Riot Platforms posts 52% decrease in Bitcoin production for Q2

Bitcoin mining firm Riot Platforms has released its Q2 financial results, showing a decline in mined crypto due to the recent halving.

Colorado-based Bitcoin (BTC) mining firm Riot Platforms has unveiled its Q2 financial results, highlighting a significant reduction in mined cryptocurrency attributed to the recent halving event that took place earlier in April.

The company reported total revenue of $70 million for the quarter ending July 31, an 8.7% decline compared to the same period in 2023. Riot Platforms attributed the revenue dip mainly to a $9.7 million decrease in engineering revenues, which was partially mitigated by a $6 million increase in Bitcoin mining revenue.

During the quarter, the firm mined 844 BTC, representing more than a 50% decrease from Q2 2023, pointing to the halving event and increasing network difficulty as primary factors behind the decline. Riot Platforms reported a net loss of $84.4 million, or $0.32 per share, missing Zack Research’s forecast of a $0.16 loss per share.

Halving increases competitive pressure

The Colorado-headquartered firm disclosed the average cost to mine one BTC in Q2, including power credits, surged to $25,327, a noticeable 341% increase from $5,734 per BTC in the same quarter of 2023. Despite this significant rise in production costs, the firm remains optimistic about maintaining competitiveness through recent deals.

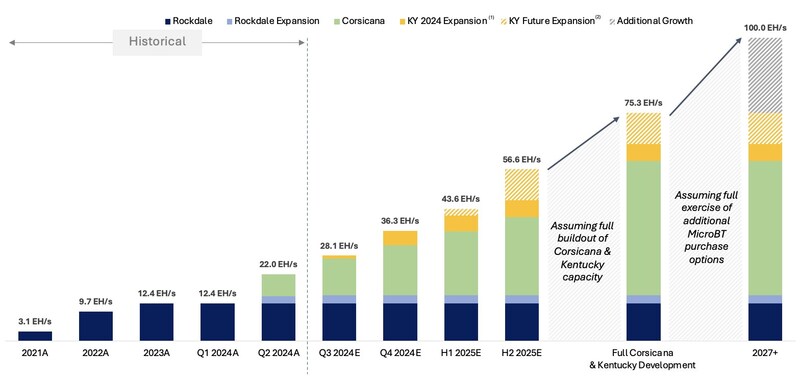

For instance, following the recent acquisition of crypto mining firm Block Mining, Riot raised its deployed hash rate guidance from 31 EH/s to 36 EH/s by the end of 2024, while also increasing the 2025 guidance from 40 EH/s to 56 EH/s.

Commenting on the firm’s financials, Riot chief executive Jason Les said that despite the halving, the mining firm still succeeded in accomplishing a “significant operational growth and execution of our long-term strategy.”

“Despite this reduction in available production for all Bitcoin miners, Riot posted $70 million in revenue for the quarter and maintained strong gross margins in our core Bitcoin mining business.”

Jason Les

Following the Q2 financial report, Riot Platforms shares fell by 1.74% to $10.19, per data from Google Finance. In the meantime, the American miner continues its pursuit of Canadian rival Bitfarms, recently acquiring an additional 10.2 million BITF shares, increasing its stake in Bitfarms to 15.9%.

As crypto.news earlier reported, Riot first announced a $950 million acquisition bid for Bitfarms in late May, claiming that Bitfarms’ founders weren’t acting in the best interests of all shareholders. They stated that their proposal was rejected by the Bitfarms board without substantive engagement.

In response, Bitfarms said that Riot’s offer “significantly undervalues” its growth prospects. Subsequently, Bitfarms implemented a shareholder rights plan — also known as a “poison pill” — to protect its strategic review process from hostile takeover attempts.