Riot Platforms explores AI revenue diversification as Bitcoin network transactions hover at 12-months low

Bitcoin miner Riot Platforms is exploring revenue diversification into AI and HPC, joining the growing trend of miners adapting their infrastructure for AI applications as Bitcoin network transactions hover at 12-months low.

On Feb. 13, Bitcoin (BTC) miner Riot Platforms announced that it’s looking into potential partnerships within the artificial intelligence and high-performance computing sectors. The company plans to ramp up evaluations for AI and HPC applications at its Corsicana Facility in Navarro County, Texas. “We are excited to continue to advance our AI/HPC evaluation process as we seek to maximize value for our entire portfolio of assets,” CEO Jason Les said in a statement.

To support this initiative, Riot has appointed three new directors to its board. Jaime Leverton, CEO of Hut 8 Mining, Doug Mouton, a former senior engineer at Meta, and Michael Turner, a real estate investment expert. Benjamin Yi, Executive Chairman of Riot, stated: “Jaime, Doug and Michael bring complementary expertise to the Board that will be immediately applicable as we continue to assess how best to maximize the value of our unique assets.”

However, Riot acknowledged that there is no guarantee that its current assets are even suitable for conversion into AI or HPC infrastructure. The company also noted that there could be challenges in negotiating financially favorable terms for any potential partnerships or realizing significant value from AI/HPC investments.

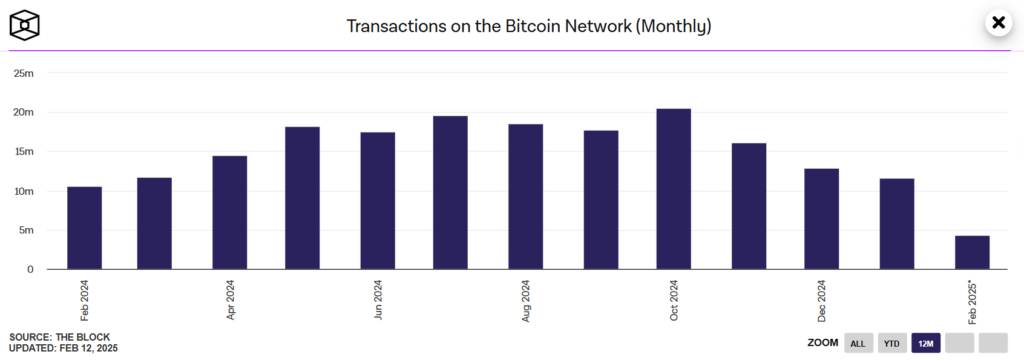

This move by Riot comes amid a growing trend among Bitcoin miners to expand their operations into sectors beyond crypto mining, particularly as Bitcoin network activity has declined in recent months. With Bitcoin transactions currently hovering at 12-month low, according to data from The Block, mining firms are looking for new avenues to generate revenue.

Many have already begun repurposing their computing infrastructure for AI applications. According to the Digital Mining Solutions and BitcoinMiningStock.io report, several BTC miners with a market cap of at least $100 million have already generated substantial revenue from their AI and HPC initiatives. For example, Hut 8 Mining reported that AI and HPC revenue accounted for nearly 8% of its total revenues in the first three quarters of 2024.