QCP Capital: Crypto market getting ‘nervous’

Crypto markets are becoming increasingly uncertain as the bias towards reducing the risk of an ETH reversal becomes even deeper.

QCP Capital analysts expect nervousness in the cryptocurrency sector will continue amid the escalation of the situation in the Middle East as the Iran-Israeli conflict develops. In addition, many traders are now trying to avoid risk amid the weak performance of U.S. stocks.

Funding for alternative contracts is also generally negative, indicating that much long-term leverage has been wiped out. At the same time, analysts point out that there is still a strong demand for Bitcoin (BTC) in the crypto market, in contrast to Ethereum (ETH).

“Perp funding for BTC is flattish with the back end of the curve holding steady at double digit yields.”

QCP Capital analysts

Given the current dynamics for significant cryptocurrencies, experts suggest “picking bottoms very defensively” and buying BTC or ETH at a substantial discount to the spot price.

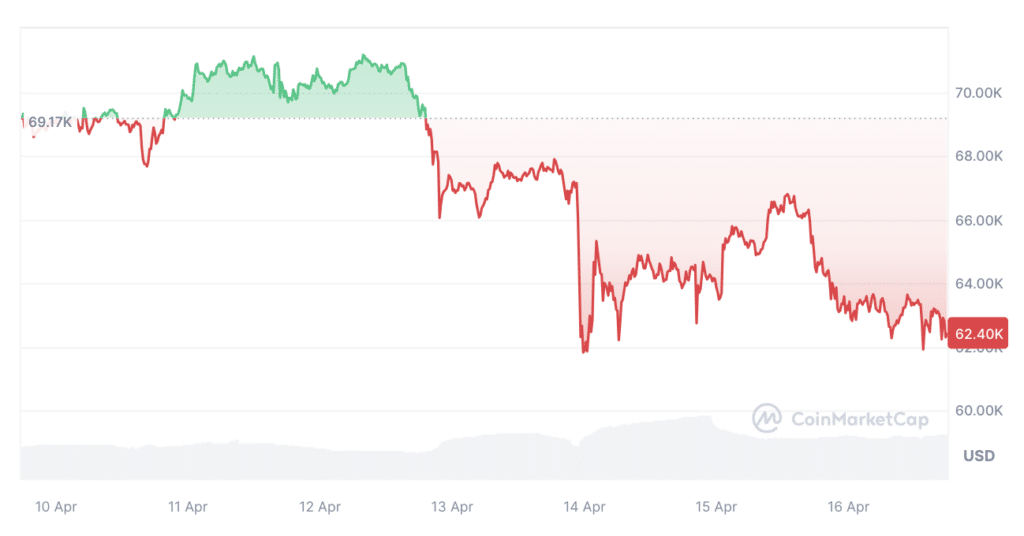

On the night of April 14, Bitcoin’s price collapsed amid news of Iran’s attack on Israel. BTC’s 8% drop below $62,000 marked its most oversized retreat since March 2023. According to CoinMarketCap data, the price had recovered slightly, reaching $62,300 at publication.

Last week, QCP Capital remained confident that the impending Bitcoin halving would not only reduce the miners’ reward for a mined Bitcoin block to 3.125 BTC but could also sharply increase demand for the first cryptocurrency.

Other factors driving growth included increased inflows into spot ETFs and reports that Citadel, Goldman Sachs, UBS, and Citi have joined BlackRock‘s exchange-traded fund. BlackRock will act as a broker-dealer authorized to create and redeem shares of the ETF.