Robinhood reports mixed operating data for May 2023, user engagement down

Robinhood Markets, Inc. has disclosed selected monthly operating data for May 2023, which depicts a complex portrait of growth and decline in user engagement and trading activities.

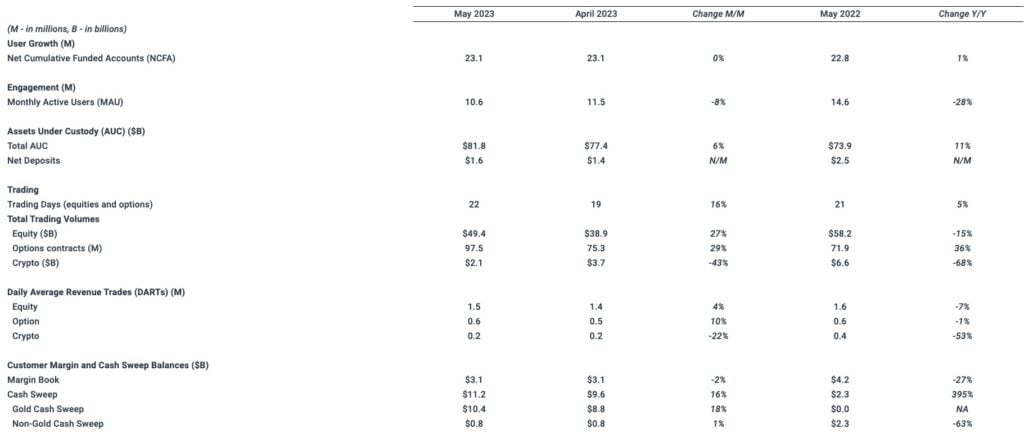

Robinhood reported an increase in net cumulative funded accounts (NCFA) to 23.1 million at the end of May, up roughly 20,000 from the previous month.

Notably, however, the trading platform experienced a decrease in monthly active users (MAU), which fell to 10.6 million in May, representing a drop of approximately 900,000 from April 2023.

The company’s assets under custody (AUC) exhibited positive growth, amounting to $81.8 billion at the end of May, a 6% increase from the previous month.

Correspondingly, net deposits were reported to be $1.6 billion in May, reflecting a 25% annualized growth rate relative to April 2023 AUC. Over the last twelve months, Net deposits were $16.5 billion, translating to an annual growth rate of 22% relative to May 2022 AUC.

Trading volumes in May saw a rise for equities and options but a decline for cryptocurrencies. Equity notional trading volumes were $49.4 billion, marking an upswing of 27%.

Options contracts traded came in at 97.5 million, up 29% from April. In contrast, crypto notional trading volumes saw a significant drop to $2.1 billion, a decrease of 43% from the previous month.

Margin balances remained consistent at $3.1 billion, mirroring the April 2023 figures. Meanwhile, cash sweep balances observed a substantial hike, ending at $11.2 billion at the close of May, a 16% increase from the end of April 2023.

While Robinhood’s latest metrics indicate a mixed performance, the contrast between growing total assets and declining active users points to a challenging dynamic for the platform.

The uptick in funded accounts and assets under custody, coupled with falling user engagement, suggest Robinhood will need to continue to innovate to maintain and grow its user base to stay a profitable business.

This monthly data, as reported by Robinhood, is unaudited and preliminary, based on the company’s estimates, and subject to the completion of financial closing procedures.

Final results for the most recent fiscal quarter might vary from the information in this release, as reported in Robinhood’s quarterly and annual filings with the U.S. SEC.