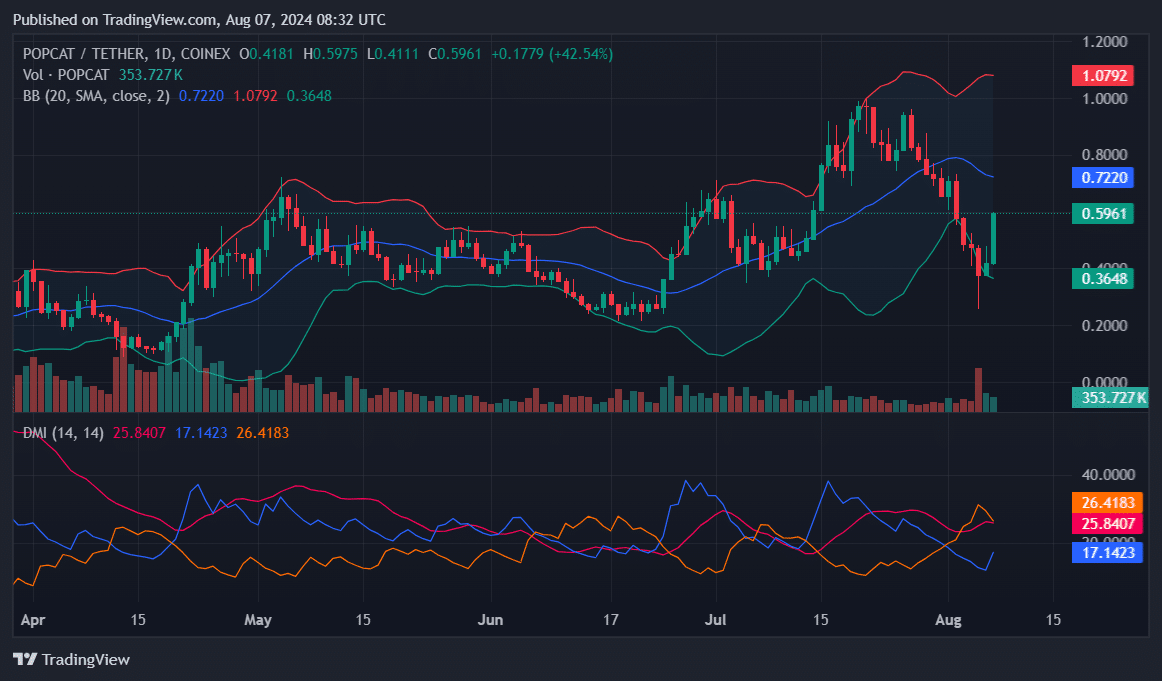

The latest rebound follows a dramatic drop to a two-month low of $0.2580 on Aug. 5, where the token lost 20% in a day as the broader market collapsed. However, Popcat (POPCAT) has rebounded by 128% from its recent low and is trading at $0.5961 at the time of writing.

Notably, Popcat’s current price position is above the lower Bollinger Band,$0.3648, but significantly below the upper band, $1.0792, and the middle band, $0.7220. This setup is rather unprecedented, considering the sharp price increase.

However, with the price significantly underneath the upper Bollinger Band, this indicates that while there has been a significant recovery, POPCAT has not yet reached an overbought condition. The gap between the current price and the upper band suggests there could be room for further growth before resistance.

Meanwhile, on the Directional Movement Index, the +DI line, which measures the strength of the upward movement, stands at 17.1423, while the -DI line, indicating the strength of the downward movement, is at 26.4183.

The Average Directional Index, which shows the strength of the overall trend, is at 25.84. With the ADX above 25, the current trend is considered moderately strong, although the higher value of the -DI compared to the +DI suggests that bearish pressure could be mounting.

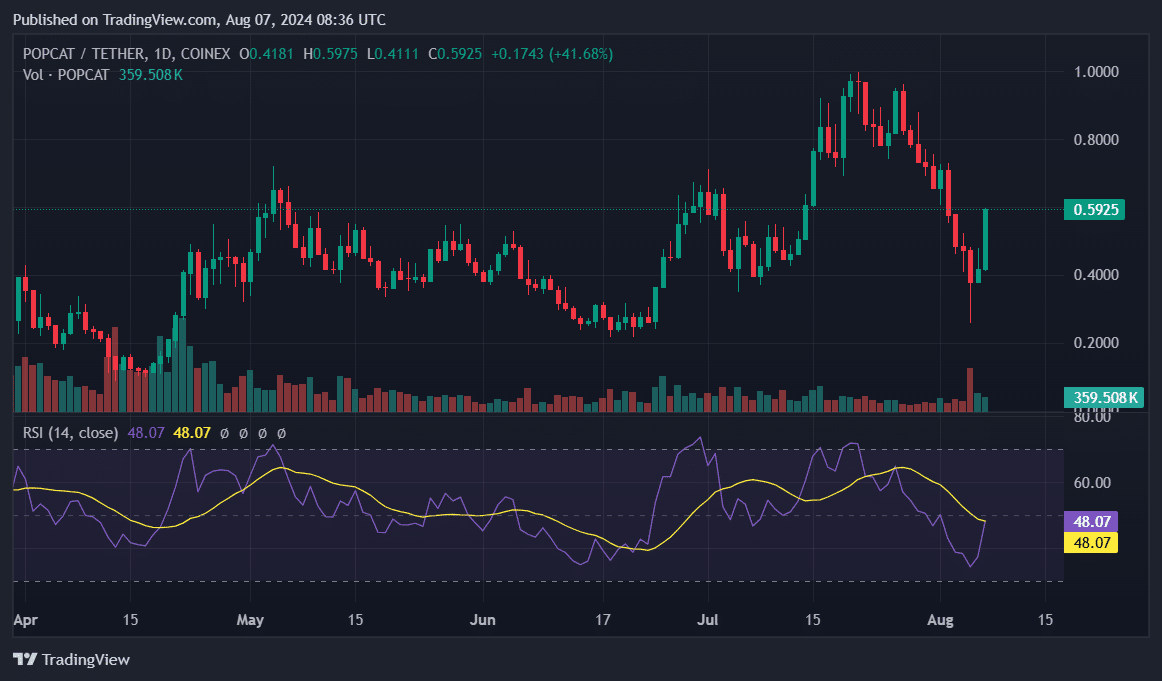

Popcat RSI suggests cautious outlook

The Relative Strength Index further supports a cautious outlook. With an RSI value of 48.07, POPCAT is neither overbought nor oversold. This neutral reading means there’s no immediate risk of a sharp reversal due to overvaluation.

However, the current RSI reading also does not signal a strong continuation of the uptrend. The current position indicates the potential for the price to move in either direction without being overstretched.

The recent surge in POPCAT’s price has been accompanied by increased trading volume, suggesting strong buying interest. However, if the volume starts to decline while the price remains high, it could indicate weakening momentum, potentially leading to a pullback.

It is important to watch for changes in trading volume and the DMI lines closely. A significant drop in volume or a crossover where the -DI surpasses the +DI could signal an impending correction.

Conversely, sustained high volume and a strengthening +DI could support further gains. While the current rally has been remarkable, mixed signals from technical indicators suggest vigilance for signs of a potential reversal, indicating that the rally might not be fully exhausted yet, but caution is advised.