Raredex offers rare earth metal exposure for investors on Arbitrum

Raredex is now live on Arbitrium, a Layer 2 solution that runs on Ethereum blockchain.

Raredex is a blockchain-based platform on the Arbitrum network that allows investors to access rare earth metals. Rare earth metals are needed for businesses ranging from developing technology to renewable energy and have traditionally been difficult for retail investors to access, hindered by the high entry costs—often above $10,000. Raredex solves this problem by enabling fractional ownership using blockchain-based tokenization. With Raredex, investors can buy one kilogram worth of the metal by purchasing one token.

Louis O’Connor, chief executive officer of Raredex, spoke to Cryptonews.com, emphasizing how “early adopters” can access an asset class that was previously accessible to governments or large investors, which he calls “well-connected and wealthy” individuals.

How does Raredex work?

Tradium, which supplies rare metals, has a bank-grade vault in Germany where Raredex stores its physical metals to ensure custody and availability. Each token carries extensive source-of-origin data, allowing investors to verify its provenance. Blockchain technology establishes an unalterable ownership record, thereby mitigating any risks related to fraud and ensuring transparency in the process.

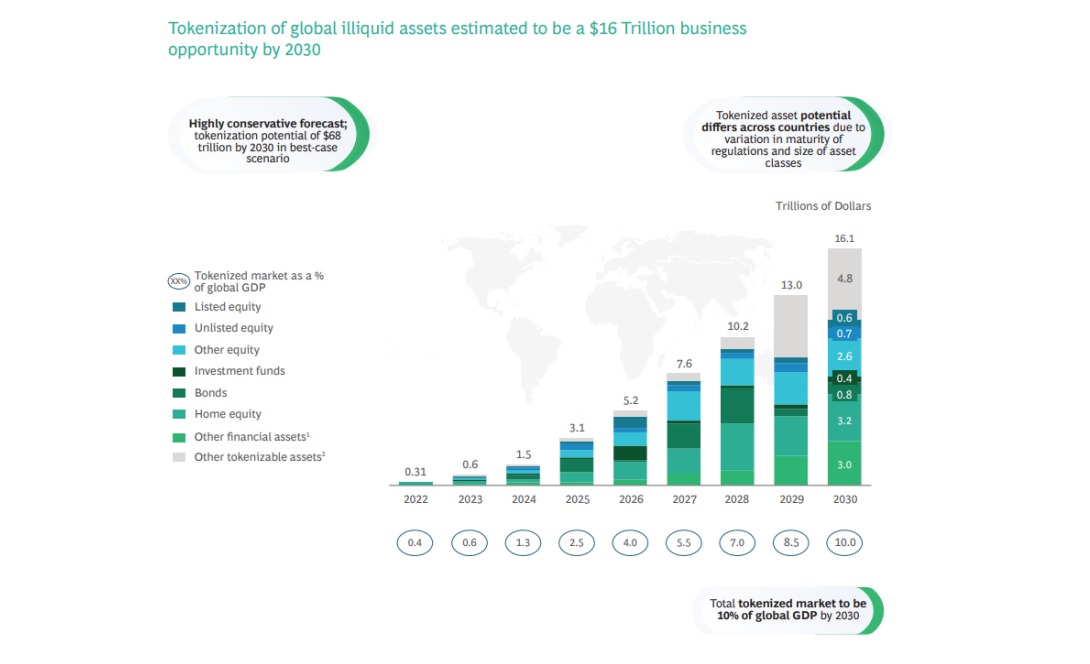

This update comes on the back of a larger trend to tokenize real-world assets. According to Boston Consulting Group and ADDX, RWAs are expected to be worth $16 trillion by 2030. The decentralized, tamper-proof nature of blockchain will increase transparency and trust, while fragmentation opens up new ways to access and invest in valuable assets.

As per Dune, Arbitrum processes an average of 6,306,487 transactions weekly, bringing to light the role it plays in the blockchain ecosystem. Arbitrum’s incorporation of RWAs, which is valued at $49.26 billion, into DeFi ecosystems represents a significant milestone for both the markets. The merger of the two projects, Raredex and Arbitrum, can bring a level of comfort to investors, who can use traditional finance and at the same time tap into blockchain’s transparency, security, and efficiency to buy real-world assets. The growth of tokenized RWAs, in turn, creates opportunities for platforms like Arbitrum to serve as the backbone of real-world asset trading on the blockchain.