Saylor’s MicroStrategy ups Bitcoin trove to $22b

Michael Saylor’s MicroStrategy has invested another $2 billion in Bitcoin as the world’s most popular cryptocurrency reaches new highs day after day.

Saylor tweeted that MicroStrategy spent $2.03 billion on an additional $27,200 Bitcoin (BTC), increasing its total holdings to 279,420 tokens since its aggressive acquisition strategy started in 2020.

According to the firm’s disclosures, MicroStrategy acquired its latest Bitcoin trove at an average price of $74,463 per BTC. The software giant has spent nearly $12 billion on Bitcoin so far, with plans to raise additional capital to buy more. Saylor stated that the company would raise $42 billion from debt and equity sales to support its ongoing Bitcoin accumulation.

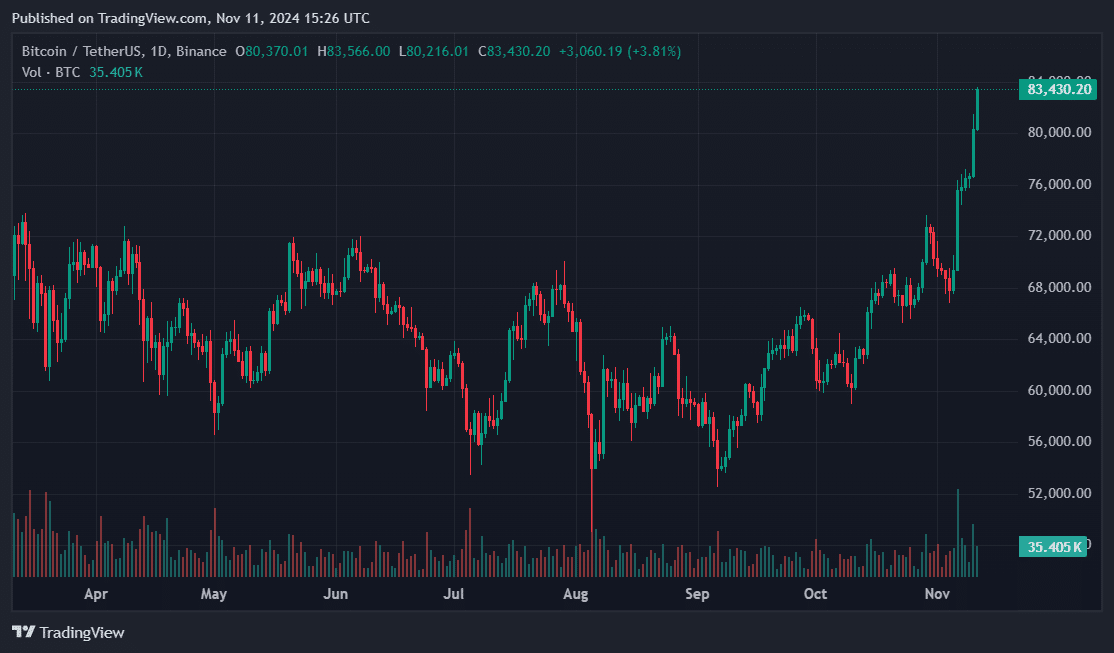

Bitcoin’s post-election bull run

MicroStrategy’s purchase was announced on Nov. 11, as Bitcoin reached a new all-time high during its rapid rise following Donald Trump’s victory last week.

Since the U.S. press declared Trump the victor, investors have injected over $500 billion into the cryptocurrency market. BTC has been a major beneficiary of this demand. The asset’s market cap eclipsed all other digital tokens, standing tall at $1.6 trillion and growing.

Post-election inflows to digital asset investment products nearly hit $2 billion last week. Electoral results for pro-crypto candidates bootstrapped year-to-date inflows to a record $31.3 billion.

At the time of publication, Bitcoin was trading around a new high of $83,400, after setting consecutive peaks over the weekend. However, experts cautioned against potential market euphoria.

Bitget Research chief analyst Ryan Lee noted that volatility could briefly stall gains and impact derivatives markets, according to an email shared with crypto.news.

Another factor to watch is the relative gains of BTC and altcoins. While BTC broke through the $80,000 level in the past 24 hours, there has not been a clear rebound in BTC exchange rates for ETH, SOL, and other tokens. This indicates that BTC is absorbing liquidity from the market, signaling a tightening of market funds. This may lead to extreme volatility in derivatives markets due to liquidity constraints.

Ryan Lee, Bitget Research