Reserve Bank of India: Blockchain Tech Holds Potential for Use “In a Big Way”

At the 12th IDRBT (Institute for Development and Research in Banking Technology) Banking Technology Excellence Awards function held in Hyderabad on July 18, 2016, the Reserve Bank of India and its Deputy Governor Rama Gandhi called for participation among Indian commercial banks in a research group established by the central bank to study various financial applications of blockchain technology.

Gandhi, who was part of a research meeting held by the central bank’s Institute for Development and Research in Banking Technology (IDRBT), said that banks ought to analyze the benefits of cloud-based computing and blockchain processing technologies, which can significantly enhance their existing IT infrastructures.

“Cloud-based computing, blockchain processing technologies and virtualization of IT systems are a few examples which hold potential for being used in a big way… Banks and IDRBT can work together to study these, test them out and adapt for best use,” said Gandhi.

Throughout his speech directed at bank directors, heads of IT departments, and members of the Governing Council of IDRBT, Gandhi noted the importance of dealing with cybercrime and the cumulative losses which banks have failed to deal with over the past few decades.

The Deputy Governor emphasized that cases of cybercrime can be substantially reduced with the implementation of secure, transparent, and innovative financial technologies like the blockchain, which can also offer a form of safe and secure digital currency.

“Today, IT systems of banks are the prime target for cyber crimes and if one were to judge by the volume and value of incidents, the menace is steadily growing,” he stated, acknowledging the vulnerabilities of IT and financial systems operated by the country’s banks.

Prior to the event, the Reserve Bank of India’s Deputy Governor Harun Khan also revealed the possibility of a blockchain research committee being established by the central bank, to lessen the country’s dependence on cash and increase the usage of digitalized money.

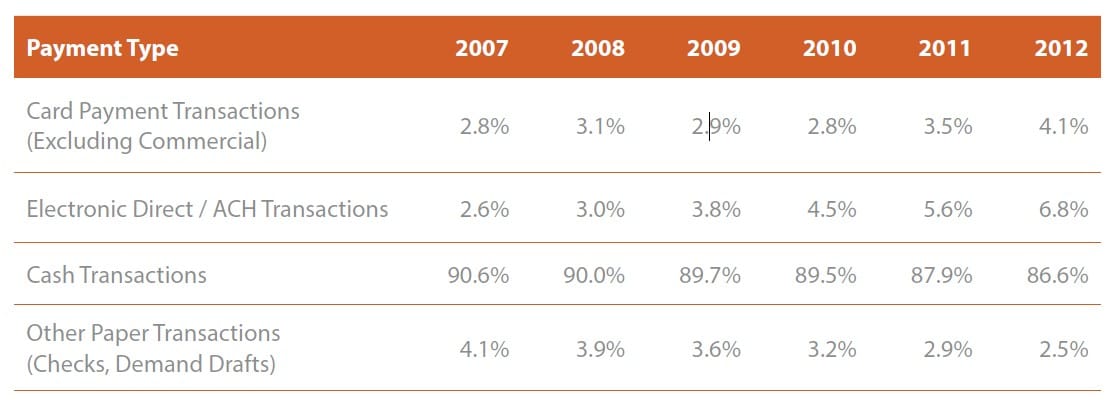

According to international research groups and financial institutions, India operates one of the world’s most cash intensive economies, with 86% of transactions still being made in cash.

The Fletcher School’s Institute for Business in the Global Context (IBGC) states that the India’s dependency on cash is negatively affecting its economy, as residents of New Delhi spent nearly 6 million hours and US$1.5 million to obtain cash.

Despite the advancement in the mobile and technology industries, the bank account adoption rate of adults in India remains at around 35 percent since 2007, which has led to the a slight increase in electronic payment and the dominance of cash transactions.

The report, which was released in January of 2015, noted that the Reserve Bank of India had taken a number of approaches to integrate financial technologies into its existing banking systems, yet failed to provide a solution to the country’s increasing dependence on cash.

MasterCard Southeast Asia Area Head Vikas Varma stated, “Innovations in the electronic payments space not only deliver greater transparency but more importantly, they simplify transactions, enhance security, increase efficiency and have the potential to dramatically reduce costs.”

Since the release of the report, the Indian federal government and its central bank have spent a significant part of their resources on analyzing the applications of financial technologies. Through their studies, the central bank came to a consensus that the transparency and flexibility which blockchain technology provides could enhance the efficiency of financial transactions.

“Blockchain is one thing that has come out of Bitcoin which provides a lot of flexibility in terms of financial transactions. So, we need to study…how this Blockchain technology can be used in financial transactions where the entire data systems move to some more levels,” said Harun Khan.

Recognition of fintech companies

While the central bank of India believes fintech companies have designed innovative technologies that can enhance security and efficiency of financial settlements and transfers greatly, the organization believes banks must explore ways to collaborate and compete simultaneously with emerging fintech companies.

During his speech, Gandhi expounded on the disruptive nature of various fintech platforms, applications, and technologies, which may potentially outperform banking systems in the near future.

The central bank of India fears that technologies that have the capability of eliminating `the need for a mediator or an intermediary like banks, should be approached and handled with care.

“The techies have now grown as Fin-Tech companies and are emerging as the direct competitors in the identified chunks of banking businesses; technology has today dissected the entire value chain of banking and finance and bundled out the chunks in innovative ways that it is they who intermediate between savers and investors, or between sender and receiver of funds,” explained Gandhi.

He further stated that banks should not restrain or prevent the development of innovative financial technologies. Instead, he encouraged banks to collaborate with young fintech companies to implement their technologies on the banks’ existing platforms.

“Banks need to handle them carefully without inhibiting innovations; banks have to find ways to cooperate, co-opt and compete with the Fin-Tech companies,” said Gandhi.

Image source: http://newsroom.mastercard.com/asia-pacific/press-releases/rbi-led-decisions-help-india-make-considerable-progress-achieving-universal-financial-access-reveals-cost-cash-india-report/