RIF on Chain Taps RSK Blockchain to Launch DeFi Platform

RIF on Chain (ROC) DeFi Exchange Goes Live

For the uninitiated, MOC recently released one of the first Bitcoin-collateralized DeFi solutions to enable people to interact and enjoy the benefits of a truly trustless and decentralized financing platform.

Some of the major robust features of MOC’s DeFi platform include giving the option to Bitcoin (BTC) holder to stake their BTC to earn passive income, provide stablecoins collateralized by BTC to any user looking to mitigate the volatility risk associated with holding BTC, and/or, offering a BTC-leveraged asset to users who’re willing to increase their long position exposure to the premier cryptocurrency.

Now, in a bid to further tap into the benefits of the platform, MOC has decided to extend its expertise in decentralized technologies to the RIF ecosystem. MOC, in conjunction with the RIF community, is determined to lay down the building blocks to launch a DeFi ecosystem backed by RIF tokens built on top of the RSK blockchain network. With a vision to provide its users with a fast, secure, and cost-efficient avenue for transacting RIF-backed digital assets, ROC marks the beginning of a new and exciting journey for both the MOC and RIF ecosystems.

In this article, we will dive deep into the nitty-gritty of the MOC DeFi platform which seeks to provide its users an alternative method to safely and confidently generate passive income by just holding RIF digital tokens.

Introducing RIF on Chain

For our readers who might not be aware of the nuts and bolts behind the MOC DeFi platform, here’s a short video to start from.

Coming to the ROC DeFi platform, it’s worth noting that at its launch, it will primarily comprise of three main asset categories, namely, the RIF dollar (RIFD) which is a digital asset-backed stablecoin pegged to the U.S. Dollar and fully collateralized with RIF tokens, the RIFpro (RIFP) token, which essentially functions as the gas for the RIF ecosystem and allows for the minting of RDOC ad RIFX via a token staking model, and, lastly, RIFX, which is a leveraged trading asset exposed to the price movements of the RIF token.

About the RIF on Chain (ROC) DeFi Platform

First and foremost, before accessing and using the ROC platform, users must ensure that they have the necessary RIF digital tokens in a supported cryptocurrency wallet. At present, Nifty and Metamask digital wallets support the storage of RIF tokens. Interested users can purchase these tokens from popular exchanges including KuCoin, Coinbene, Bitfinex, Bithumb, Liquid, and MXC, among others.

After having purchased the RIF tokens, the users will get access to other aforementioned components of the ROC ecosystem: RDOC stablecoins, RIFpro, and RIFX.

What Exactly are Stablecoins?

To paint a clear picture of the RDOC ecosystem for our readers, we believe it is important for them to be aware of the know-how of stablecoins. As might be evident from the name, stablecoins are digital coins or token with a relatively “stable” nature.

Essentially, stablecoins are digital tokens that derive their value from the collateralized asset or a bundle of assets they are backed with. These assets can include precious metals, fiat currencies, and other commodities with real market value. Stablecoins play a particularly important role in the cryptocurrency industry as they provide a bridge for crypto traders to partake in the industry movement without necessarily being exposed to the volatile see-sawing crypto price fluctuations.

Stablecoins can immensely help those who have been on the fence with regard to entering the cryptocurrency industry because of its notorious volatility. Particularly, the volatile nature of cryptocurrencies is a big cause of concern in spaces such as remittances, commerce, salaries, rents, lending & prediction markets, and for tools that are typically used as a store of value for hedging against market risks.

For the purpose to help our readers have a granular understanding of the ROC ecosystem, we will divide stablecoins among three broad groups: Fiat-collateralized, Crypto-collateralized, and non-collateralized.

Fiat-collateralized stablecoins are pegged to fiat currencies including the U.S. Dollar and Euros. Some of the most prominent and liquid fiat-pegged stablecoins are Tether (USDT), USD Coin, Gemini, USDC, and TUSD.

Crypto-collateralized stablecoins differ from fiat-pegged stablecoins in that rather than being pegged to fiat currencies, they are pegged to other decentralized crypto assets including the likes of MakerDao.

Finally, non-collateralized stablecoins, are a little more complex in nature in that they derive their value from seigniorage shares, decentralized banks, and algo stabilizing mechanisms. Some of the most prominent non-collateralized stablecoins today are Terra, Ampleforth, and Element Zero.

Where Do RDOC Tokens Fit?

As many of you might have figured out by now, the RIF Dollar stablecoin (RDOC) comes under the umbrella of a crypto-collateralized stablecoin as it derives its value from the underlying RIF token.

However, RDOC is not just any other crypto-collateralized stablecoin. It differs from its peers largely due to the manner in which it is issued. Basically, RDOC stablecoins are produced whenever there is a certain amount of RIFpro (RIFP) staked in the DeFi platform. Unlike other staking platforms, the ROC DeFi platform doesn’t require individual users to stake a minimum amount of RIFP to mint RDOC. Rather, in the platform, only the total amount of RIFP – staked by any or all users – is considered for minting RDOC.

In this way, whenever the minimum amount of RIFP that needs to be staked is reached, the platform – ROC – automatically initiates the minting of RDOC which is then available to any users for acquisition. The users can later transfer the collected RDOC tokens to their hardware wallet and choose to transfer them to another user or use them to purchase products available in the RIF marketplace. if we had to present an analogy, RIFP token is to RDOC what water is to a budding plant.

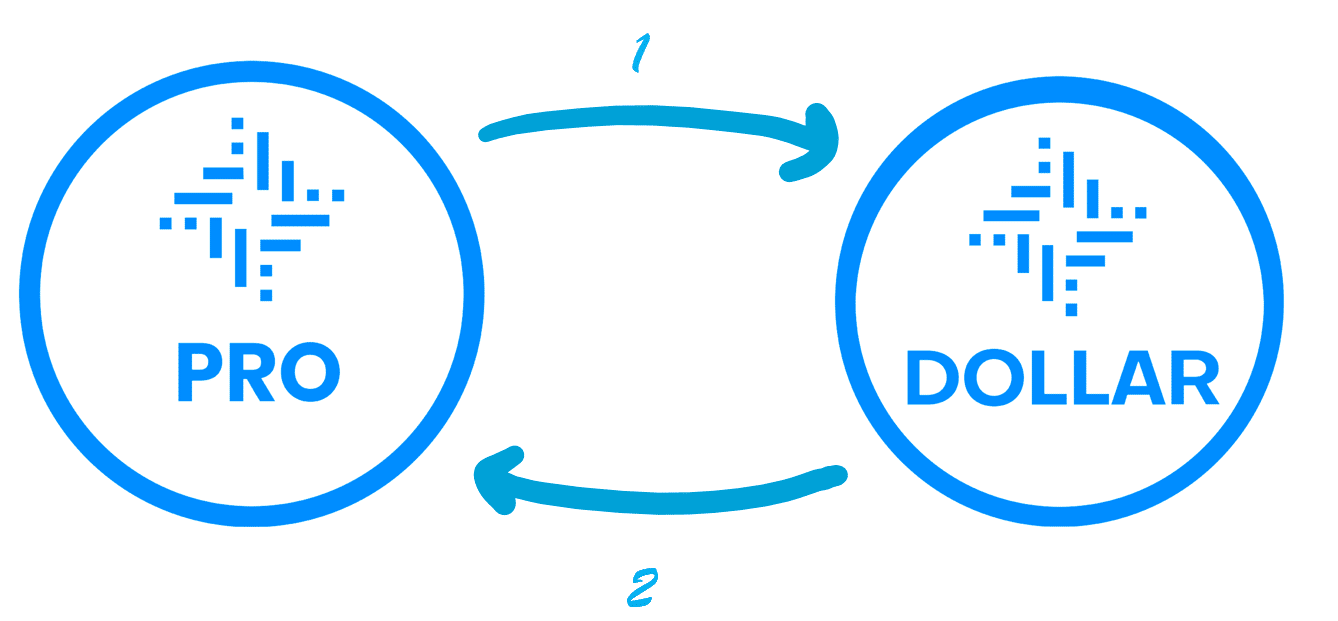

At this point, it is understandable for you to question the relationship between the RDOC stablecoins and the RIFP tokens. To answer this, we will use the following graphic followed by an explanation.

Essentially, the staking of RIFP tokens allows for the issuance of RDOC stablecoins because it enables them to transfer the volatility associated with them to the staked RIFP tokens. As an added incentive, they also transfer a set percentage of the fees received from stablecoin users. At this point in time, RIFP tokens can enjoy some degree of leverage on the accounting of accepting volatility from the RDOC stablecoins. Further, they also start accruing fees paid by the buyers of the RDOC token.

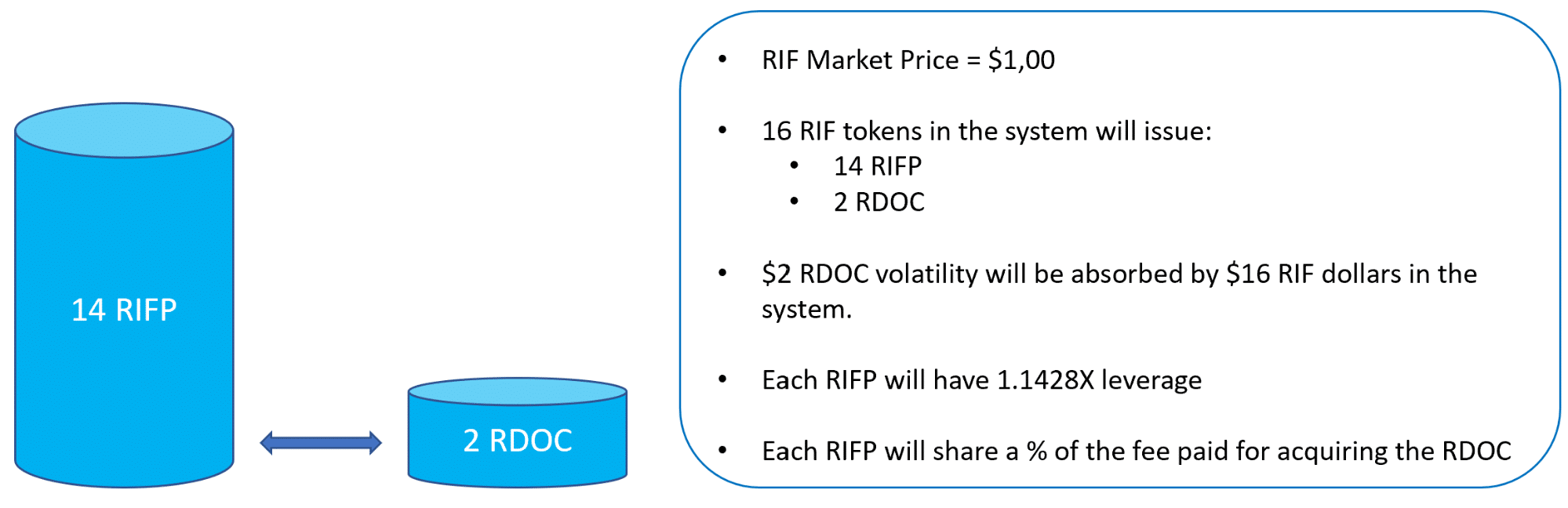

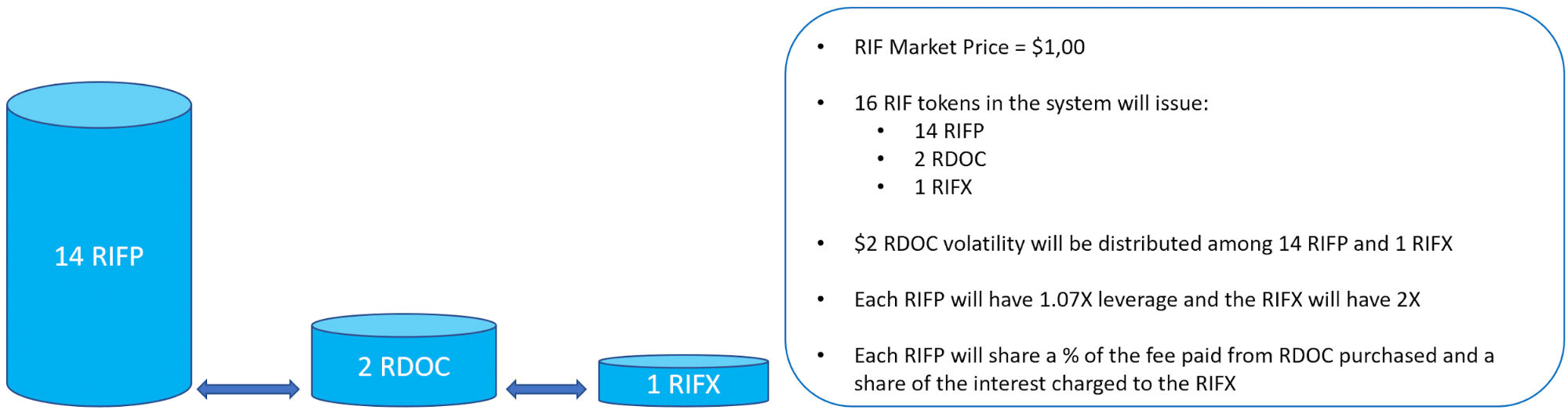

With the help of random math relationships between the aforementioned two digital tokens, we will use the following graphic as an example to display the back and forth between RIFP and RDOC from having 16 RIF tokens in the platform.

E.g. 16 RIF Tokens in the system at a RIF market price of $1,00 will issue 14 RIFP and subsequently $2 RDOC, resulting in $16 dollars in the system absorbing $2 RDOC volatility. Those $2 dollars volatility will be distributed among the RIFP, consequently the leverage factor will be of 1.1428X per RIFP staked [$16 / ($16 – $2)] => 14,28%.

Please note that numbers and values used are by way of example and not based on real ROC values.

As stated earlier in the article, the main purpose of RIFP is to function as a tool to allow RIF token holders to generate a passive income. This passive income would, to a large extent, come from the fees generated by users interacting with the platform, rather than RIFP functioning as a leveraged financial product by design.

That said, many would be inclined to retain some leverage on a long-staked position, assuming the price movement of the product turns bullish, it also acts as a double-edged sword in that it could turn this bad for the token holders should the bears take control of the market. Keeping in mind the likelihood of such circumstances, RIFP is designed in such a manner that it offsets any additional price volatility via the fees received by RIFP tokens and by transferring a significant percentage of that leverage to the RIFX token in the ROC DeFi platform.

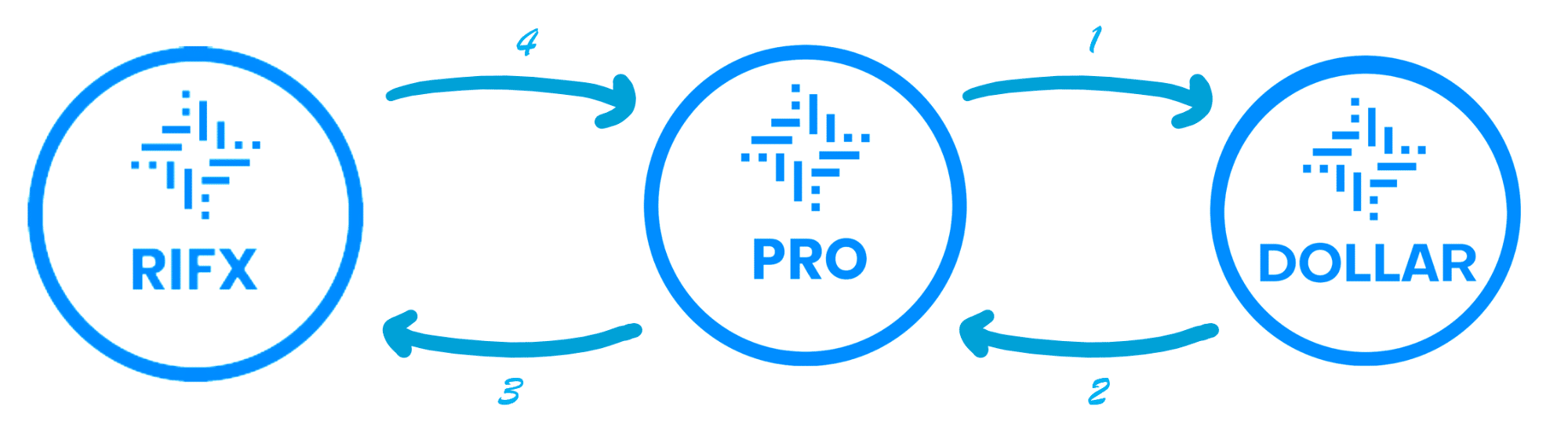

Following the logic explained above, we can say that RIFP tokens “fictionally sell” the majority of their leverage received from the RDOC stablecoins to the RIFX. In a nutshell, RIFP tokens act as a value-carrying bridge between RDOC and RIFX. The following graphic should make things clearer for our readers.

From the above graphic, we can summarise the following:

1) RDOC stablecoins are issued as a result of staking RIFP tokens

2) In addition to transferring their volatility, RDOC stablecoins also transfer a part of the fees paid for the acquisition of RIFP tokens to the latter

3) In turn, RIFP tokens transfer most of the volatility they receive to RIFX leverage asset

4) RIFX users pay an interest rate for trading the RIFX leverage asset.

5) This interest is then distributed by the ROC system among the RIFP tokens

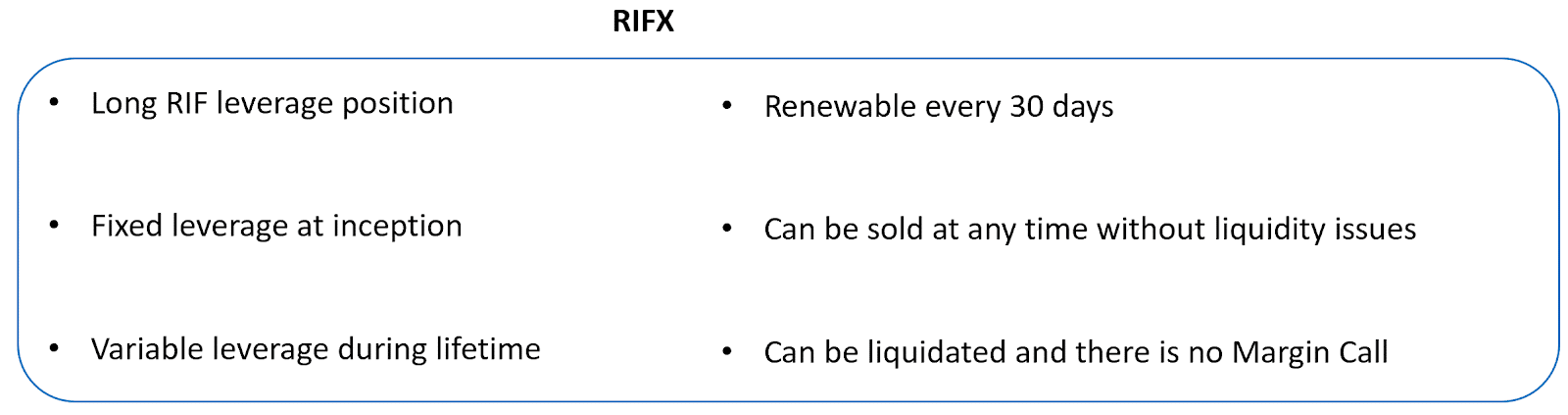

What Exactly is RIFX?

We briefly touched on RIFX early on in the article. Now, we will delve deeper into this financial product.

Fundamentally, RIFX is a leveraged product that renews itself every 30 days acting as a tool to provide traders and speculators an opportunity to leverage up their gains or losses based on the price movement of the RIF token. This definition might prompt our readers to ask questions about the product’s leverage factor. Is it fixed during the lifespan of the contract?

Well, RIFX has a fixed leverage multiplier of 2x at the beginning of each contract which might vary through its 30-day lifespan depending on the movement of multiple variables, including the ready availability of ROC stablecoins on the platform and the movement of RIF tokens in the market.

Here, it’s vital to substantiate the leverage variability of RIFX. Whenever a user acquires RIFX (except for their acquisition at the beginning of the contract), it’s likely that the acquired leverage would be different than 2x. Hence, it’s vital for traders to check the leverage factor on the RIFX Wallet section or on the Metrics section in the DeFi platform before entering a trade. Another point worth highlighting is to be aware of the difference between RIFX and more conventional leveraged assets including exchange-traded funds (ETFs) that typically enjoy a perpetually fixed leverage ratio.

Building on to our previous example that established a relationship between RIFP and RDOC through random numbers, we will now add RIFX into the mix to complete the end-to-end economic process of the ROC platform:

E.g. 16 RIF Tokens in the system at a RIF market price of $1,00 will issue 14 RIFP, $2 RDOC and subsequently 1 RIFX. $2 RDOC volatility will now be distributed among 14 RIFP and 1 RIFX. So what was used to be 14,28% (2 RDOC for 14 RIFP = 2/14 = 1/7 = 14,28%) in the previous case, will now be 1 RDOC volatility for 14 RIFP and 1 RDOC volatility for 1RIFX. This reduces the volatility of the RIFP by half 1,071X and allows the system to start with a leverage multiplier of 2X for the RIFX.

Please note that numbers and values used are by way of example and not based on real ROC values.

In a nutshell, RIFP tokens will function as the fuel of the DeFi platform and will benefit from fees paid by RDOC purchasers and the interest rate paid by RIFX traders on their leveraged positions. The digital token will, in the long-run, also be benefited from their exposure to small volatility brought about by stablecoins.

Notably, the full redemption of the stablecoin position – selling the RDOC stablecoins for RIF tokens or transferring them – can only be availed at the expiration of the RIFX contract, i.e., every 30 days. Similarly, partial redemption of the contracts can be executed during the lifespan of the contract if the outstanding amount of RIFX tokens in the market matches the given threshold.

The reasoning behind such an architecture is that in the instance of the price of the token rallying, it’s the RDOC stablecoins that are going to “pay” the leveraged gains to the RIFX tokens. In order to keep the platform functionally sound and strong, it is required to have a minimum amount of circulating supply of RDOC stablecoins within the DeFi platform for the duration of the RIFX contract. Despite the fact that RDOC stablecoins might potentially have some redemption limitations as explained in the aforementioned example, they can, in fact, be liquidated or sold at any time which gives the traders an additional option to exit their trades as and when they wish.

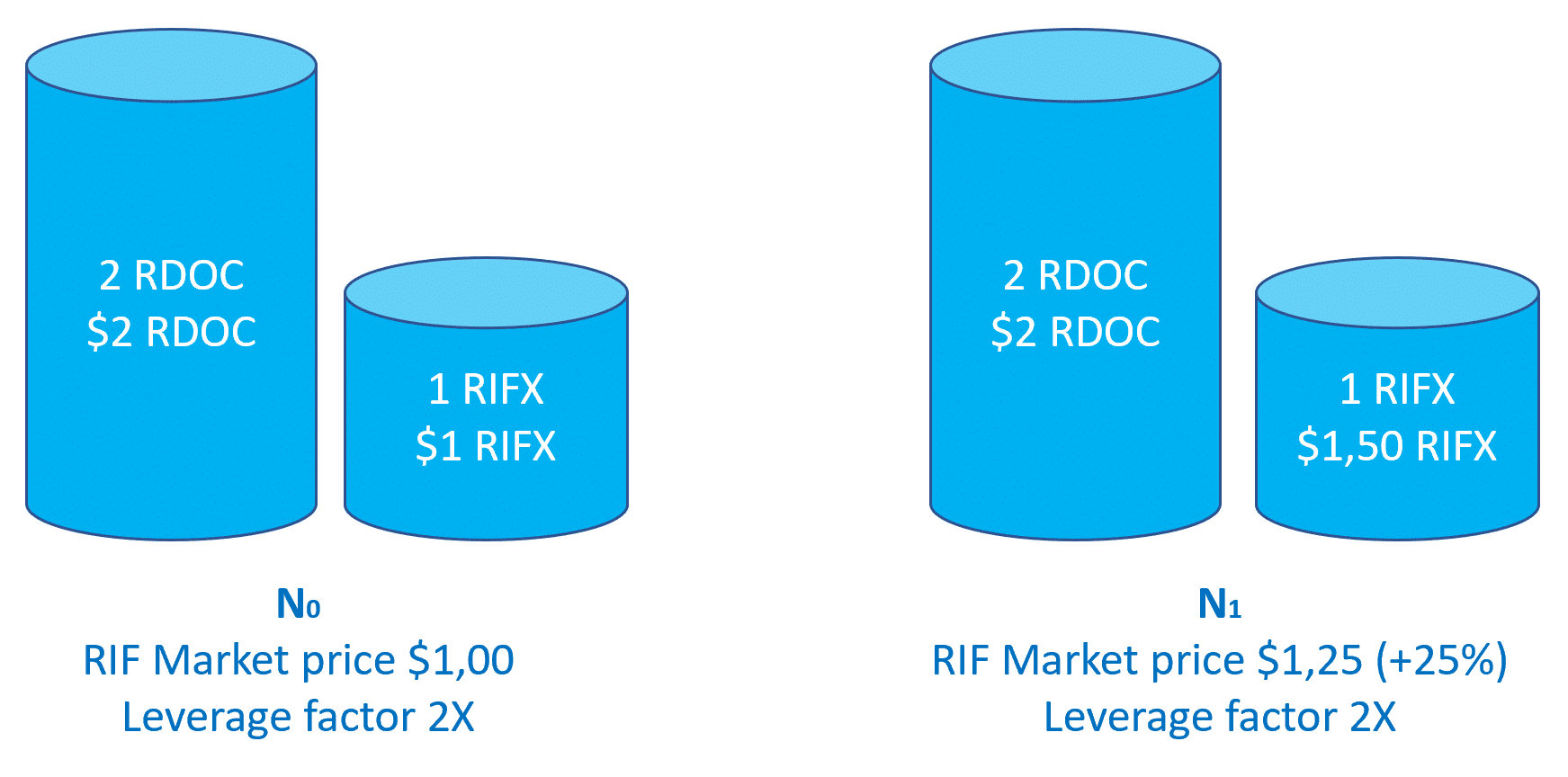

Let’s have a look at the following example once again:

As shown above, at the beginning of the contract (N0) the system has 2 RDOC and 1 RIFX with a RIF market price of $1,00. At N1 the price of the token has jumped in the market by 25% to $1,25 generating a +50% gain in the RIFX position due to its 2X leverage. Given that the RDOC stablecoins are Stable by definition, they won´t get benefit from the rally and they will transfer those gains to the RIFX, “paying” its leverage. The inexistence of RDOC for backing up the leverage of the RIFX due to a total allowance in their redemption at any given moment would have jeopardized the entire system.

Please note that numbers and values used are by way of example and not based on real ROC values.

Let’s quickly summarise the main takeaways from the first part of the post.

After acquiring RIF tokens on the RIF on Chain (ROC) DeFi platform, the next step for the token holder is to transfer the acquired RIF tokens to a MetaMask or Nifty wallet. Notably, if you’re using the MetaMask wallet, it’s imperative to have the required configuration in place for the RSK blockchain to facilitate the transfer of RIF tokens into the app. More information about the configuration of the wallet can be acquired here.

Finally, the user must click on this link to allow the MetaMask or Nifty wallet to interact with RIF on Chain platform by enabling the automated connection of the wallets with the DeFi platform.

RIF on Chain (ROC) Token Summary

While we have discussed the three primary tokens that constitute the driving force behind the ROC platform, we will quickly touch on the main characteristics of these three tokens: RIF Dollar (RDOC), RIFpro (RIFP), and RIFX, to firmly establish the use and extent of functionality of the tokens.

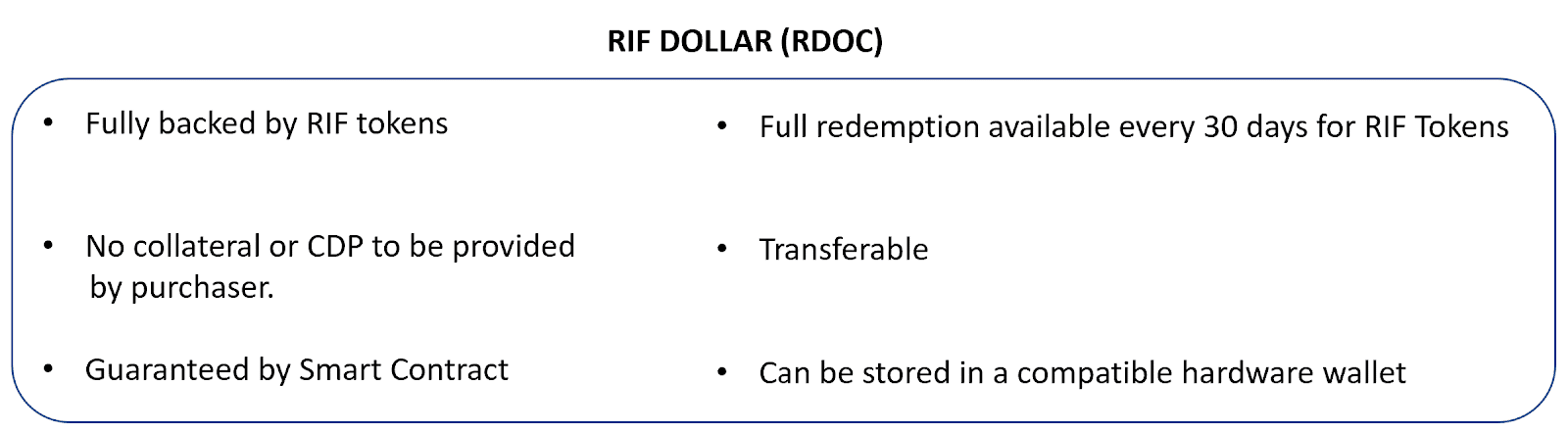

RIF Dollar (RDOC)

The RIF Dollar (RDOC) is a stablecoin pegged 1:1 to the U.S. Dollar and guaranteed by a smart contract. RDOC holders can choose to either redeem their full position at contract expiration or partial position during the lifespan of the contract based on the ready availability of redeemable RDOC stablecoins.

As mentioned earlier, RDOC stablecoins are fully-collateralized by RIF tokens. Further, platform users can acquire these stablecoins directly in the platform without having to provide any collateral whatsoever like the vast majority of other platforms.

These RDOC tokens are freely transferable among platform users and can be used to buy services and products in the RIF Marketplace. The token is also flexible in nature in that it can be stored in any compatible hardware wallet.

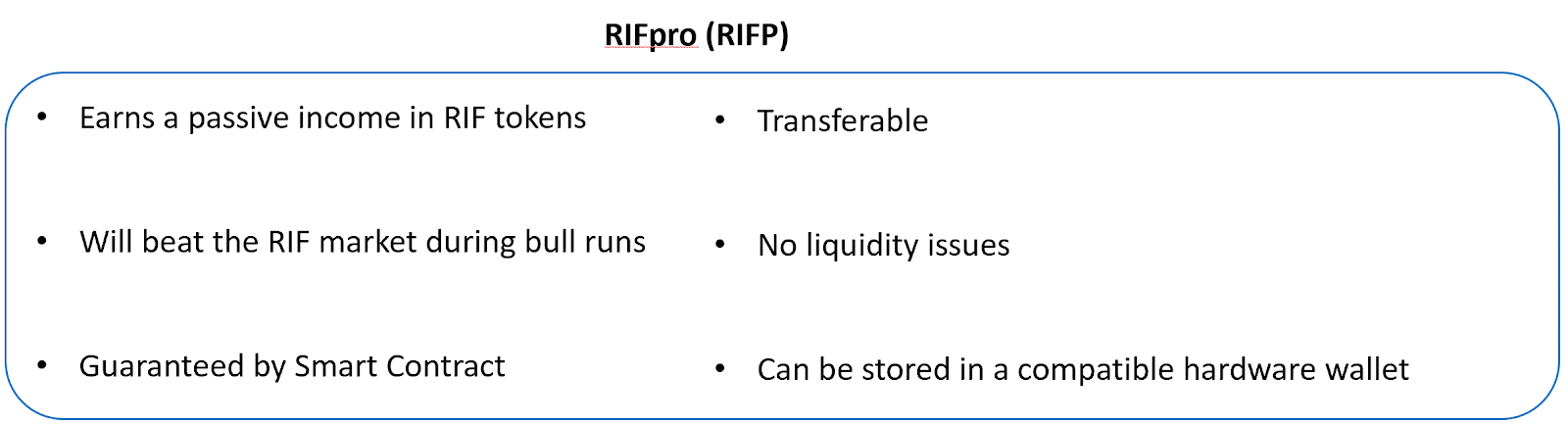

RIFpro (RIFP)

RIFP can be understood as a token that takes a few characteristics from both – the RIF token and the RDOC stablecoin. While it absorbs some volatility from RIF, it also takes a small amount of leverage from the RDOC stablecoins.

RIFP benefits from a percentage of the transaction fees charged by the platform from the users and traders of RDOC and RIFX, respectively. This makes RIFP an ideal candidate for those who wish to earn small passive income with minimum leverage on their RIF token position.

RIFX

Coming to the last but not the least significant of the products, RIFX is essentially a RIF leverage decentralized long position.

RIFX is based on an automated smart contract that renews itself every 30 days. Further, the product has a leverage factor of 2x at the beginning of its lifespan and variable leverage afterward depending upon several variable factors including the price of RIF token and the amount of RDOC stablecoins in the ROC platform.

That said, users must be cognizant of the risks associated with trading a leveraged asset including the possibility of the liquidation of their holdings. At present, the ROC platform doesn’t have a Margin Call notification. However, RIFX’s design allows users to exit their trade position anytime they want unlike having to wait until the expiration date in the case of RDOC stablecoins.

Final Thoughts

By now, our readers would have developed a fair understanding of the functioning of the ROC on Chain DeFi platform. Looking to usher in a new era of decentralized trading accessible to all, the platform leverages blockchain technology with an aim to develop an all-inclusive economy for the future. Looks like DeFi is finally happening in 2020 and RSK, the smart contract platform on top of Bitcoin, is making a great contribution to the ecosystem.